October 30, 2025

Barry Habib on Mortgage Rates, the Fed, and What’s Coming Next

In this must-watch interview, market legend Barry Habib joins me for a wide-ranging conversation on the future of mortgage rates, Fed policy, and what it all means for our industry. Barry, founder of MBS Highway and a Fannie Mae board member, shares his take on why we’re heading into a golden window of opportunity—especially for loan officers who’ve weathered the storm. We also talk about his work at Fannie Mae, where he’s shaping big-picture housing finance strategy. If you’re wondering what’s next for rates, refis, and real estate, Barry’s forecast is your roadmap.

Exclusive Interview with Barry Habib

In this powerhouse podcast episode, Barry Habib delivers an unfiltered look at today’s mortgage landscape. He explains how inflation data, bond market behavior, and central bank reactions are converging to shape the path for mortgage rates—and what that means for loan originators and homebuyers.

We also explore Barry’s role at Fannie Mae, where he’s contributing to critical housing finance strategies that will impact both policy and industry innovation for years to come. His unique vantage point offers invaluable insights for those navigating today’s unpredictable market.

Most importantly, Barry shares why loan officers who are still standing after this challenging cycle are poised for massive success in the next one. It’s a motivating message full of clarity, strategy, and optimism. Don’t miss it.

Visit MBSHighway.com for daily market insights from Barry and his team.

Loan Officer Perspective

Barry’s message is clear: this isn’t a time to retreat—it’s a time to prepare. Rates are likely to trend downward, and when they do, opportunities for refis, move-up buyers, and savvy investors will explode. Use this time to build relationships, sharpen your tools, and stay informed.

Frank’s Thoughts

Man, what a privilege to sit down with Barry Habib. This guy doesn’t just talk about markets—he calls them. And he’s calling for opportunity ahead, especially for those of us who’ve stayed the course during the toughest cycle in years.

Barry reminded me that while rates and headlines shift, what really matters is your daily consistency. If you’re focused, improving, and serving your clients well, you’re setting yourself up for a breakout when this market turns—which it will.

I walked away from this conversation more confident than ever that we’re on the verge of something big. Stay locked in, keep learning, and most of all—don’t sit on the sidelines. The next wave is coming, and it’s got your name on it.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 29, 2025

Could The AI Boom Hinder Homeownership?

The term AI Boom describes the rapid growth of artificial intelligence infrastructure, data centers, and energy demands — and this week’s mortgage and real estate news reveals how that boom is entering the housing conversation. We explore how these tech-driven shifts could increase homeownership costs, why buyers are showing up this fall despite uncertainty, and what new rental data means for long-term buyer pipelines. Mortgage and real estate pros, this is a moment to understand how AI impacts affordability — and how to guide clients accordingly.

How the AI Boom Could Push Homeownership Out of Reach

Read the Full Story → Scotsman Guide

The rise of AI infrastructure — especially large-scale data centers — is expected to significantly increase U.S. electricity consumption in the coming years. That growing demand could push up energy prices and strain utility grids, introducing new challenges for household affordability.

While AI is boosting electric demand, other homeownership costs are already on the rise. Insurance premiums have surged recently, and property taxes continue to climb in many areas. These factors, though not directly linked to AI, are reshaping the affordability equation.

The article argues for a broader view of homeownership costs — one that includes energy, insurance, and taxes — as these flexible expenses become more unpredictable and impactful to borrowers’ monthly budgets.

Join the Daily LOBC Live Call

Every weekday morning from 8:30–9:00 AM ET, the LOBC (Loan Officer Breakfast Club) hosts a free live Zoom coaching call for mortgage professionals nationwide. Each call is packed with valuable insights — from market updates to sales strategies — designed to help you start your day with clarity and confidence.

This isn’t a boring webinar. It’s an engaging community of originators, processors, and branch leaders sharing real-world solutions and hearing from special guests across the industry. Whether you’re struggling with a file or planning your Q4 marketing, you’ll walk away with new ideas and motivation.

Best of all? It’s totally free. Click the live stream image to join the call.

The Housing Market Surprise: Buyers Are Back — For Now

Read the Full Story → Fortune

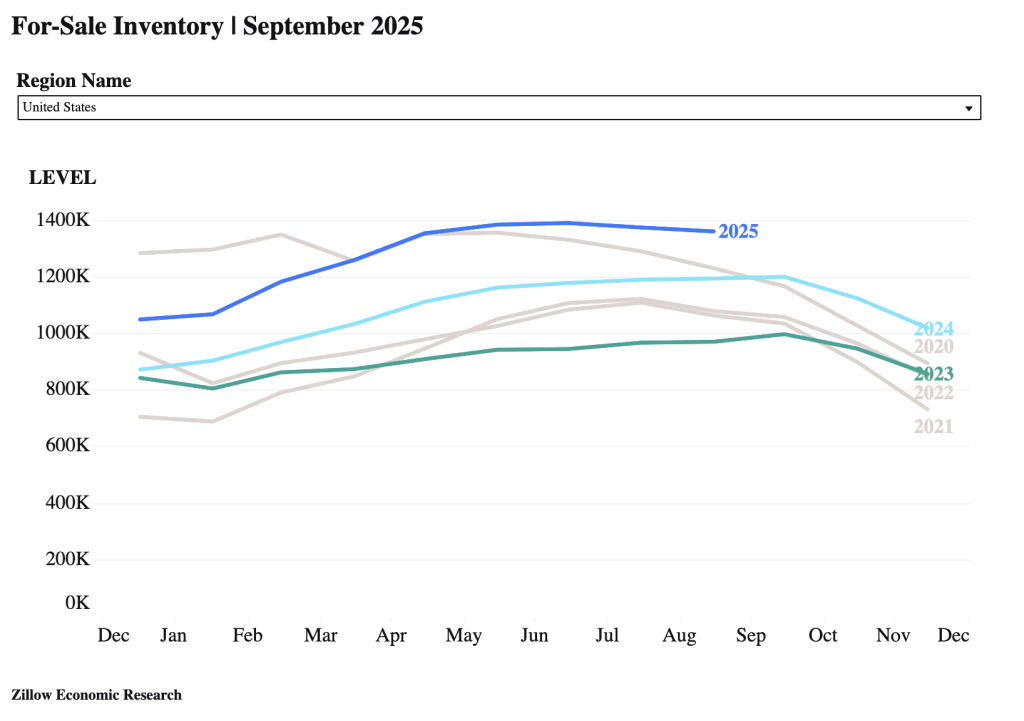

Zillow’s latest report shows a fall surge in buyer activity, with new listings up 3% year-over-year in September. That reverses the usual seasonal slowdown — a surprising twist driven by lower mortgage rates and pent-up demand.

Fifteen of the nation’s 50 largest metros have shifted into buyer’s market territory, giving consumers more negotiating power and slightly less competition. This could be the first glimpse of opportunity for sidelined buyers who sat out during peak inflation.

Still, affordability remains an issue. Even with rates dipping, rising energy, insurance, and utility costs (thanks in part to the AI Boom) mean buyers are facing complex cost landscapes.

Renters & Shifting Patterns: The Rental Base Speaks

Read the Full Story → Zillow Research

The 2025 Zillow Renters Report shows that the median income for renter households is just $54,000 — far below the national average. That income gap continues to delay transitions into homeownership, especially among younger adults.

Renters are increasingly negotiating lease concessions, seeking digital rental tools, and moving more frequently. These trends highlight a market in flux, with fewer long-term rental commitments and more demand for flexibility and tech-forward property experiences.

This instability in the rental base reinforces the importance of affordability — and shines a spotlight on the pressure points created by rising non-mortgage housing costs tied to the AI Boom.

Loan Officer Perspective

If you’re a loan officer, the AI Boom gives you a fresh angle for talking about affordability with your clients. Energy, utility, and insurance costs are no longer background noise — they’re becoming critical parts of the housing decision. Educate borrowers on total cost of homeownership, and include these factors in your affordability conversations.

Use the fall buyer momentum as a lead-conversion opportunity. Some clients who were hesitant in spring are now seeing improved conditions. Keep follow-up systems sharp and position yourself as the guide who sees beyond the rate.

And don’t overlook renters. They’re future buyers who need clear roadmaps. Use Zillow’s renter data to build trust and long-term pipeline strategies.

Real Estate Agent Perspective

This week’s news gives you valuable ways to connect with both current clients and prospects. The AI Boom story lets you talk intelligently about hidden costs — a great value-add in listing appointments or buyer consults. Think: utility bills, insulation quality, and home energy efficiency as differentiators.

Zillow’s report that buyers are returning this fall means your open houses and listing activity could pick up — especially in buyer-friendly markets. Be ready with updated comps and negotiation strategy.

And if you work with renters, now’s a good time to discuss lease-end plans and get them thinking about ownership while conditions remain favorable.

Home Buyer & Seller Perspective

Buying or selling a home in 2025 isn’t just about rates anymore. The AI Boom is reshaping energy demand, utility pricing, and local infrastructure — all of which impact your housing costs. Buyers should ask their lender or agent to estimate total monthly expenses, not just the mortgage payment.

If you’re selling, features like energy efficiency, updated systems, and newer roofs or HVAC units can increase your home’s appeal and help buyers manage future costs.

If someone shared this post with you, reach out to them. Whether you’re just curious or ready to act, they can help you navigate this evolving market with clarity.

Frank’s Thoughts

This AI Boom topic is one I think we’ll be talking about for years — and the smart professionals are going to be the ones who start that conversation now. When clients hear about “AI,” they don’t think about housing — but as the data shows, they absolutely should.

I was encouraged by the fall buyer activity. We’re not out of the woods yet, but it’s proof that people still want to own, even when the market isn’t perfect. We can work with that.

To everyone feeling a little fatigued or overwhelmed: don’t check out. Stay sharp. Keep showing up. Our value as pros is helping clients understand what really matters — and in this market, that’s more important than ever.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 28, 2025

Rate Cut – Fannie Revised Forecast & Luxury Real Estate

The term Rate Cut is dominating headlines again as the Federal Reserve weighs a potential policy shift amid mixed economic signals. Meanwhile, Fannie Mae’s latest forecast pours cold water on hopes for sub‑6 % mortgage rates anytime soon. And in the luxury housing market, recent data shows buyers are getting more for their money as home prices soften at the high end. For everyone in the business, the key message this week is perspective—a 6 % 30‑year fixed mortgage is still very affordable by historical standards.

Fed Faces Dilemma Amid Expected Rate Cut Decision

Read the Full Story → Fox Business

The Federal Reserve is walking a tightrope as it prepares to make its next move on interest rates. While inflation has cooled slightly, it remains above the Fed’s 2 % target, making any decision to cut rates more complicated than usual.

On one hand, the labor market has shown signs of softening, which gives the Fed room to lower rates without overheating the economy. But at the same time, officials are wary of cutting too soon and reigniting inflation.

This complex backdrop is what makes the upcoming Fed meeting so pivotal. For mortgage pros, staying informed on the Fed’s language will be key in setting expectations for clients.

Join the Daily LOBC Live Call

The free LOBC Daily Call is your secret weapon for staying sharp and confident in today’s fast-moving market. It runs Monday–Friday, 8:30–9:00 AM ET, and it’s packed with real-time insights, practical strategies, and good vibes.

Each session covers the latest in rates, mortgage programs, prospecting tips, and features occasional guest appearances from elite LOs, underwriters, and agents. It’s like morning coffee—if your coffee also boosted your pipeline.

Best of all, it’s totally free. Click the live stream image to join the call.

Fannie Mae Revises Rate Outlook—Still Above 6%

Read the Full Story → Scotsman Guide

Fannie Mae has updated its mortgage rate forecast, and it’s not exactly what buyers were hoping to hear. According to their latest projections, the 30-year fixed mortgage rate is expected to remain above 6 % through at least the end of 2025.

The outlook suggests rates may slowly decline, but likely won’t dip below 6 % until 2026. That’s a more conservative timeline than many were banking on earlier this year.

This should serve as a wake-up call to buyers and sellers waiting for “better” rates—today’s market is the one we’ve got, and it’s more stable than many think.

More for Your Money in the Luxury Market

Read the Full Story → Realtor.com

According to Realtor.com’s latest research, buyers in the luxury segment are seeing more value than they have in years. While inventory is still tight, there’s been a noticeable shift in pricing trends at the high end of the market.

The share of million-dollar homes offering larger square footage has increased, and listing prices are softening slightly in several upscale markets.

For move-up buyers and affluent clients, this could be the moment to act—especially with borrowing costs holding steady and luxury homes offering more space per dollar.

Loan Officer Perspective

This week’s stories are your cue to reframe the rate conversation. A 6 % 30‑year fixed is still historically low, and the Fed’s caution confirms that we’re in a stable, not volatile, zone. Use this narrative to encourage clients to move forward confidently.

Also, the luxury segment is becoming more approachable—great news for borrowers with jumbo scenarios. Share Realtor.com’s insights to prompt conversations with wealthier leads who may be on the fence.

Keep being the guide: interpret rate news calmly, offer clear next steps, and remind clients that affordability isn’t just about rate—it’s about timing and opportunity.

Real Estate Agent Perspective

Fannie Mae’s update gives agents a chance to reset buyer expectations: rates under 6 % aren’t just around the corner. That creates urgency, not hesitation, especially with inventory levels beginning to shift in several price bands.

Use the luxury market data to your advantage. Move-up buyers who felt priced out six months ago may now have a window of opportunity. Talk value, not just price.

And team up with your loan officer to pre‑educate clients. When the agent and LO are aligned on rate realities, transactions run smoother and deals get done faster.

Home Buyer & Seller Perspective

Here’s what matters if you’re planning to buy or sell: the Fed is still considering a rate cut, but mortgage rates are expected to stay above 6 % for the foreseeable future. That’s not bad news—it’s actually a great time to make your move.

Buyers: A 6 % rate is affordable when you look at the bigger picture of rent inflation, tax savings, and long‑term equity. Sellers: With serious buyers still in the market, now is a strong window to list—especially with luxury buyers finding more for their money.

Have questions about financing or timing? Reach out to the loan officer or real estate pro who shared this blog and let’s talk.

Frank’s Thoughts

Let me just say this plainly: a 6 % 30-year fixed rate is still very affordable. I know the headlines love to chase “rate drops” and sub‑6 % predictions, but if you’re waiting around for 5.5 % to magically appear, you might miss real opportunities right now.

I’ve been in this business long enough to see the full rate cycle, and I’m telling you—what we have today is stable, healthy, and workable. We should be encouraging our clients to move forward with confidence, not hesitation.

Let’s stop acting like 6 % is a bad number. It’s not. It’s just the new normal—for now—and it still works for smart, serious buyers.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 27, 2025

Rate Cuts, Homeownership Tenure & ChatGPT Atlas

The term Rate Cut is front and center for mortgage and real estate professionals today. With the Federal Reserve widely expected to move forward despite a slight CPI uptick, it’s a key moment for strategy and outreach. Meanwhile, homeowners are staying put longer than ever, and a major shift in how we show up online is unfolding with ChatGPT’s new browser. Here’s what’s happening and how you can turn it into opportunity.

CPI Uptick Unlikely to Derail Fed Rate Cut This Week

Read the Full Story → MPA

Inflation in September rose 0.3% month-over-month and 3.0% year-over-year—just slightly above expectations. While not ideal, the data doesn’t suggest inflation is getting out of control.

Despite the uptick, the Federal Reserve is still widely expected to move ahead with a rate cut this week. There are divisions within the Fed on how fast to cut and by how much, but the market seems to have priced in some action.

In response, the 10-year Treasury yield fell below 4%, and mortgage rates have also dipped. The average 30-year fixed rate is now around 6.2%, the lowest since September of last year.

Join the Daily LOBC Live Call

Every Monday through Friday from 8:30–9:00 AM ET, mortgage professionals gather on Zoom for a free live coaching session. These calls cover everything from scripts and strategy to marketing ideas and compliance tips. You’ll also hear from special guests who bring real-time insight from the front lines.

Whether you need daily motivation or just want to stay sharp, this 30-minute call will start your day right. It’s fast-paced, practical, and packed with ideas you can use immediately.

Click the live stream image to join the call.

Homeownership Tenure Reaches Highest Level in a Quarter Century

Read the Full Story → Scotsman Guide

Homeowners who sold in Q3 2025 had owned their homes for an average of 8.39 years—the longest tenure in at least 25 years. This trend shows how high rates and limited supply are freezing movement in the market.

Factors contributing to the record tenure include higher mortgage rates, elevated home prices, and a rise in all-cash transactions, which made up nearly 39% of all sales last quarter.

Some states saw dramatically higher averages. In Massachusetts, the average tenure was 12.91 years, while California followed at 11.2 years. Meanwhile, states like Maine and Mississippi saw lower averages.

Why the ChatGPT Browser Launch Matters to Us

Read the Full Story → AP News

OpenAI has launched “Atlas,” a browser that integrates ChatGPT directly into your web experience. Initially available for macOS, it combines AI assistance with browsing, memory, and task automation.

Features include sidebar chat, page memory, and an “Agent Mode” that can handle tasks on your behalf. It positions itself as a direct challenge to Google Chrome and other traditional browsers.

Why does this matter for mortgage and real estate? Because how people search is changing. It’s no longer just about being found on Google—you want to be referenced by AI, too.

Loan Officer Perspective

This week’s expected Rate Cut is your headline opportunity. Use it in conversations, marketing, and your scripting. Many homeowners and buyers are watching for signs to make a move—give them a reason to act.

The tenure data signals a deep well of potential in your database. People aren’t moving as often, but that doesn’t mean they don’t need to refinance, renovate, or tap equity. Go reengage those long-term clients.

On the tech front, think ahead. Join platforms like loanofficercrm.ai to stay visible in the evolving AI space. Visibility is no longer just SEO—it’s about AI relevance.

Real Estate Agent Perspective

With fewer people moving, every listing becomes more valuable. Use the homeownership tenure data to highlight scarcity—this is a great time for potential sellers to maximize their equity.

A Rate Cut may open doors for more buyers or at least increase interest. Make sure you’re aligned with your lender partners to update your buyer messaging quickly.

Also, consider how your listings and website content might show up in AI-assisted searches. Think about conversational phrasing and FAQs—not just keywords.

Home Buyer & Seller Perspective

A Rate Cut this week could improve affordability or unlock better loan options. Whether you’re buying your first home or looking to move, this is the kind of shift that creates new opportunity.

Sellers are in a strong spot too. With people staying in homes longer, your listing stands out even more. Tight inventory gives you leverage in pricing and negotiations.

Have questions? Reach out to the mortgage or real estate professional who shared this blog. They can help you explore what’s possible right now.

Frank’s Thoughts

I included the ChatGPT browser story simply because I found it interesting. I tried to install it on my Mac but realized I need to upgrade my OS. That’s on my to-do list.

Why am I interested? Because for years, we’ve worked to show up at the top of Google. Now that dynamic is shifting. The goal isn’t just to rank—it’s to be referenced by AI.

If you’re a loan officer, I recommend joining loanofficercrm.ai. It’s built to help you navigate this exact kind of evolution. Staying visible is about more than algorithms now—it’s about conversation.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 24, 2025

Housing Boom: The New Reality for Buyers, Sellers, and Industry Pros

The housing boom isn’t over—it’s just evolving. This week’s headlines reveal an upgraded outlook for home prices, a deeper look at whether the boom still qualifies as one, and a dramatic tech shake-up with Zillow’s new ChatGPT integration. From updated forecasts to industry disruption, real estate professionals and consumers alike have a lot to track.

Is the Housing Boom Still Happening—or Just a Buzzword?

Read the Full Story → The Hill

A recent opinion piece in The Hill challenges the narrative of a continued housing boom, calling today’s market “stable but fragmented.” It argues that while home values remain resilient in some areas, the dramatic price acceleration seen during the pandemic era is long gone.

The article points to persistent inventory shortages, a high interest rate environment, and uneven regional demand. This combination is keeping prices from falling but also limiting runaway gains. The boom hasn’t disappeared—it’s just matured into something less headline-grabbing.

In essence, today’s “boom” is better described as a patchwork of local trends rather than a broad-based surge. That means professionals and consumers alike need to approach the market with clarity, not hype.

Join the Daily LOBC Live Call

Every weekday from 8:30–9:00 AM ET, the LOBC team hosts a free live Zoom coaching call for mortgage professionals. These sessions are packed with real-time strategies, updates, and guest appearances from industry leaders who help you sharpen your skills in an ever-evolving market.

Want to know how to explain today’s “housing boom” without overhyping? Curious about how to work your pipeline better or close deals faster? You’ll find those answers on the call. It’s fast, engaging, and packed with value.

Whether you’re building momentum or bouncing back, this daily call keeps your head in the game and your actions aligned with market trends. Click the live stream image to join the call.

Zillow Upgrades Its Forecast: Modest Gains Ahead

Read the Full Story → Fast Company

Zillow has increased its home price forecast for 2025–2026, now predicting a +1.9% year-over-year rise across U.S. markets. That’s a significant shift from earlier this year when it projected a –1.7% decline, then later adjusted to +0.4%. This upgrade reflects a market showing cautious signs of recovery.

However, Zillow notes substantial regional variation. Some markets—like Atlantic City, NJ—could see price increases over 5%, while others, such as Houma, LA, may experience notable drops. The housing boom looks very different depending on your zip code.

This data supports a more balanced narrative: while we aren’t back in the explosive growth phase, positive momentum is returning—especially in select metros.

Zillow + ChatGPT = A Tech Disruption in the Making

Read the Full Story → Real Estate News

Zillow’s latest move—integrating with ChatGPT—has sparked a wave of industry debate. Now, home shoppers can use conversational AI to search listings, ask market questions, and get property insights directly through the chatbot interface.

This innovation raises big questions: Will it disrupt MLS data rules? How will traditional listing portals compete? Could this accelerate the housing boom by streamlining the buyer journey? Some MLSs are still investigating the compliance angle.

What’s clear is that buyer behavior is changing. Faster search, better answers, and AI-guided decisions could compress the timeline from “just browsing” to “making an offer”—further fueling local market surges.

Loan Officer Perspective

Loan officers can use this week’s housing boom insights to reframe conversations and add more value. Start by emphasizing stability with upside—your borrowers don’t need to fear crashing prices, and modest gains still build equity.

Make use of Zillow’s regional forecast map to help clients understand specific local trends. That will boost your credibility and allow for more tailored financing strategies. And as AI tools reshape buyer behavior, you’ll want to speed up your follow-up and application flow to keep up.

Most importantly, plug into the LOBC call daily to stay ahead of tech changes and borrower mindset shifts.

Real Estate Agent Perspective

Agents, now’s the time to become a local housing boom expert. With headlines floating around, your clients need clarity. Use the Fast Company and Zillow data to showcase where your market stands—and what that means for pricing, timing, and negotiation.

Be the first agent in your market to master Zillow’s ChatGPT interface. Know how it works so you can explain it to clients and use it as a lead capture tool. Your quick understanding of this tech may be your next competitive edge.

In short, lean into education, adapt to tech, and double down on high-value service. The boom isn’t dead—it’s just smarter now.

Home Buyer & Seller Perspective

Buyers: The housing boom may not feel like 2021, but it’s still a good time to buy—especially in metros expecting gains. Prices aren’t likely to drop, and with tech making house-hunting faster, you’ll want to get pre-approved and act when the right home hits the market.

Sellers: Moderate growth means your home still holds strong value, but overpricing could backfire. Use a smart pricing strategy and lean on your agent’s local expertise to sell faster and for the right amount.

If you found this update helpful, reach out to the loan officer or real estate agent who shared it with you. They’ll help you apply this info to your personal situation.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 23, 2025

Will Blockchain Cut Closing Costs by 75%

Blockchain technology is poised to radically transform the real estate and mortgage industry. This week’s lead story features luxury real estate broker and crypto expert Tony Giordano explaining how blockchain could slash closing costs by as much as 75%, make mortgage rates portable, and attract foreign capital through tokenized property. We’ll also explore how small lenders are pushing for creative mortgage solutions and whether investment property still makes sense today. The blockchain revolution isn’t just coming — it’s already started, and it could be a game-changer for everyone in the industry.

Blockchain Could Disrupt Real Estate Closings

In a CNBC interview, Tony Giordano laid out how blockchain could upend real estate closings. He says closing costs could drop by up to 75% thanks to blockchain eliminating much of the paperwork and third-party involvement in title, escrow, and funding processes

One of the most compelling ideas is transferable mortgage bonds. This concept would allow borrowers to carry their low-interest rates with them to a new property — something that could completely reshape how homeowners and investors approach financing.

Giordano also emphasized tokenization, where commercial real estate is split into digital shares. This opens the market to global investors, increases liquidity, and speeds up transactions. According to Giordano, the entire industry will operate on blockchain within 10 years.

Join the Daily LOBC Live Call

Every weekday morning from 8:30 to 9:00 AM ET, mortgage professionals nationwide jump on the free Loan Officer Boot Camp Zoom call. It’s a quick, high-value session where you’ll pick up actionable insights, learn pipeline-building strategies, and hear from guest experts who know what’s working right now.

If you’ve ever felt stuck or just want new ideas to grow your business, this is where you need to be. Topics range from market updates and tech tools to sales tactics and mindset tips that’ll help you thrive, even in tough markets.

And yes — we’ll be talking about blockchain this week and what it means for your day-to-day business. Don’t miss it. Click the live stream image to join the call.

Community Lenders Pitch New Rate Strategy

Read the Full Story → Scotsman Guide

A group of independent mortgage lenders is proposing a unique partnership with industry leaders Ben Bessent and Bill Pulte to lower mortgage rates across the board. Their idea? Use government-supported programs to temporarily buy down rates and inject more flexibility into underwriting.

The plan focuses on smaller lenders who often can’t compete with larger institutions on pricing. By pooling resources and collaborating with policymakers, these lenders hope to bring competitive rates to borrowers who might otherwise be priced out of the market.

If successful, this could level the playing field — giving community lenders the tools to win business in a rate-sensitive environment.

Is Investment Property Still Worth It?

Read the Full Story → Realtor.com

With higher rates and tighter margins, some investors are questioning whether real estate is still a smart move. Realtor.com breaks down what to consider before jumping in, including location trends, rental demand, and cash flow projections.

The article emphasizes that while returns may be lower in the short term, long-term fundamentals still look solid. Appreciation, rental income, and tax benefits continue to make real estate attractive — especially if purchased strategically.

Bottom line: it’s not a “get rich quick” play, but for investors with patience and the right team, real estate still offers compelling advantages over other asset classes.

Loan Officer Perspective

Blockchain, rate flexibility, and evolving investor strategies all point to one thing: more opportunity for smart, prepared LOs. Understanding blockchain now means you can start positioning yourself as a tech-savvy advisor ready for the next wave of innovation.

The lender collaboration story shows that even in tough markets, creative thinking wins. This gives you a new narrative for rate shoppers — and a way to stand out against the big players.

Use the investment property piece to start conversations with investor clients who may be sitting on the sidelines. Help them run the numbers and see how real estate still pencils out.

Real Estate Agent Perspective

The idea of faster, cheaper closings is pure gold for agents. If blockchain adoption means fewer headaches and quicker commissions, it’s something worth paying attention to. Educate yourself now so you’re ready to guide clients when this tech hits your market.

Smaller lenders fighting for better rates can boost your buyer pool — especially for first-time buyers struggling with affordability. Know who’s offering creative programs locally and build those relationships.

And if you work with investors, help them see past the headlines. Investment property isn’t dead — it just requires better strategy and smarter advice.

Home Buyer & Seller Perspective

Buyers should know that new technology like blockchain could soon make buying a home faster, easier, and cheaper. That’s real savings — and less stress.

If you’re a seller, having a team that understands these trends can help your home stand out. Speedy closings and flexible financing attract serious buyers.

Questions? Curious how all this applies to your specific situation? Contact the loan officer or real estate agent who shared this post with you — they’re ready to help you navigate what’s next.

Frank’s Thoughts

Man, this is the stuff I get excited about. Blockchain may sound futuristic, but it’s already being used — and it’s going to simplify so many parts of the process.

Lenders and agents who learn about this early will have a major edge. Remember when e-signatures first came out? Same thing. Be the pro who explains it, not the one asking what it is.

The big lesson here: don’t get stuck in “how it’s always been.” Stay open. Stay curious. And stay ready to lead when change shows up at your door.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 22, 2025

Zillow Drops Matterport: Listing Media Showdown & Mortgage Market Shifts

The big headline this week is Zillow Drops Matterport, a move that signals a significant change in the real estate media landscape. As Zillow and CoStar square off over 3D tour licensing, agents, MLSs, and photographers are caught in the crossfire. Meanwhile, the mortgage world is debating a shift to single-bureau credit checks, and new data shows down payments are holding steady while higher-income buyers continue to dominate the market. These stories offer critical insight for professionals navigating 2025’s evolving housing market.

Zillow Drops Matterport: A Real Estate Tech Power Play

In a bold and controversial move, Zillow has removed Matterport virtual tours from its platforms, including Zillow.com and StreetEasy. The decision stems from recent API restrictions following CoStar Group’s 2024 acquisition of Matterport for $1.6 billion. CoStar, in turn, has accused Zillow of violating licensing terms and infringing on intellectual property.

The result is widespread confusion among real estate professionals. Many MLSs have warned that listings using Matterport or CoStar-branded media could face fines or takedowns if licensing isn’t clarified. Agents and photographers are scrambling to understand what’s allowed—and what risks their listings might face.

Zillow is now pushing its proprietary “3D Home Tour” as an alternative, but critics question its quality and flexibility. As the dust settles, other virtual tour companies like Giraffe360 and iGuide are gaining attention as potential replacements. Agents are advised not to panic—but to stay informed and adjust quickly.

TransUnion Slams Single-Bureau Model for Mortgage Credit Checks

Read the Full Story → Scotsman Guide

TransUnion is pushing back hard against the mortgage industry’s growing interest in using a single credit bureau for loan underwriting. The tri-merge model—using data from Equifax, Experian, and TransUnion—has long been standard, but some lenders and regulators are exploring alternatives to reduce costs.

TransUnion warns that relying on a single bureau could create blind spots in borrower profiles and lead to riskier loans. Their analysis suggests some borrowers could pay up to $6,000 more over the life of a mortgage due to less accurate credit assessments.

While cost-cutting is a priority in a tight market, many industry voices agree that data quality should come first. With the future of mortgage credit models under review, this debate is far from over.

Down Payments Plateau as Higher-Income Buyers Dominate

Read the Full Story → MPAMAG

New data reveals that the average down payment on U.S. homes has plateaued around $30,000—or about 14% to 15% of the purchase price—even as home values remain historically high. This signals that affordability remains out of reach for many lower-income and first-time buyers.

Meanwhile, the market is increasingly dominated by higher-income borrowers, many of whom can bring more cash to the table. Their ability to navigate high interest rates and competition gives them an edge, further widening the accessibility gap.

As a result, real estate professionals may need to recalibrate marketing strategies and financing solutions to reach underserved buyer segments—or lean into premium-market opportunities.

Join the Daily LOBC Live Call

Every Monday through Friday from 8:30–9:00 AM ET, the LOBC Daily Coaching Call offers mortgage professionals 30 minutes of powerful insights, strategy sharing, and live Q&A. Whether you’re new to the industry or a seasoned veteran, these calls will give you the edge you need to stay sharp and proactive.

You’ll hear actionable tips on lead generation, market shifts, borrower conversations, and smart ways to grow your business in today’s environment. The sessions often feature surprise guest speakers from across the industry—bringing you up-to-the-minute guidance from top producers and trainers.

If you’re serious about leveling up your mortgage game, this is a can’t-miss event. Click the live stream image to join the call.

Loan Officer Perspective

These stories reveal key market shifts that mortgage pros can’t ignore. First, the Zillow–Matterport fallout might slow transaction timelines if listings are pulled or downgraded, which means communication with agents becomes even more critical. Second, the credit-reporting debate highlights how even back-end decisions can impact pricing, risk, and client experience. Third, the plateau in down payments offers both a challenge and an opportunity—creative financing options and buyer education will set great LOs apart.

Real Estate Agent Perspective

Agents need to act fast on the media changes. Ensure your listings are compliant and consider switching to supported 3D tour tools. This not only protects your business but gives you a marketing edge when competitors may be scrambling. Understanding how credit and down payment dynamics are shifting also helps you coach buyers more effectively—especially as higher-income clients take center stage. Adjust your listing presentations and buyer consultations accordingly.

Home Buyer & Seller Perspective

If you’re a home buyer, this is a moment to ask questions: How will your credit be evaluated? What tour tools are being used in your listing? Are your down payment expectations realistic in today’s market? Sellers should ask their agent whether their listing media is compliant and competitive. To get ahead in this complex landscape, connect with the pro who shared this post—they can walk you through your options and help you move forward confidently.

Frank’s Thoughts

Man, what a week for behind-the-scenes drama. But here’s the thing: this is where pros shine. When media platforms, credit models, and buyer trends start shifting, there’s one guaranteed path to success—be the calm in the chaos.

Your value isn’t just in knowing the answers, it’s in guiding clients through uncertainty. That’s what wins trust and repeat business. And let’s be honest—this industry never stops moving, so learning to adapt fast is a superpower.

Lean in, don’t stress out. You’ve got this. Your clients are counting on you—and they’re lucky to have you in their corner.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 21, 2025

UWM, Arizona’s Data Boom, and Housing Reform

This week in mortgage and real estate news, our focus keyword is UWM. We explore how Arizona’s desert is turning into a hub for massive data center investments, what the rise of UWM and Rocket Mortgage means for the rest of the mortgage industry, and a new immigration reform proposal with potential implications for housing. These stories offer insight into shifting opportunities for investors, lenders, and agents. Whether you’re in the trenches as a loan officer or guiding buyers as an agent, there’s actionable intel here for everyone.

Arizona Desert Transforms into a Data Center Goldmine

Read the Full Story → Realtor.com

Real estate investor Anita Verma-Lallian is leading a bold push into Arizona’s desert, turning barren land into billion-dollar data center campuses. With land prices still relatively affordable and major tech companies hungry for space and power, this frontier is rapidly becoming a digital goldmine.

The strategic shift is driven by the need for cloud infrastructure to support AI, fintech, and massive data needs. It’s also a compelling example of how investors can reimagine underutilized land in high-sun, low-cost markets.

Local governments are playing a supporting role, helping fast-track zoning and power access. For those watching real estate market trends, Arizona’s evolution into a tech hub is worth tracking.

Join the Daily LOBC Live Call

LOBC’s free Zoom coaching call runs Monday through Friday, 8:30–9:00 AM ET, and is one of the best-kept secrets in the mortgage world. Designed for loan officers at every level, these sessions provide fast, focused coaching to jumpstart your day with energy and ideas.

Each call features strategies that are working in real time, plus guest appearances from top-producing LOs and industry experts. You’ll hear tips on prospecting, lead follow-up, and market messaging you can use immediately.

Click the live stream image to join the call. It could be the most valuable 30 minutes of your workday.

UWM and Rocket Surge: What About Everyone Else?

Read the Full Story → MPA

With UWM and Rocket posting strong numbers, market analysts are starting to ask: What happens to the rest of the mortgage market? The big players have capitalized on automation, scale, and branding, leaving smaller lenders to fend off margin pressure and volume slowdowns.

The article dives into analyst Henry Coffey’s take on how UWM and Rocket are weathering the storm, while regional players are either shrinking, merging, or fading from relevance. The challenge is no longer just rates—it’s marketing reach and tech investment.

For industry pros, this isn’t a doom story; it’s a wake-up call. Innovation and clear messaging are the keys to staying competitive when giants like UWM dominate the headlines.

The Dignity Act: A Bipartisan Push on Immigration Reform

Read the Full Story → NAHB

The National Association of Home Builders is backing the Dignity Act, a bipartisan immigration reform bill with potential implications for the housing market. The bill provides a pathway to legal status for undocumented immigrants while enhancing border security.

For the construction and housing industries, labor shortages remain a persistent issue. Legalizing and stabilizing the workforce could ease those pressures, especially in homebuilding.

This proposal could ultimately translate to more housing starts, shorter project timelines, and improved affordability over time. While still in early stages, it’s a meaningful signal that policymakers are connecting immigration with economic and housing health.

Loan Officer Perspective

The resurgence of niche real estate plays like data center developments in Arizona should encourage LOs to expand their networks with investors and commercial developers. The success of UWM and Rocket is a signal to focus on tech and brand differentiation—no matter your size. And if immigration reform passes, it could loosen up builder pipelines, which means more homes to finance.

Real Estate Agent Perspective

Agents should be tracking these investment trends and sharing insights with clients interested in commercial or long-term growth plays. The news around UWM and Rocket reminds us that big players dominate attention, so agents must double down on local value and personalized marketing. Immigration reform may open up labor supply, translating to more homes on the market.

Home Buyer & Seller Perspective

Buyers may benefit from increased home availability if immigration reform boosts construction. Sellers in tech-forward regions like Arizona could see rising demand. Curious how these trends impact your next move? Contact the mortgage or real estate pro who shared this post with you. They’re ready to help you navigate it all.

Frank’s Thoughts

Man, this Arizona data center story is a perfect reminder that innovation often starts where others see nothing. That desert land is now a tech magnet—just wild.

The UWM and Rocket conversation is real. If you’re not investing in systems, branding, and communication, you’re gonna feel the squeeze. But the cool thing? Small teams can still win with speed and trust.

And immigration reform tied to housing? That’s smart policy thinking. We need more workers to build more homes. It’s all connected, and staying informed means staying ahead.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 20, 2025

WH Budget Director Wants CFPB GONE!

The mortgage industry is buzzing after a major political move—White House Budget Director wants the CFPB gone. That’s just one of several impactful developments this week. We’re also watching President Trump’s latest executive orders that could reshape the FHFA’s housing policy, and new data from Zillow shows rents are still sliding across the country. From regulatory shakeups to rental trends, here’s what mortgage and real estate pros need to know now. This week’s focus keyword: CFPB.

White House Budget Director Aims to Shut Down the CFPB

Read the Full Story → Scotsmanguide

A major headline emerged this week as the White House Budget Director announced his desire to eliminate the Consumer Financial Protection Bureau (CFPB). The bold move signals a potential shift in how consumer protections are managed in the mortgage and financial sectors.

His argument? The agency is unconstitutional and an overreach. He believes consumer protections should fall under the purview of the Federal Trade Commission (FTC), which has a multi-member leadership and is accountable to Congress.

The CFPB was created in the aftermath of the 2008 financial crisis and has been a lightning rod ever since. Supporters argue it plays a vital role in preventing predatory lending. If it’s shut down, we may see a rollback to pre-2008 regulatory conditions.

Join the Daily LOBC Live Call

Each weekday morning, top-producing mortgage pros hop on Zoom to sharpen their edge—and you can too. The LOBC Daily Live Call runs Monday through Friday, 8:30–9:00 AM ET, delivering actionable insights, scripts, and strategies you can use immediately.

Led by industry veterans and guest speakers, these sessions are focused, fast-paced, and packed with value. Whether you’re looking to refine your marketing, navigate rate environments, or sharpen your scripting, this free call is a must-attend.

Bring your coffee, your questions, and your curiosity. You’ll leave each day more prepared than the last. Click the live stream image to join the call.

Trump Executive Orders Reshape FHFA Housing Strategy

Read the Full Story → Scotsmanguide

President Trump is once again shaking up the housing conversation. A new wave of executive orders outlines a sweeping strategy to reorient the Federal Housing Finance Agency’s (FHFA) direction.

The plan includes a rollback of affordability mandates and a renewed push to privatize Fannie Mae and Freddie Mac. Critics say this could reduce access to affordable housing, while proponents argue it would reduce government risk and create a more competitive market.

For now, these orders set the tone for the 2025 campaign trail—but if implemented, they could have long-term consequences on housing finance as we know it.

Zillow Reports Rents Dropped Again in September

Read the Full Story → Zillow

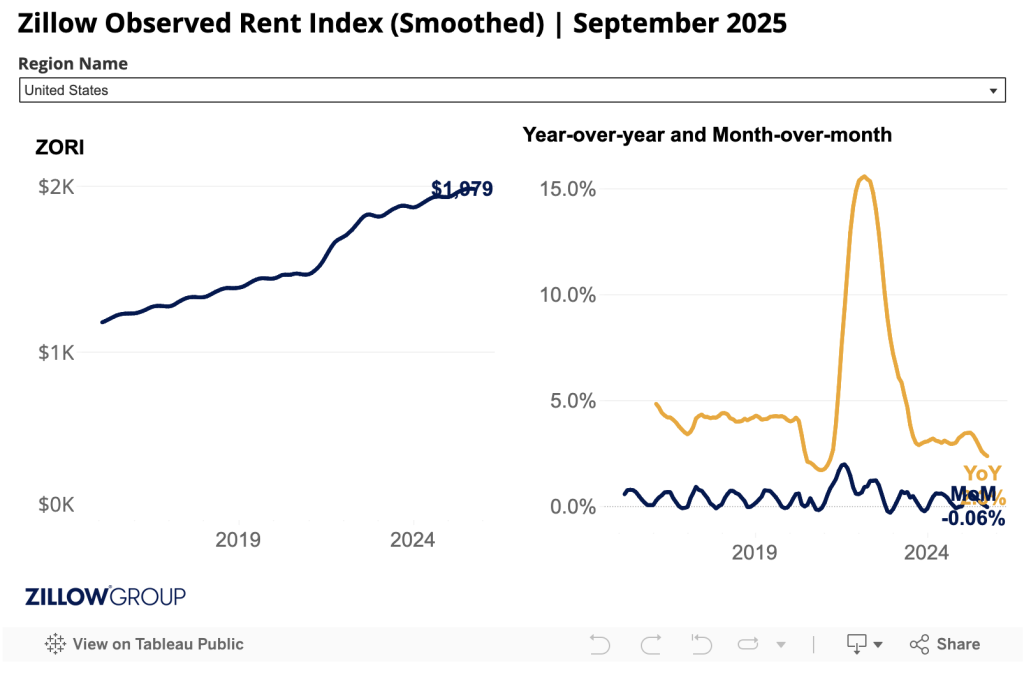

Zillow’s latest Rent Report for September 2025 shows a continued national decline in rental prices, now marking the fifth consecutive month of downward movement. Median rent is down 0.6% month-over-month and 1.2% from this time last year.

Sun Belt cities saw the biggest drops, with places like Austin and Phoenix leading the decline. Meanwhile, rental demand remains soft due to high home affordability issues and a robust pipeline of multifamily completions hitting the market.

While lower rents may make renting more attractive short-term, buyers concerned about future rent hikes or looking for stability may still consider homeownership as a long-term solution—especially with rising inventory and softening prices in some markets.

Loan Officer Perspective

Loan officers should keep an eye on regulatory changes like the potential CFPB closure and the FHFA policy shifts. These stories aren’t just headlines—they could directly impact how you do business. Stay informed and proactive with clients who might have concerns.

The rental market story is also an opportunity. As rents slide, you can reframe homeownership as a path to long-term financial stability. Educate your database with data-driven messaging about why now might be the time to act.

And don’t forget—calls like the LOBC Daily Live Call give you a community and a knowledge edge. Plug in and keep leveling up.

Real Estate Agent Perspective

If the CFPB is dismantled or FHFA direction changes, mortgage products and consumer confidence could shift. Stay connected with your lending partners to anticipate changes and advise clients wisely.

Falling rents may delay some renters from entering the buyer pool, but it’s a perfect time to focus on educating potential buyers about long-term equity and stability. Partner with lenders to craft strong rent-vs-own messaging.

Also, use these stories in your weekly client updates. Educating your audience positions you as the go-to market expert.

Home Buyer & Seller Perspective

This week’s news underscores why staying informed matters. If the CFPB were shut down, consumer protections could look very different. Buyers and sellers should work with professionals who stay on top of these changes.

For renters seeing lower prices, now might be a good time to save or reconsider timing—but also weigh the long-term benefits of owning a home in markets where buying is becoming more feasible.

Have questions or want to talk through your next steps? Contact the loan officer or real estate agent who shared this post. They’re here to help.

Frank’s Thoughts

Let’s be clear: removing the CFPB entirely wouldn’t be a win for loan officers. The agency may have its flaws, but it also brought clarity and structure after the chaos of 2008. Without it, we risk reverting to a messy, pre-crisis regulatory landscape.

Many forget that before the CFPB, the patchwork of rules we had was not only inconsistent—it was hostile to originators. Enforcement varied wildly, and loan officers were often the ones caught in the crossfire.

Rather than scrapping the CFPB, let’s talk about smart reform. Change the parts that need fixing, but don’t throw the whole thing away. A better path forward protects both consumers and professionals.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 17, 2025

Big Rate Cut Ahead?

The mortgage world is buzzing over a possible rate cut this October. With the Federal Reserve’s next move uncertain, markets are parsing every statement from Fed officials. One governor wants a bold half-point reduction, while another leans toward a more modest cut. At the same time, mortgage rates are dipping slightly, and builder optimism is surprisingly up. In this week’s post, we’ll explore how these shifts could impact loan officers, agents, and buyers—and why the next Fed meeting might be one of the most pivotal in recent memory.

Fed Governors Split on Rate Cut Size

Read the Full Story → CNBC

Fed Governor Stephen Miran is calling for a bold half-point rate cut at this month’s FOMC meeting, citing restrictive monetary policy and economic headwinds. His remarks stand in contrast to fellow Governor Christopher Waller, who advocates for a more cautious 25 basis point reduction.

This internal debate reveals growing concern about slowing job growth and inflation moderation. Waller emphasizes gradual moves to avoid reigniting inflation, while Miran sees urgent need for stimulus to head off broader slowdown.

Markets are watching closely. The conversation around a rate cut is heating up fast—and the size of the move could send ripples through mortgage rates and housing activity.

Join the Daily LOBC Live Call

Each weekday morning from 8:30–9:00 AM ET, we host a free LOBC Daily Coaching Call for mortgage professionals and real estate agents.

This fast-paced Zoom session delivers timely insights on market movements, rate trends, and lock strategies. We break down economic data, Fed commentary, and how to apply it with your clients in real-time.

You’ll also hear from special guests—top-producing LOs, economists, and marketing strategists—who share tips that work now. Whether you’re pricing a tricky file or prepping your daily calls, this 30-minute session sets the tone.

Click the live stream image above to join the call

Mortgage Rates Nudge Lower, Eyes on Fed

Read the Full Story → Mortgage News Daily

Mortgage rates eased slightly this week, with the average 30-year fixed dipping to 6.10%. That’s down 11 basis points from the day before, and nearly 20 points below last week’s levels.

The decline is fueled by cooling inflation data and rising expectations for a Fed rate cut. Investors are pricing in easing, though long-term mortgage rates don’t always fall in sync with Fed policy.

Even so, the shift is meaningful. Lower rates could reignite buyer interest, spur refinances, and drive more lock-in activity—especially if the Fed delivers in their next meeting.

Builder Confidence Ticks Up in October

Read the Full Story → NAHB

In a surprise twist, builder sentiment rose this month despite economic headwinds. The NAHB/Wells Fargo Housing Market Index climbed to a six-month high, driven by expectations of improving buyer demand.

Builders are hopeful that a forthcoming rate cut will make homes more affordable, and many are offering incentives and pricing deals to capitalize on potential demand before the Fed acts.

This bounce in optimism could signal renewed life in new construction, particularly if borrowing costs fall further heading into year-end.

Loan Officer Perspective

This is a moment to position yourself as the market translator. A potential rate cut offers two powerful conversations—how clients can benefit now, and how to prep for what’s next.

Use the recent rate dip to reconnect with leads and refi prospects. Present “what-if” scenarios that show payment impacts of a 25 vs 50 bps Fed move.

And don’t forget your builder partners—if confidence is rising, they’ll want a lender ready to respond quickly.

Real Estate Agent Perspective

A rate environment in flux means buyers are looking for answers. That’s your opportunity to lead.

Share content that explains how rate cuts influence affordability and how timing a purchase or sale around rate moves might help clients.

Builder confidence can also shift local comps and buyer urgency. Tap into new home sales pipelines and stay close to your lender partners who are tracking the data.

Home Buyer & Seller Perspective

Buyers, a rate cut could lower your monthly payment—but don’t assume you have to wait. Many mortgage pros can help you lock now and float down later if rates drop.

Sellers, a more affordable mortgage climate often brings more motivated buyers. If you’re listing soon, this could boost interest and help your pricing strategy.

Questions? Connect with the loan officer or agent who shared this post—they can walk you through current options.

Frank’s Thoughts

If the Fed delivers a half-point rate cut, it would be a game-changer. But even a quarter-point move shows they’re serious about supporting the economy.

That’s a green light for mortgage and real estate pros: opportunity is out there. Stay visible, stay helpful, and stay ready to explain what this all means to your clients.

Now’s the time to be proactive—not just reactive. Keep reaching out, sharing insights, and leading from the front.

Powered by: Mortgage Marketing Animals

Important Links