The mortgage and real estate industries are facing major shifts, with artificial intelligence taking center stage. Our lead story features a HousingWire video where AI forecasts the future of housing, revealing surprising and insightful trends. Alongside this, we explore the growing momentum for a jumbo rate cut, a significant uptick in cash-out refinancing, and the mixed reception to OpenAI’s new GPT-5 model. These developments underscore a rapidly evolving landscape. For professionals ready to adapt and consumers seeking clarity, understanding these stories is essential. Our focus keyword this week: AI housing prediction.

AI Predicts the Future of Housing

In this engaging video, HousingWire asked AI to predict the future of the housing market, and the results are both fascinating and telling. The AI outlines how automation, demographic shifts, and economic pressures could reshape homeownership, pricing, and even how we finance and build homes.

The video touches on how AI tools may help homebuyers make better decisions, allow real estate agents to market more effectively, and assist lenders with risk assessment and loan processing. It forecasts faster, more tailored services, but also raises concerns about equity and affordability.

Ultimately, the piece urges industry professionals to embrace these changes proactively. AI isn’t just a futuristic concept—it’s already reshaping our world, and those who adopt it early could gain a serious edge.

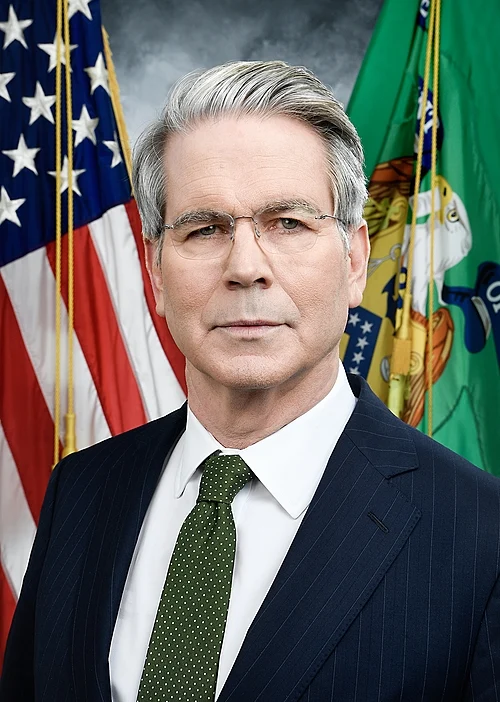

Bessent Pushes for Jumbo Rate Cut Despite Fed Hesitancy

Read the Full Story → Scotsman Guide

Scott Bessent, former Soros Fund Management CIO, is calling for a 50-basis-point rate cut from the Fed, citing recent downward revisions in job data. He argues the Fed is operating off outdated data and that a larger cut is justified to boost the economy.

Despite his strong stance, current Fed officials appear unconvinced. While the market largely anticipates a 25-basis-point cut, many within the Fed are reluctant to commit to aggressive policy changes with inflation still above target.

This divergence in opinion sets the stage for a closely watched September meeting. Market participants will be watching Fed commentary closely as economic indicators continue to evolve.

Cash-Out Refinancing Surges as Homeowners Tap Equity

Read the Full Story → AP News

Cash-out refinances now represent nearly 60% of all refinance activity, the highest level in almost three years. Homeowners are leveraging increased equity, with the average withdrawal hitting $94,000 per transaction.

This trend is notable because it comes despite higher interest rates. Many borrowers are accepting steeper payments in exchange for access to capital—often for renovations, debt consolidation, or investment.

While this reflects strong consumer confidence, experts urge caution. Increased loan balances and monthly costs can strain household budgets. Still, for many, the benefits outweigh the risks, especially in markets with strong appreciation.

GPT-5 Rolls Out with Major Advances, Mixed Reviews

Read the Full Story → San.com

OpenAI has launched GPT-5, boasting improved reasoning, enhanced memory, and more human-like responses. The new model features a 272,000-token context window and more sophisticated tool usage, making it a powerhouse for automation.

Users report improved productivity, particularly in research, code generation, and content creation. However, feedback is mixed regarding the model’s consistency and how well it integrates into existing workflows.

Despite some criticisms, GPT-5 is a clear leap forward and signals where AI is heading next. It further validates that AI literacy is becoming critical across all professional sectors, including mortgage and real estate.

Loan Officer Perspective

- Share the HousingWire AI video with clients and referral partners as a conversation starter and show of thought leadership.

- Revisit your past client database: the refinance market is hot again, with opportunity hiding in plain sight.

- Stay informed on rate expectations—a jumbo cut, if realized, could trigger new waves of purchase and refi demand.

Real Estate Agent Perspective

- AI tools like GPT-5 can streamline listing descriptions, lead gen, and client communication—learn to leverage them.

- Cash-out refinances may empower your clients to prep homes for sale or fund new purchases.

- Monitor Fed movements closely; a rate shift could reignite sidelined buyers and create new urgency in the market.

Home Buyer & Seller Perspective

- Curious about AI’s impact on your next move? The future of housing is changing—ask your agent or lender how to stay ahead.

- Have equity? You might qualify for a cash-out refinance to fund upgrades or consolidate debt—but talk to a pro first.

- Thinking of buying or selling soon? Contact the loan officer or agent who shared this post to understand your best timing and strategy.

Frank’s Thoughts

The AI prediction from HousingWire really got me thinking. It’s exciting—and a little wild—to imagine how deeply artificial intelligence could reshape housing. But here’s the truth: we can either fear change or lead it. I believe every mortgage and real estate pro should get serious about integrating AI into their work now.

One thing I’ll keep hammering home: don’t sleep on refinances. They make up about 40% of the mortgage market today. If you think “no one wants to refi,” think again. Go back to your database, start calling past clients, and you’ll find more business than you expect.

And let’s not forget: it’s not just about the loans themselves, but the referrals they generate. When you serve well, you grow organically. AI can enhance that, but relationships remain the heart of this business. Use both.

Powered by: Mortgage Marketing Animals

Important Links