Capital gains has become a central theme in U.S. housing market discussions as policymakers and industry experts debate how tax reform could unlock inventory and ease affordability constraints. This week’s market data shows a modest rise in new home purchase mortgage applications, a slight uptick in the homeownership rate, and persistent debate around capital gains tax rules that may be influencing seller behavior and home supply. We cover the latest trends in mortgage activity, homeownership rates, and how calls for a capital gains fix resonate across housing policy and market activity.

Mortgage Activity: New Home Purchase Apps Up 3.1%

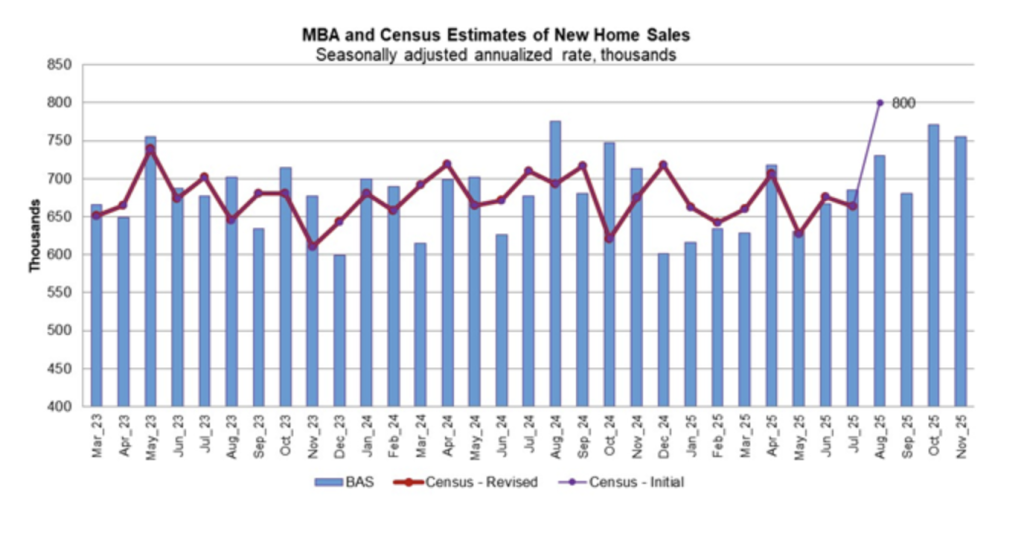

In November 2025, new home purchase mortgage applications increased 3.1% year‑over‑year, according to the Mortgage Bankers Association’s Builder Application Survey.

Builders and lenders point out that while the annual gain is positive, applications were lower compared with the typical seasonal pattern late in the year, illustrating ongoing volatility tied to mortgage rates and buyer affordability.

For mortgage and real estate pros, this metric suggests that some prospective buyers are still pressing ahead with purchases despite headwinds, indicating that underlying housing demand hasn’t completely softened.

Homeownership Rate Inches Up, but Affordability Still Tight

The U.S. homeownership rate rose to 65.3% in the third quarter of 2025, according to the Census Bureau’s Housing Vacancy Survey analyzed by Eye On Housing.

Although this represents a slight increase from earlier in 2025, the rate remains close to prior quarters and highlights that long‑term affordability and supply issues persist.

Mortgage rates that have stayed elevated and limited active listings continue to constrain first‑time buyers and move‑up households, factors which directly tie to slower overall homeownership growth.

Capital Gains Fix: The Policy Debate Heating Up

A key part of the housing policy conversation involves updating the capital gains exclusion on home sales. Currently, the federal home sale exclusion remains at $250,000 for single filers and $500,000 for married couples—thresholds that haven’t budged since 1997 despite significant home price appreciation.

Advocates argue that this outdated exclusion functions as a de facto tax on equity, discouraging sellers from listing homes and contributing to low inventory and high prices.

Several proposals are now gaining bipartisan attention in Washington:

- Indexing the capital gains exclusion for inflation, so only real gains are taxed, not phantom gains created by decades of price growth.

- Doubling the exclusion limits and adjusting them periodically to reflect market conditions.

- No Tax on Home Sales Act, which would eliminate federal capital gains tax on primary residence sales entirely.

Proponents contend that a capital gains fix could unlock millions of homes from sellers who are “locked in” to current properties to avoid large tax bills, improving turnover and easing pressure on prices.

What Market Participants Are Saying

Industry analysts highlight that without reform, more sellers could face a capital gains tax bill when they move, which weakens their ability to afford a new home and suppresses for‑sale inventory.

Some forecasts suggest that removing or significantly adjusting capital gains taxes could especially benefit move‑up buyers and retirees who hold long‑term equity, potentially stimulating activity and adding listings to the market.

At the same time, debates continue about who benefits most from changes and whether reforms should target specific homeowner segments.

Loan Officer Perspective

Loan officers should monitor the capital gains policy discussion closely, as any reform could shift seller and buyer behaviors, affecting origination volumes. A capital gains fix could spur more move‑up purchases, refinancing to fund renovations, and increased demand for jumbo financing as homeowners leverage equity. Clear communication with clients on how tax rules impact their net proceeds can be a differentiator in building trust.

Real Estate Agent Perspective

For real estate agents, the capital gains narrative offers a timely opportunity to educate sellers about the tax implications of moving and how proposed reforms might affect their equity strategy. Helping clients understand tax exposures and planning around them can position agents as trusted advisors. Additionally, tracking local inventory trends in response to policy shifts will be essential for pricing and listing strategies.

Source Links

MBA | Eye On Housing | Realtor.com

Powered by: Mortgage Marketing Animals

Important Links