The housing boom isn’t over—it’s just evolving. This week’s headlines reveal an upgraded outlook for home prices, a deeper look at whether the boom still qualifies as one, and a dramatic tech shake-up with Zillow’s new ChatGPT integration. From updated forecasts to industry disruption, real estate professionals and consumers alike have a lot to track.

Is the Housing Boom Still Happening—or Just a Buzzword?

Read the Full Story → The Hill

A recent opinion piece in The Hill challenges the narrative of a continued housing boom, calling today’s market “stable but fragmented.” It argues that while home values remain resilient in some areas, the dramatic price acceleration seen during the pandemic era is long gone.

The article points to persistent inventory shortages, a high interest rate environment, and uneven regional demand. This combination is keeping prices from falling but also limiting runaway gains. The boom hasn’t disappeared—it’s just matured into something less headline-grabbing.

In essence, today’s “boom” is better described as a patchwork of local trends rather than a broad-based surge. That means professionals and consumers alike need to approach the market with clarity, not hype.

Join the Daily LOBC Live Call

Every weekday from 8:30–9:00 AM ET, the LOBC team hosts a free live Zoom coaching call for mortgage professionals. These sessions are packed with real-time strategies, updates, and guest appearances from industry leaders who help you sharpen your skills in an ever-evolving market.

Want to know how to explain today’s “housing boom” without overhyping? Curious about how to work your pipeline better or close deals faster? You’ll find those answers on the call. It’s fast, engaging, and packed with value.

Whether you’re building momentum or bouncing back, this daily call keeps your head in the game and your actions aligned with market trends. Click the live stream image to join the call.

Zillow Upgrades Its Forecast: Modest Gains Ahead

Read the Full Story → Fast Company

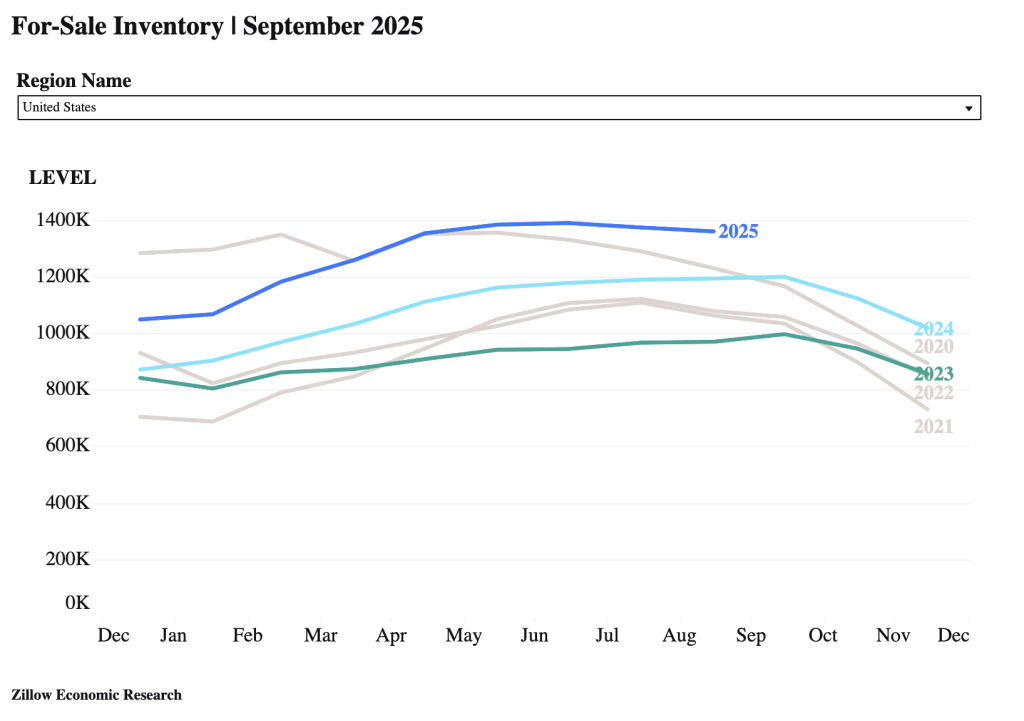

Zillow has increased its home price forecast for 2025–2026, now predicting a +1.9% year-over-year rise across U.S. markets. That’s a significant shift from earlier this year when it projected a –1.7% decline, then later adjusted to +0.4%. This upgrade reflects a market showing cautious signs of recovery.

However, Zillow notes substantial regional variation. Some markets—like Atlantic City, NJ—could see price increases over 5%, while others, such as Houma, LA, may experience notable drops. The housing boom looks very different depending on your zip code.

This data supports a more balanced narrative: while we aren’t back in the explosive growth phase, positive momentum is returning—especially in select metros.

Zillow + ChatGPT = A Tech Disruption in the Making

Read the Full Story → Real Estate News

Zillow’s latest move—integrating with ChatGPT—has sparked a wave of industry debate. Now, home shoppers can use conversational AI to search listings, ask market questions, and get property insights directly through the chatbot interface.

This innovation raises big questions: Will it disrupt MLS data rules? How will traditional listing portals compete? Could this accelerate the housing boom by streamlining the buyer journey? Some MLSs are still investigating the compliance angle.

What’s clear is that buyer behavior is changing. Faster search, better answers, and AI-guided decisions could compress the timeline from “just browsing” to “making an offer”—further fueling local market surges.

Loan Officer Perspective

Loan officers can use this week’s housing boom insights to reframe conversations and add more value. Start by emphasizing stability with upside—your borrowers don’t need to fear crashing prices, and modest gains still build equity.

Make use of Zillow’s regional forecast map to help clients understand specific local trends. That will boost your credibility and allow for more tailored financing strategies. And as AI tools reshape buyer behavior, you’ll want to speed up your follow-up and application flow to keep up.

Most importantly, plug into the LOBC call daily to stay ahead of tech changes and borrower mindset shifts.

Real Estate Agent Perspective

Agents, now’s the time to become a local housing boom expert. With headlines floating around, your clients need clarity. Use the Fast Company and Zillow data to showcase where your market stands—and what that means for pricing, timing, and negotiation.

Be the first agent in your market to master Zillow’s ChatGPT interface. Know how it works so you can explain it to clients and use it as a lead capture tool. Your quick understanding of this tech may be your next competitive edge.

In short, lean into education, adapt to tech, and double down on high-value service. The boom isn’t dead—it’s just smarter now.

Home Buyer & Seller Perspective

Buyers: The housing boom may not feel like 2021, but it’s still a good time to buy—especially in metros expecting gains. Prices aren’t likely to drop, and with tech making house-hunting faster, you’ll want to get pre-approved and act when the right home hits the market.

Sellers: Moderate growth means your home still holds strong value, but overpricing could backfire. Use a smart pricing strategy and lean on your agent’s local expertise to sell faster and for the right amount.

If you found this update helpful, reach out to the loan officer or real estate agent who shared it with you. They’ll help you apply this info to your personal situation.

Powered by: Mortgage Marketing Animals

Important Links