Construction financing is seeing renewed demand in 2025, with loan volume rising for the first time in two years. Other significant stories this week include how rent payments are increasingly being used to build credit, and an eye‑catching property in Oregon making waves for its unique graffiti art. The focus keyword: construction financing, as we explore what’s happening in lending, credit, and the real estate scene.

Construction Loan Demand Surges Nationally

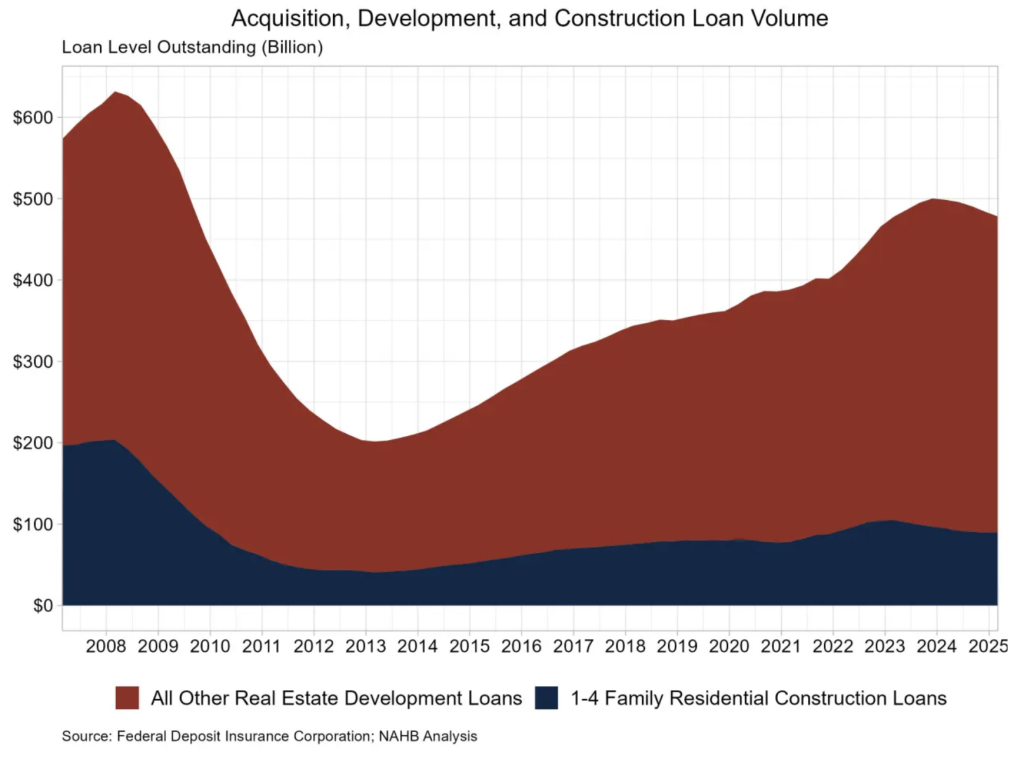

New data shows that 1‑to‑4 family residential construction loan volume rose for the first time in two years during the first quarter of 2025. According to FDIC‑reported figures cited by Eye On Housing, outstanding construction and land development loans in this category reached $90.0 billion, up slightly (0.6%) from the previous quarter despite being down compared to a year before.

Justin Hubbert, President of Park Place Finance, says the firm has felt that upward shift. “We’re seeing significantly more demand for construction financing this year, which mirrors what the national data are showing,” Hubbert said. “Many banks have pulled back in construction lending in key markets, which opens the door for lenders who can move quickly. Our process is streamlined to help construction loans reach the finish line much faster.”

For loan officers and realtors, the growth in construction financing reflects a broader market. Builders and investors are turning to new projects to meet affordability demands. With traditional banks scaling back, alternative lending sources are playing a larger role in keeping these projects funded and moving forward.

If you or your clients need fast, reliable construction loan options, reach out to Justin Hubbert’s team via workwithparkplace.com.

Using Rent Payments to Boost Credit Scores

A new piece from CNBC highlights that many Americans pay rent on time each month, yet their rent payments are not reported to credit bureaus—and thus don’t help build credit. Reporting rent payments, however, can boost credit scores for those who participate.

Credit reporting systems like FICO 9 and FICO 10 now allow rent payments (when reported) to be included in credit history. This gives renters—especially those with thin or no credit files—an opportunity to demonstrate a pattern of on‑time payments. It’s an incremental but potentially impactful lever for improving creditworthiness.

That said, participation depends on landlords, reporting services, and whether the lender or credit model considers these data points. Not all institutions use FICO 9/10; many still rely on older score versions that ignore rent history.

Read the Full Story → CNBC

Oregon Graffiti House: Uniqueness Selling Fast

A Salem, Oregon home filled with bold graffiti art is proving hugely popular among buyers. What started as a quirky, artistic property has become a hot ticket: multiple offers are already flooding in.

The house blends street art and residential architecture in a way that breaks the mold. It’s a reminder that aesthetic uniqueness and bold design statements can transcend conventional buyer expectations—and in certain markets, even enhance value.

Potential buyers in such cases are drawn not just to square footage or neighborhood, but to story, character, and visual intrigue. Features like art installations or unconventional style can become key selling points—especially in markets where inventory is otherwise similar.

Read the Full Story → Realtor.com

Frank’s Thoughts

I’ve been getting more and more calls about construction financing lately. Just this weekend, a small builder reached out needing $10 million for a multifamily project. He was ready to go and didn’t want to deal with his bank’s delays and red tape.

Last week, a past client contacted me about funding for two lots he picked up in Southern California. These kinds of projects are popping up more often—and they’re ready for action now. It’s clear that construction financing isn’t just bouncing back—it’s opening real doors for real people.

And that Oregon house? I had to include it. It’s just too cool. A perfect example of how personality and story can turn a property into something unforgettable.

Powered by: Mortgage Marketing Animals

Important Links