October 16, 2025

Shutdown Freezes USDA Loans

The ongoing shutdown is already freezing key USDA loan activity and injecting uncertainty into the rural housing market. At the same time, mortgage application data from the MBA shows refinancing strength despite softer purchase demand. And over in proptech, Zillow is teaming up with Esusu to help renters build credit—potentially opening up new buyer pipelines even in a sluggish market. Below we break down what’s happening, and how professionals on both sides of the transaction can stay ahead of the challenges.

USDA Loan Halt Amid Shutdown

Read the Full Story → Realtor.com

The federal shutdown has placed a freeze on USDA rural housing programs, putting a stop to new USDA direct and guaranteed loan activity. This impacts thousands of rural buyers who depend on these programs for affordable homeownership, often with zero or low down payments.

Some in-process deals may still close if they already received conditional commitments, but any new commitments are off the table until the government reopens. This has thrown a wrench into timelines for both buyers and sellers, especially in small markets with heavy USDA reliance.

With over $7 billion in USDA loans at stake, the shutdown’s impact is far from minor. Lenders and agents working in rural markets will need to communicate early and often to manage buyer expectations and explore alternative loan options where possible.

Mortgage Applications Dip, But Refi Is Holding Up

Read the Full Story → MBA

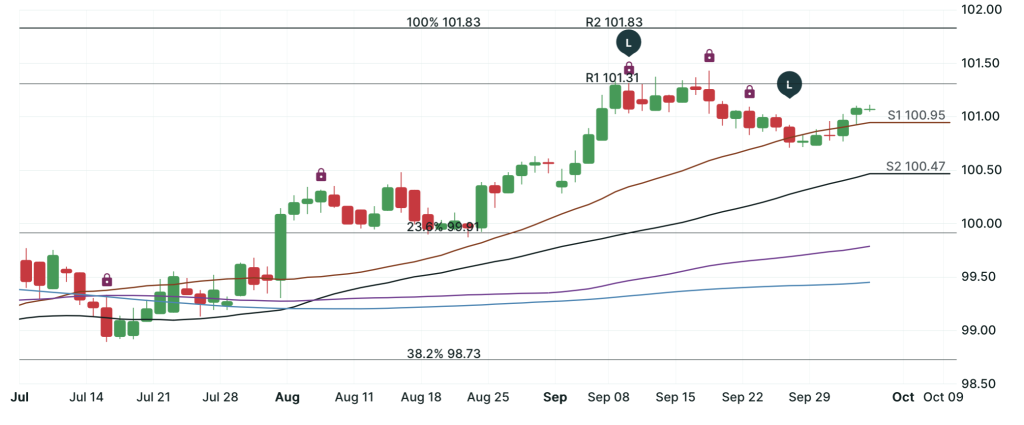

In its latest survey, the Mortgage Bankers Association reports that mortgage applications overall dropped 12.7% week-over-week. But amid that decline is a bright spot: refinance activity is still showing strength compared to this time last year.

While refinances dipped 8% from the previous week, they remain up 16% year-over-year—a clear sign that many borrowers are still chasing lower rates or restructuring debt while they can. Purchase loan activity also softened slightly but still reflects steady demand in key segments.

For loan officers and brokers, this means refinance volume continues to provide a valuable revenue stream, even as purchase demand feels the pinch of affordability concerns and seasonal slowdowns.

Zillow + Esusu: Credit Building for Renters

Read the Full Story → Scotsman Guide

Zillow has partnered with Esusu, a fintech company that helps renters build credit by reporting on-time rental payments to credit bureaus. This move has the potential to reshape how renters transition into homeownership.

By partnering with Zillow, Esusu gains broader exposure to renters who may not have traditional credit files but are responsible with their monthly housing payments. For many of these renters, this credit boost could help them qualify for mortgages sooner.

With affordability tight and financing programs like USDA paused during the shutdown, these private credit-building innovations could play a larger role in preparing the next wave of homebuyers.

Loan Officer Perspective

This shutdown may be stalling USDA files, but it’s also a great reminder to dig back into your database for refi opportunities. With refinance volume still trending up year-over-year, now is a good time to reconnect with clients who didn’t lock in last year or who may have new financial goals.

You should also review your current pipeline and flag any USDA-dependent transactions. Having proactive conversations about possible delays and alternate financing will go a long way in building trust and keeping deals alive.

Also, the Zillow–Esusu partnership opens the door to a new conversation with renters. Many may not realize that their rent history could now work in their favor. Educating your referral partners—and your audience—on this shift could build future buyer pipelines you didn’t even know you had.

Real Estate Agent Perspective

If you’ve got rural listings or buyers leaning on USDA financing, now’s the time to get ahead of the message. Let them know the shutdown has paused funding, and encourage buyers to have a Plan B lined up—whether that’s FHA, conventional, or waiting it out.

Sellers should also be prepped for longer timelines or buyers needing to change financing midstream. A little prep now can save a lot of stress later.

Meanwhile, the Zillow and Esusu news could be a sleeper win. Renters improving their credit today could be your clients tomorrow. Stay in front of them through renter-friendly marketing, and offer tools or resources that help them start their homeownership journey.

Home Buyer & Seller Perspective

For homebuyers counting on USDA financing, the current shutdown puts your plans on hold. Unfortunately, new USDA loans won’t be issued until government funding resumes, which could take days or even weeks.

If you’re a seller working with USDA buyers, expect potential delays or dropped deals. Talk to your agent about how to protect your sale or attract other types of financing.

Not sure what your next move should be? Contact the loan officer or real estate pro who shared this post. They can help you sort through your options and make sure you’re not left waiting in the dark.

Frank’s Thoughts

It’s easy to panic when you hear the word “shutdown,” but I think this is where professionals shine. What sets you apart isn’t just how you close loans—it’s how you handle chaos with calm and clarity.

Refi business being up year-over-year tells us people still want to act. They just need someone to guide them through it. Be that guide. Be the calm in the storm.

And let’s not overlook the Zillow–Esusu story. That’s a reminder that innovation is still happening. There are always new buyers waiting to be found—you just have to know where to look. Stay sharp out there.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 15, 2025

LendingTree CEO Dies in ATV Accident

The unexpected passing of LendingTree CEO Doug Lebda is a major loss for the fintech and mortgage industries. As the founder and visionary behind one of the most recognized names in digital lending, Lebda’s impact cannot be overstated. This week’s housing news doesn’t stop there. While the Fed continues to hint at rate cuts, long-term Treasury yields are holding firm, keeping mortgage rates stubbornly high. And with the federal government now officially shut down, home closings in flood-prone markets like Florida are already facing delays. These stories offer important insights—and practical takeaways—for mortgage professionals, agents, and clients navigating today’s housing landscape.

LendingTree CEO Doug Lebda Dies in ATV Accident

Read the Full Story → Scotsman Guide

Doug Lebda, the founder and CEO of LendingTree, died in a tragic ATV accident on October 12, 2025, while on a family farm in North Carolina. He was 55. The news has sent a wave of grief through the financial services industry, where Lebda was known as a pioneer in consumer lending transparency and access.

The company acted quickly to stabilize leadership by appointing COO Scott Peyree as the new CEO and naming Steve Ozonian as chairman. While operations remain intact, investors responded with concern—LendingTree stock dropped over 4% following the announcement.

Lebda launched LendingTree in 1996 after a frustrating personal experience trying to shop for a mortgage. His vision transformed how consumers compare and apply for loans, credit, and insurance. His legacy lives on through the platform he built and the millions of consumers it continues to serve.

Yields Hold Firm Even as Fed Easing Looms

Read the Full Story → CNBC

A new Reuters poll of 75 bond strategists shows long-term Treasury yields—especially the 10-year note—are expected to stay elevated through the next 12 months, even as the Federal Reserve begins cutting short-term interest rates. That means mortgage rates may not fall as quickly as some hope.

The 10-year yield is projected to hover above 4%, with some analysts predicting it could rise slightly, despite easing from the Fed. Factors like persistent inflation, growing federal deficits, and increased term premium are all keeping a floor under long-term borrowing costs.

This dynamic may slow the impact of Fed policy on the housing market. While the central bank is trying to stimulate borrowing, the bond market isn’t fully on board—keeping mortgage rate relief modest and gradual at best.

Government Shutdown Already Impacting Florida Home Closings

Read the Full Story → Realtor.com

The federal government is shut down, and the effects on the housing market are already being felt—especially in flood-prone states like Florida. The National Flood Insurance Program (NFIP) has paused the issuance of new policies, forcing many closings to be delayed or canceled.

With NFIP offline, roughly 1,300 to 1,400 home transactions per day are at risk of falling through. This is particularly problematic in Florida, where many properties are in flood zones and cannot close without active flood coverage.

Beyond NFIP, other housing-related services are slowing down or on hold. IRS tax verification, USDA and FHA loan processing, and VA underwriting are among the areas hit by the shutdown—further complicating an already tight housing market.

Frank’s Thoughts

Doug Lebda was a pioneer who saw what mortgage lending could be before anyone else did. His death is tragic, but the company and the movement he built are bigger than one person. Still, it’s a wake-up call to always have solid partners and contingency plans.

Treasury yields aren’t falling like people hoped. That’s frustrating—but it also creates a moment for real pros to shine. We can’t change the market, but we can help clients navigate it smartly. That’s where trust is built.

And with the shutdown already here? If your files are tied to federal processes, treat it like an emergency checklist. Get creative, be proactive, and don’t let clients get blindsided.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 14, 2025

Federal Layoffs Worry Mortgage Industry

Layoffs are shaking up the real estate world as federal reductions in force (RIFs) resume during an ongoing government shutdown. At the same time, new data reveals surprising strength in housing demand across overlooked markets like Springfield, MA and several Wisconsin metros. Together, these developments create a complex picture for the mortgage and housing industries. In this week’s roundup, we cover the hottest housing markets, examine the impacts of federal layoffs on government-backed lending, and explore how these factors may shape buyer behavior and lending timelines.

Hottest U.S. Housing Markets — September 2025

Read the Full Story → Realtor.com

Springfield, MA has once again topped Realtor.com’s list of the hottest housing markets in the U.S., holding the top spot for the fifth month in a row. Demand remains strong despite high rates, and Springfield’s relative affordability is part of the appeal.

Seven of the top 20 markets are in Wisconsin, including Kenosha, Appleton, and Milwaukee. These metros offer homes priced below the national median, making them attractive to buyers looking for value in a tight inventory environment.

Inventory rose 17% year-over-year nationally, but supply remains well below pre-pandemic levels. This imbalance continues to put upward pressure on prices in competitive markets.

White House Resumes Layoffs Amid Shutdown

Read the Full Story → Scotsman Guide

As the government shutdown entered its tenth day, the White House announced it is resuming large-scale layoffs across multiple federal agencies. These RIFs go beyond furloughs and represent permanent staffing reductions.

The Department of Housing and Urban Development (HUD) confirmed it is implementing layoffs to align with administration priorities. This could affect federal housing programs and service delivery timelines.

These federal layoffs are stirring concern across industries that rely on timely interagency coordination—particularly housing, where delays in program approvals and inspections can disrupt closings.

Mortgage Industry on Edge as Federal Layoffs Begin

Read the Full Story → MPA

The mortgage industry is bracing for fallout from these federal layoffs. FHA, VA, and USDA programs are already seeing delays as agencies operate with minimal staff or pause new file processing.

With federal staff reduced, timelines for government-backed loans may stretch significantly. Lenders are worried about interruptions in underwriting, approvals, and loan guarantees.

Rural housing markets, in particular, are vulnerable to these delays. Borrowers depending on USDA loans are seeing their closing dates pushed back indefinitely in some cases.

Loan Officer Perspective

Proactive communication is key right now. If your clients are using FHA, VA, or USDA loans, make sure they understand that delays may occur due to ongoing federal layoffs. Being upfront can help manage expectations and reduce stress.

This is also a good time to review your timelines and add buffer room for any deals involving government-backed programs. Clients will appreciate your foresight and planning.

By staying calm, informed, and flexible, you’ll show borrowers why having a great loan officer matters—especially when the road gets bumpy.

Real Estate Agent Perspective

Agents should be prepared for financing hiccups, especially when deals involve FHA, VA, or USDA loans. Partnering closely with lenders who are tracking these changes can help keep transactions on course.

At the same time, don’t overlook the momentum in secondary markets like Springfield or several cities in Wisconsin. These areas are gaining steam, and sellers in those markets may benefit from the buzz.

Set expectations early with both buyers and sellers. Clear communication around timing, financing, and market trends will help build confidence during uncertain moments.

Home Buyer & Seller Perspective

Buyers who plan to use federal programs for their mortgage—like FHA, VA, or USDA—should check with their lender right away. Timelines may be affected due to federal staffing cuts, but there may be options to help keep things moving.

Sellers should stay flexible and open to conversations about timing. Some delays are beyond a buyer’s control right now, especially when government agencies are involved in the loan process.

If you’re unsure about how this news impacts your plans, reach out to the loan officer or real estate agent who shared this post. They’re ready to help you make informed, confident decisions.

Frank’s Thoughts

This week’s news is another reminder that the mortgage world doesn’t operate in a vacuum—it’s tied to the broader economy and government. These layoffs aren’t just numbers—they’re ripple effects that touch everything from loan timing to consumer confidence.

But there’s opportunity here, too. Agents and loan officers who keep their clients informed and calm will earn loyalty that lasts beyond one transaction.

Markets like Springfield and mid-sized metros in Wisconsin are showing us that buyers are still out there, even with the noise. Let’s keep helping them move forward.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 13, 2025

The Road to Housing Act of 2025

he U.S. housing market continues to evolve with legislative changes, economic signals, and new opportunities for mortgage and real estate pros. This week, the Senate passed the Road to Housing Act of 2025, a major bipartisan step toward addressing housing affordability and supply. Meanwhile, the Fed signals more rate cuts could still be on the table for 2025, stirring anticipation across financial markets. And a fresh revenue stream is emerging for loan officers and agents through business loan referrals—offering up to $16K per deal. Here’s your snapshot of this week’s most impactful Housing news.

Senate Passes Road to Housing Act of 2025

Read the Full Story → MBA

In a decisive bipartisan move, the Senate passed the Road to Housing Act of 2025 as part of the National Defense Authorization Act (NDAA). This legislation aims to improve housing affordability and availability by reducing regulatory barriers and incentivizing local governments to expand housing development.

The Mortgage Bankers Association (MBA) praised the bill, highlighting its potential to alleviate housing shortages and support a stronger national economy. It encourages more housing starts by addressing land use, permitting delays, and zoning issues—frequent bottlenecks in building supply.

If signed into law, the Act could make a real dent in the Housing inventory crisis. By empowering state and local reforms, it’s poised to spur new construction and offer long-term relief to both buyers and renters navigating limited options.

Fed Still Eyeing Rate Cuts in 2025

Read the Full Story → Yahoo

According to the latest FOMC minutes, Federal Reserve officials remain divided, but many still anticipate additional rate cuts this year. The central bank is balancing optimism about declining inflation with caution over ongoing economic uncertainties.

Despite recent robust job growth and consumer spending, several policymakers signaled openness to cutting rates if inflation continues to ease. The Fed is especially attentive to lagging housing data and broader affordability trends, which are deeply impacted by mortgage rates.

The prospect of lower rates in late 2025 could inject new life into the Housing market. If inflation keeps trending downward, rate cuts may create a more favorable borrowing environment for homebuyers and investors alike.

LOs & Realtors Earn 8 Points by Referring Business Loans

Get More Info → WorkWithARF

Loan officers and real estate agents are discovering a high-value opportunity: referring business owner clients for working capital and line of credit solutions. By simply making a referral, LOs and agents can earn up to 8 points—4 at closing, and 4 over the following year.

Megan Pavone recently highlighted this referral program on Loan Officer Breakfast Club. With the average business loan size around $200,000, agents and LOs can pocket $16,000 from one successful referral—without handling any part of the loan process themselves.

All it takes is connecting a business owner to Megan. She takes it from there. This program opens a new income stream for professionals already well-connected in the small business world. Learn more or get started at WorkWithARF.com.

Remodeling Market Sentiment Ticks Up in Q3

Read the Full Story → Eye On Housing

The NAHB’s Remodeling Market Index rose in Q3 2025, signaling renewed optimism among remodelers and contractors. This shift is attributed to stabilized material costs, improved financing conditions, and pent-up consumer demand for home upgrades.

While large-scale remodels remain flat, demand for small-to-mid-sized projects—like kitchen refreshes, bath updates, and energy-efficient improvements—is gaining traction. Many homeowners are investing in their current properties due to ongoing housing shortages and elevated mortgage rates.

This trend may ease pressure on the tight Housing inventory, as more people choose to upgrade rather than sell. It also supports adjacent industries like construction, materials, and home improvement retail.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 10, 2025

Rates Forecast, Weekly Trends & Credit Access: What’s Moving This Week

This week’s housing headlines reveal subtle but meaningful shifts in the world of rates. Fannie Mae released a more hopeful mortgage rate forecast, while Zillow noted softening weekly trends that could signal a gradual cooling ahead. Meanwhile, the MBA reported a slight loosening in credit availability, potentially opening more doors for borrowers. These stories highlight the slow but steady motion in the real estate finance world. Whether you’re tracking rate movement, lending conditions, or housing market forecasts, this roundup delivers the essentials.

Fannie Mae’s Housing Market Forecast: Rates to Fall, Activity to Rise

Read the Full Story → TheStreet

Fannie Mae’s latest forecast offers a more optimistic tone, predicting mortgage rates could dip below 7% by the end of 2025. The outlook is rooted in expectations of a slowing economy and a more dovish Fed as inflation cools.

The agency anticipates modest growth in home sales volume and refinancing activity if rates fall as expected. This marks a shift from the stagnation that’s defined much of 2024 and early 2025, with affordability pressures showing signs of easing.

Still, Fannie points out that inventory constraints and elevated home prices remain obstacles. Demand may rise faster than supply, keeping upward pressure on prices even as financing becomes more affordable.

Zillow: Mortgage Rates Cooling—But How Fast?

Read the Full Story → Zillow

Zillow’s weekly update shows a slight dip in mortgage rates as of early October, aligning with broader market optimism about the Fed nearing the end of its tightening cycle. However, volatility remains a factor.

Their analysts caution that while rates may have peaked, the path down won’t be smooth. Global economic uncertainty, oil prices, and job market data could all delay or reverse downward movement.

The takeaway? Rates may improve slowly, but don’t expect a dramatic drop overnight. Zillow emphasizes the importance of watching week-to-week shifts for actionable opportunities.

Mortgage Credit Availability Ticks Up in September

Read the Full Story → MBA

The Mortgage Bankers Association reports a small but notable increase in mortgage credit availability in September, marking a reversal from months of tightening standards. The uptick was led by jumbo and conventional loan segments.

While not a return to the looser credit seen pre-2022, the report suggests lenders are slowly becoming more comfortable extending credit in today’s higher-rate environment. This could help marginal buyers and those with unique income scenarios.

MBA noted that investor demand and slightly lower rates have helped widen eligibility criteria, even if modestly. This is a trend to watch as the purchase market tries to regain traction heading into 2026.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 9, 2025

Fannie Freddie IPO Buzz, HUD Market Warnings, and a Credit Score Shakeup

The mortgage and housing world is buzzing this week with headlines that could impact the entire industry. A former HUD official is raising serious concerns about long-standing market challenges, FICO is shaking up the credit reporting game by cutting out the middlemen, and perhaps most notably—the government is exploring a Fannie Freddie IPO. These stories offer critical insight into where things might be headed next. In this post, we unpack the details so real estate professionals and lenders can stay ahead of the curve.

HUD Veteran Flags Key Issues in Housing Market

Read the Full Story → Scotsman Guide

A former HUD official has outlined major structural problems that continue to weigh on the housing market. Among them: a chronic shortage of homes, outdated infrastructure, and restrictive zoning laws that make new development difficult.

She argues that affordability remains a growing crisis, particularly in underserved communities. If housing policy doesn’t evolve soon, more Americans could find themselves priced out of homeownership.

The article emphasizes the need for better coordination between government and private industry to address the root causes of housing inequality and supply bottlenecks.

FICO’s New Move Could Sidestep Credit Bureaus

Watch the CNBC video for full details.

In a bold pivot, FICO plans to license its scoring models directly to lenders—cutting traditional credit bureaus out of the equation. This could lead to faster approvals, greater transparency, and significant cost savings for consumers.

With direct access to FICO scores, lenders may be able to tailor loan programs more precisely and reduce overhead on credit reporting fees.

It’s a big step toward modernizing the mortgage process. Be sure to check out the CNBC video embedded in this post to see what this could mean for lenders, consumers, and the future of credit scoring.

U.S. Considers Fannie Freddie IPO

Read the Full Story → The Mortgage Point

The federal government is reportedly evaluating a Fannie Freddie IPO, a move that would take the two mortgage giants out of conservatorship and back into the public markets. This would be the first step toward privatizing entities that have played a central role in the housing market since 2008.

Such a shift would dramatically alter the secondary mortgage market, potentially impacting loan pricing, investor strategies, and government risk exposure.

While there’s no timeline yet, the conversation around a Fannie Freddie IPO is picking up speed, signaling a possible turning point in federal housing finance policy.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 8, 2025

Housing Affordability Improves as Investors and Cash Buyers Shift the Market

Housing affordability is finally seeing some relief, offering a glimmer of hope for buyers navigating high rates and tight inventory. In this week’s news roundup, we highlight three major trends shaping the real estate market: the best affordability levels since 2023, a spike in investor-driven purchases, and an influx of cash buyers targeting affordable luxury markets. These dynamics are redefining affordability across key metros and influencing who’s getting into homes—and how. For mortgage and real estate professionals, staying in tune with these affordability shifts is more essential than ever.

Affordability Hits Highest Point Since 2023

Read the Full Story → Scotsman Guide

Housing affordability improved in September, reaching its strongest level since early 2023. The Mortgage Bankers Association (MBA) reported that the national median monthly payment applied for by purchase applicants fell to $2,155.

This shift in affordability comes as home prices softened slightly and incomes rose modestly, leading to a 1.5% drop in the MBA’s Purchase Applications Payment Index. It’s a small but important move toward greater affordability for many potential buyers.

Even amid high mortgage rates, this bump in affordability may encourage more sidelined buyers to re-enter the market, signaling renewed momentum heading into year’s end.

Investors Drive Market, Affecting Affordability

Read the Full Story → CNBC

Investor activity hit a five-year high in Q2 2025, with 19% of all home purchases made by investors, according to Redfin. These buyers are primarily seeking single-family rentals, attracted by softening prices and strong rental demand.

A major factor: most of these investor deals are cash purchases. By avoiding today’s high interest rates, investors gain a strategic edge—and in doing so, they often compete directly with traditional buyers, impacting affordability in key markets.

The ripple effect is real. As investors scoop up homes, especially in lower-priced segments, they further strain affordability for first-time and financed buyers.

Cash Buyers Flock to Affordable Luxury Metros

Read the Full Story → Realtor.com

A new trend is emerging: cash buyers are increasingly drawn to metros offering a blend of upscale living and relative affordability. Realtor.com highlights cities like Tampa, Charlotte, and Colorado Springs as prime examples.

These affordable luxury markets offer a compelling mix of lifestyle and price, attracting well-capitalized buyers looking for value. In some areas, cash buyers now account for more than 40% of all home sales.

As these cash-rich buyers enter the scene, they’re reshaping local affordability standards—often outpacing buyers who rely on financing and redefining what “affordable” really means in popular cities.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 7, 2025

How the Shutdown Could Disrupt Mortgages and Market Strategy

This week, the real estate and mortgage world is closely watching the ongoing shutdown in Washington, and how it could disrupt lending processes. While the mortgage machine may continue to roll, small hiccups could cause big delays. At the same time, builders are stepping up with incentives to lure hesitant buyers, and new Zillow data shows sellers using off-market strategies could be missing out on thousands. Staying informed during a shutdown helps pros and consumers alike navigate smarter decisions.

A Government Shutdown Could Slow the Mortgage Process

Read the Full Story → Realtor.com

The ongoing federal shutdown has housing professionals on high alert. While Fannie Mae and Freddie Mac aren’t funded through annual congressional budgets—and will likely keep operating—services that depend on other government departments could see interruptions.

Fannie and Freddie issued temporary lender guidance (LL‑2025‑03) to offer some flexibility, including relaxed documentation standards. But other areas—like IRS tax transcripts, flood insurance processing, and certain FHA/VA underwriting verifications—may experience bottlenecks.

Ultimately, while the housing market won’t come to a halt, the shutdown could throw sand in the gears. Professionals who stay ahead of these slowdowns will be best positioned to guide clients calmly and confidently.

Park Place Finance Helps Agents, Loan Officers & Investors with Fix & Flip Loans

Park Place Finance (PPF) empowers mortgage loan officers, real estate agents, and investors with private capital Fix & Flip Renovation Loans that fund fast and flexibly. As a direct private lender with in-house capital, PPF can close in as little as 3–5 days and process rehab draws within 24 hours—keeping deals moving smoothly.

Whether you’re a first-time flipper or experienced investor, PPF welcomes all experience levels.

- Up to 93% Loan-to-Cost (LTC) for experienced borrowers

- As little as 10% down for first-timers

- 660+ minimum FICO

- Loans from $100K to $5M, terms 12–24 months

- Nationwide (except AK, ND, SD, NV, AZ)

Agents and loan officers trust PPF for fast, flexible lending that helps clients acquire, renovate, and flip investment properties with ease.

To Get a Quote on a Deal: http://workwithparkplace.com

Need to Talk to Us: (737) 313-5213 ask for Caden

Low‑Rate Homeowners Are Finally Letting Go — But Only for the Right New Deal

Read the Full Story → Realtor.com

A surprising shift is underway: some homeowners with sub‑4 % mortgage rates—once thought immobile—are trading them in to move into new homes, provided builders offer compelling incentives.

Why now? The share of mortgages in the 3 %–4 % band has slipped, even as builders roll out promotions like rate buydowns, closing cost credits, and upgrades to tip the scale. These incentives are making it possible for homeowners to justify giving up their low rates.

Still, the move is selective. Many will only sell if the financial benefit is clear enough to offset the cost of a higher rate. New‑build incentives are emerging as one of the few levers strong enough to coax these “locked‑in” homeowners into action.

Off-MLS Listings Are Costing Sellers Thousands

Read the Full Story → Zillow

According to a new Zillow study, sellers who bypass the MLS lose an average of $4,975—about 1.5% less than those who go public with their listings. The data spanned 2023–2024 sales and shows how limited exposure can hurt final sale prices.

In states like California, the gap is even wider. Sellers using private or pocket listings there netted nearly 3.7% less—roughly $30,000 on a median sale.

While some sellers value privacy or exclusivity, the data suggests wide exposure usually wins. Sharing the listing with the largest buyer pool possible leads to stronger offers.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 6, 2025

Rising Rates, FICO Models & Starbucks Closures on Real Estate

Rising rates are once again shaping the mortgage and housing conversation as we enter October. Paired with FICO’s announcement of new alternative pricing models and a surprising trend in Starbucks store closures, the real estate industry faces both fresh challenges and new opportunities. While buyers react to shifting affordability, lenders and agents can use this moment to sharpen their messaging and strategies. From macro finance to neighborhood coffee shops, these stories connect to one larger theme: change is here, and those who stay informed will thrive.

Mortgage Rates Climb for Second Straight Week

Read the Full Story → SAN

Freddie Mac’s latest report shows the average 30-year fixed mortgage rate has climbed to 6.34%, with the 15-year fixed now at 5.55%. While still below last year’s peak, this marks the second consecutive week of increases.

Mortgage applications have dropped significantly, falling 12.7% in just one week—suggesting buyers are responding quickly to even slight rate fluctuations.

Experts say volatility may continue as markets respond to broader economic data. Investors are watching inflation and Fed policy closely, with many unsure where rates will land in Q4.

MBA Reacts to FICO’s New Alternative Pricing Models

Read the Full Story → MBA

FICO’s new pricing models aim to make mortgage credit access more equitable by using alternative data and refined risk tiers.

The Mortgage Bankers Association welcomed the move with cautious optimism, urging validation and transparency as lenders consider these tools.

These models could offer borrowers with less traditional credit histories better pricing—but widespread adoption will depend on regulatory clarity and industry alignment.

Starbucks Store Closures & Local Property Value Implications

Read the Full Story → Realtor.com

Starbucks has begun shuttering hundreds of locations nationwide, focusing on store performance and shifting consumer habits.

In some communities, the closure of a Starbucks can signal declining walkability or neighborhood appeal—both of which can affect residential property values.

Real estate experts caution that while the closures aren’t inherently bad news, empty retail spaces must be quickly repurposed to avoid negative knock-on effects.

Loan Officer Perspective

The conversation around rising rates is a chance to show leadership. Educate clients on timing strategies, rate lock options, and programs that provide payment relief in a higher-rate environment. Be proactive—reaching out before they panic means they see you as the solution, not just a vendor.

FICO’s changes could be a game-changer for underserved borrowers. If you work with clients who are on the edge of qualifying, start following how your lenders adapt to these models. Staying ahead of the curve could open doors for buyers who previously didn’t have a shot.

Lastly, don’t sleep on the Starbucks closures. For condo buyers or urban clients, a disappearing coffee shop could mean more than caffeine—it may reflect larger economic shifts in that neighborhood. Keep an eye out and use it as a conversation starter.

Real Estate Agent Perspective

This week’s rising rates news doesn’t have to be a deal killer. It’s a chance to coach buyers through affordability tactics or help sellers understand the urgency buyers may feel. The more you inform, the more you build trust.

FICO’s new pricing models are exciting because they may expand the pool of pre-approved buyers. Partner with lenders who understand these shifts and can guide your clients through the evolving credit landscape.

As for the Starbucks story—it’s more than just a frappuccino loss. It signals opportunity. Use closures as a reason to spotlight upcoming development or highlight thriving local businesses. Buyers want to know what’s next, not just what’s gone.

Home Buyer & Seller Perspective

Rising rates may feel intimidating, but they don’t mean the window has closed. They do make it more important to get pre-approved and know your numbers before shopping. If you’re ready, now is still a good time—especially if you work with a pro who understands rate timing.

If you’re selling, the rate narrative can work in your favor. Buyers may feel pressure to act quickly before financing costs go higher. Highlight your home’s affordability and neighborhood strengths to stay competitive.

Concerned about a Starbucks closing nearby? You’re not alone. But one store doesn’t define a neighborhood. Talk to your agent or loan officer about what’s happening in the area. New businesses often fill the gap quickly. If you have questions or want to explore your next steps, reach out to the professional who shared this post with you.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 3, 2025

Fannie Mae’s Rate Revision, Shutdown Disruptions, and the Power of Consistency

Fannie Mae’s latest rate revision is sending ripples through the mortgage industry, with the GSE forecasting a slower decline in rates through 2025–2026 than previously expected. Meanwhile, a government shutdown threatens to delay critical housing-related services like flood insurance and USDA loans. Amid these headlines, one loan officer reminds us that consistent financial habits—not just market timing—are what truly empower homeownership. This week’s roundup brings together stories that highlight economic adjustments, systemic risks, and timeless personal finance truths—all essential reading for mortgage pros and real estate partners.

Fannie Mae’s Rate Revision Cools Rate Drop Expectations

Read the Full Story → TheStreet

Fannie Mae has revised its mortgage rate forecast, signaling that rates are likely to decrease, but at a slower pace than previously thought. The updated projection sees the 30-year fixed rate landing at 6.2% by the end of 2025 and 6.0% by the end of 2026.

This rate revision reflects a more cautious view of inflation, labor trends, and the Fed’s long-term posture. Although mortgage rates are still expected to fall, this tempered outlook counters more optimistic predictions of a sharp decline.

The takeaway? While lower rates may still be on the horizon, borrowers shouldn’t bank on a dramatic drop anytime soon—especially not one that reopens the floodgates of refi activity or massive buying surges.

Consistency Over Circumstance: The Real Key to Homeownership

Read the Full Story → Amy DeBusk

Loan officer Amy DeBusk makes the case that the most powerful factor in achieving homeownership isn’t rates—it’s personal structure and consistency. She explains how saving habits, credit discipline, and routine financial reviews form the real path to homebuying success.

By treating homeownership like a long game with steady progress, buyers are better positioned to act when the timing is right. No rate revision can replace the value of readiness and resilience.

This mindset also reframes the narrative: instead of waiting for “perfect conditions,” buyers can focus on building the personal systems that make any conditions manageable.

Read Amy’s full blog post by CLICKING HERE.

Shutdown Strains: Housing Industry Reacts to Government Closure

Read the Full Story → Scotsman Guide

With the federal government shut down, housing groups are warning of immediate disruptions. New flood insurance policies from the NFIP are suspended, which could halt 1,300 home closings per day. USDA loans are also in limbo, along with many HUD and FHA services.

The impact of this shutdown goes beyond bureaucracy—it directly affects loan processing, underwriting timelines, and buyer confidence. Lenders and agents may see delays on files tied to government-backed programs.

It’s a strong reminder that while we often focus on rate revisions, operational risks like shutdowns can create real friction in the mortgage pipeline—especially for rural and first-time buyers.

Loan Officer Perspective

This week’s rate revision story is your chance to reset borrower expectations and stand out as a voice of clarity. Use this to highlight your knowledge, set realistic timelines, and offer strategic rate-lock advice.

Amy’s post gives you a great framework to share: offer tools that help clients build habits—budget sheets, credit score tracking, monthly check-ins. These make you more than a loan originator; they make you a long-term financial ally.

Finally, take the lead in navigating shutdown hurdles—be proactive about NFIP zones, USDA eligibility, and underwriting timelines. Your foresight will earn serious trust.

Real Estate Agent Perspective

A slower rate revision means the market won’t snap back overnight—but that’s okay. Use this moment to counsel patience and preparation. Some buyers will need more handholding, especially as they hear conflicting headlines.

Amy’s take on consistency is pure gold. Share it in your newsletters or client meetings—it’s the perfect non-rate-driven advice that still adds value.

Be extra alert to the effects of the shutdown, particularly in rural areas and homes in flood zones. Deals that might normally sail through could hit snags. Being prepared can keep them from unraveling.

Home Buyer & Seller Perspective

If you’re thinking of buying, don’t wait around for some magic moment where mortgage rates drop dramatically. Fannie Mae’s rate revision suggests changes will be gradual. Focus instead on your own readiness—savings, credit, and monthly budgets.

For sellers, the shutdown could create short-term delays, especially on federally backed loans. Your agent can help navigate those waters and keep your deal on track.

Have questions? Talk to the loan officer or real estate agent who shared this blog with you. They’re ready to help you make smart, informed moves—no matter what the headlines say.

Powered by: Mortgage Marketing Animals

Important Links