October 2, 2025

Zillow Lawsuit, Lock-In Friction, and Mortgage Demand Dip Highlight Industry Tensions

This week’s mortgage and housing headlines revolve around Zillow. The FTC has filed an antitrust lawsuit accusing Zillow and Redfin of illegally suppressing competition in the online rental advertising space. Meanwhile, the “lock-in effect” continues to restrict housing inventory, as more homeowners cling to ultra-low mortgage rates. And the MBA reports a dip in mortgage application volume, indicating continued buyer caution. Together, these stories point to a market in flux—stuck between legal disruption, rate pressure, and demand softness. Zillow may be at the center of the legal spotlight, but the entire industry feels the ripple.

FTC Sues Zillow and Redfin Over Rental Advertising Monopoly

Read the Full Story → CNBC

The Federal Trade Commission has filed a lawsuit accusing Zillow and Redfin of entering an anti-competitive agreement. The FTC alleges that Zillow paid Redfin $100 million to exit the rental advertising business and exclusively syndicate Zillow’s rental listings.

According to the FTC, this deal harmed landlords, renters, and advertisers by consolidating market power and raising prices for rental property ads. The agency claims it violates federal antitrust laws and restricts competition in the multifamily digital ad space.

Zillow and Redfin argue that the agreement improved efficiency and benefited consumers. Still, the lawsuit could reshape digital advertising in the real estate sector, with broad implications for platforms, brokers, and marketers.

Lock-In Effect Continues to Limit Housing Supply

Read the Full Story → WolfStreet

WolfStreet’s latest update shows the “lock-in effect” still has a tight grip on the housing market. Many homeowners are reluctant to sell because they don’t want to give up mortgage rates under 3%, which were locked in during the pandemic.

The report shows that only about 20.4% of active mortgages still carry rates below 3%, while nearly 20% have crossed the 6% mark. That wide disparity keeps potential sellers sidelined, limiting housing inventory across the country.

Until more rate-stuck borrowers are willing—or forced—to move, platforms like Zillow may continue to face inventory shortages even as buyer interest slowly reemerges.

MBA Survey Shows Dip in Mortgage Applications

Read the Full Story → MBA

The Mortgage Bankers Association reports that mortgage applications declined by 0.5% last week. Both purchase and refinance activity were down, though the drop in refinancing was more pronounced.

This decrease suggests that higher interest rates and economic uncertainty are still weighing on borrower confidence. Even though rates have stabilized slightly, affordability concerns persist.

The trend reinforces that mortgage demand remains fragile—and platforms like Zillow that rely on search activity and ad engagement may see traffic shifts if consumer enthusiasm wanes further.

Loan Officer Perspective

The lock-in effect keeps many homeowners on the sidelines, but it also creates a unique window to educate clients on when it makes sense to move or refinance. Be the advisor they need—steady, smart, and always looking out for their best path forward.

Stay nimble with your product mix and marketing. A slower market is a chance to build better habits, clean up your CRM, and focus on quality over quantity.

Real Estate Agent Perspective

The Zillow lawsuit could create shifts in where and how listings are promoted. Be ready to adapt—whether that means experimenting with new ad platforms or doubling down on local SEO and organic reach. Don’t wait to pivot if change comes.

Coach sellers on ways to sweeten their offers and reassure them that today’s market still rewards well-presented homes.

Most importantly, help buyers navigate uncertainty. Walk them through the pros and cons of waiting versus acting now. You are their calm in the chaos—and that builds loyalty.

Home Buyer & Seller Perspective

If you’re a buyer: You may start to notice fewer homes for sale—that’s due to many owners staying put in their low-rate loans. But fewer buyers also means less competition. It’s a great time to explore your options, especially if you’re pre-approved.

If you’re a seller: You might feel stuck by your current mortgage rate. But the market is hungry for listings, and serious buyers are still out there. If you’re thinking about selling, your agent can help you crunch the numbers and see if it makes sense.

Call to Action: If you’re curious how this news affects your situation, reach out to the loan officer or real estate agent who shared this post. They’d love to help you talk through your next move—whether it’s buying, selling, or just planning ahead.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

October 1, 2025

Government Shutdown Worries, Migration Shifts, and a Move-Up Buyer Goldmine

Q4 is here and housing headlines are heating up. This week, we look at how a government shutdown could disrupt deals just as buyers regain confidence, explore shifting migration trends across the U.S., and uncover a huge opportunity among move-up sellers—most of whom need a mortgage. We also examine how brokers are adjusting their strategies to tap into the investor market with nonconforming loans. Each of these developments spells opportunity for smart mortgage and real estate pros ready to adapt. Let’s break it down.

Government Shutdown Could Disrupt Housing Market

Read the Full Story → Morningstar

A looming government shutdown could put a serious dent in home-buying momentum. With fall activity picking up, federal disruptions would delay FHA and VA loan processing, among other critical services. The timing couldn’t be worse.

The article warns that if Congress doesn’t pass a funding bill soon, many housing-related federal agencies could be forced to close or scale back operations. This could leave homebuyers in limbo, waiting on paperwork they can’t control.

Despite this, buyer interest remains strong, and agents report increased activity from clients re-entering the market. It’s a race against the political clock to prevent the government shutdown from derailing these transactions.

Americans Are On the Move Again

Read the Full Story → MPA

A new LendingTree survey shows that 40% of Americans are considering a move within the next year—a notable jump from prior years. Top reasons include cost of living, job changes, and desire for more space.

The trend appears strongest among millennials and Gen Z, with many eyeing suburban or smaller metro areas as they look for affordability and flexibility. Southern states continue to attract movers, while major coastal cities see more outflow.

This uptick in planned migration means new markets are heating up. It’s a great time to realign marketing efforts and partnerships to match where people are going.

69% of Move-Up Sellers Need a Mortgage — Let’s Get Them

If you’re looking to connect with more serious, ready-to-move buyers before anyone else does, MoveTube is your new secret weapon.

Here’s the scoop: In 2024, 69% of all move-up buyers needed a mortgage—and nearly all of them came through listing agents. MoveTube helps you build strong relationships with those agents by giving them something they can’t say no to: a way to get their listings on streaming TV. When you help agents win more listings, they send those seller-buyers your way.

This isn’t about cold-calling or chasing agents. This is about giving them real value that puts you in the referral seat. And the best part? There’s an on-demand, AI-powered demo that walks you through exactly how it works—and answers your questions on the spot.

Click it, Watch it, Get it, Win!

Brokers Shift Focus to Investor-Owned and Nonconforming Loans

Read the Full Story → Scotsman Guide

As traditional volume dips, many brokers are turning to investor-owned properties and non-QM loans to stay competitive. According to new data, the share of investor-owned properties rose to 26.5% in Q2—25, marking a 2.5% jump year-over-year.

This shift is driving more interest in nonconforming loan products, including DSCR and bank statement loans. These tools are increasingly popular among self-employed investors who don’t qualify under standard income requirements.

The pivot suggests brokers are finding creative ways to serve niche buyers in a tighter lending environment—a trend that may stick well into 2026.

Loan Officer Perspective

Loan officers, these stories are gold. The government shutdown may seem like a setback, but it gives you a perfect excuse to check in with pre-approved clients and keep them moving. Migration shifts? Target those inbound buyers. And with MoveTube, you have a killer way to form agent alliances that deliver high-intent leads. Don’t sleep on the non-QM market either—there’s business to be had if you’re ready to learn the products.

Real Estate Agent Perspective

Agents, you are in the driver’s seat. These stories reinforce how vital your role is: whether it’s helping sellers become buyers, guiding relocating clients, or navigating federal hiccups. MoveTube is a serious listing differentiator—get it in your toolbox now. As more buyers shift into smaller or emerging markets, you have a chance to build early loyalty by educating them on their new neighborhoods.

Home Buyer & Seller Perspective

Buyers and sellers, the market is full of opportunity—if you’re ready. Be aware that government shutdown activity might affect your loan process, so stay connected with your mortgage and real estate team. If you’re thinking of moving, you’re not alone. There’s a whole wave of Americans exploring new cities, and chances are, someone is eyeing yours. If you’re curious about what’s possible, reach out to the pro who shared this post. They’re here to help you make the right move.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 30, 2025

Fed Rate Cut Looms, Market Shifts & a Construction Lending Secret Weapon

With the next Fed meeting scheduled for late October, all eyes are on a potential rate cut that could shift momentum across mortgage and real estate markets. But that’s not the only change in the air — Dallas Fed President Lorie Logan is advocating for a new central bank target, the TGCR, which could reshape how rates are managed long-term. Meanwhile, existing-home sales took a small dip in August, though year-over-year numbers still show growth. We’ll also spotlight how Park Place Finance can help loan officers thrive in construction lending—regardless of where rates go.

October Fed Meeting: Market Bets on a Rate Cut

Read the Full Story → Investopedia

Markets are nearly unanimous: a rate cut is expected at the Fed’s October 28–29 meeting, with odds strongly favoring a 25-basis-point reduction. This move would drop the target range to 3.75%–4.00%, the lowest since early 2024.

Despite this, some Fed officials have issued cautionary notes due to mixed economic data. Labor markets remain resilient, but inflation data isn’t cooperating quite as quickly as some had hoped. A looming government shutdown could also muddle the timing or clarity of key data releases.

If a rate cut does materialize, it may trigger a wave of refinancing inquiries and mortgage rate movement. Loan officers and agents should stay close to market news and be ready to act quickly with updated strategies.

Dallas Fed’s Logan Calls for New Target Rate

Read the Full Story → Scotsman Guide

Fed policymaker Lorie Logan has proposed replacing the current fed funds rate with the tri-party general collateral rate (TGCR) as the Fed’s primary target. Her argument? The TGCR better reflects the realities of today’s money markets, especially in a post-pandemic, reserve-abundant banking system.

She notes that the fed funds market is too thin and unpredictable to serve as a modern benchmark. Instead, repo-based rates like the TGCR offer more stability and transparency. This isn’t about policy direction, Logan says—it’s about technical modernization.

If implemented, this change could reshape how mortgage rates respond to Fed moves, especially in environments where a rate cut is on the table. This technical shift may feel subtle now, but it could influence long-term mortgage pricing models.

Existing-Home Sales Dip Slightly in August

Read the Full Story → Zillow

Existing-home sales slipped 0.2% in August, a modest month-over-month decline, but are still up 1.8% from a year earlier. The median home price rose again to $422,600, underscoring persistent affordability challenges.

Inventory remains tight, with many would-be sellers still locked into low-rate mortgages. However, regions like the Midwest and South saw small gains, hinting at localized momentum.

Should the Fed follow through with a rate cut, lower borrowing costs could spark renewed buyer interest and nudge inventory off the sidelines—especially if affordability improves even slightly.

Why Loan Officers Should Add Park Place Finance to Their Construction Lending Toolkit

For many loan officers, construction loans represent 30% or more of their overall business. If that’s you, then you already know how important it is to have the right lender partners—ones that can deliver speed, flexibility, and programs tailored for builders.

That’s exactly where Park Place Finance comes in.

Unlike traditional banks, we’re not a tax return lender. Our process is streamlined, documentation is simplified, and approvals are faster. That means fewer headaches for you, happier clients, and more closed deals.

What Park Place Finance Offers Loan Officers

- High Leverage Options – Loan-to-Cost (LTC) ratios up to 90%, helping your builder clients maximize financing while keeping more capital available.

- Flexible Loan Sizes – From $150,000 to $5 million, we support everything from infill to large-scale developments.

- Fast, Simple Process – No tax returns needed, which keeps projects and pipelines on track.

- Bridge Loans for Builders – Keep construction flowing smoothly from one project to the next.

- Competitive Structures – Broker-friendly terms help you win more deals and boost client satisfaction.

Fit Us Into Your Business

Adding Park Place Finance to your lender list means broader product options, faster approvals, and more competitive construction lending.

Got a deal you need help with now? – Give us some quick details: http://workwithparkplace.com

To grab our matrix visit: http://parkplacematrix.com

Loan Officer Perspective

With a rate cut possibly on the horizon, the conversation with borrowers changes. Lower rates could reignite demand for refis and jump-start purchase momentum in key markets.

Meanwhile, understanding potential structural changes like the shift to TGCR helps you stay ahead of rate modeling and client expectations. The better you understand the moving parts, the better you can advise.

Lastly, now’s the time to push construction loan offerings—especially with Park Place Finance. High leverage, fast approvals, and simple docs mean more volume, more speed, and fewer hurdles.

Real Estate Agent Perspective

A coming rate cut may finally shake some inventory loose, particularly from sellers who’ve been rate-locked and hesitant. That’s great news for buyers—and your pipeline.

Buyers on the edge of affordability may get fresh motivation if rates tick down. Be ready with lender referrals and trusted partners to make fast moves.

Also, team up with builders. New construction could absorb the growing demand, especially when paired with streamlined construction loans from lenders like Park Place Finance.

Home Buyer & Seller Perspective

For buyers, a Fed rate cut could mean better affordability, especially on monthly payments. But limited inventory means it’s critical to be prepared.

For sellers, this environment might bring more buyers to your doorstep. If you’ve been waiting for demand to rise, now might be your moment.

Thinking about building your dream home? Construction loans from lenders like Park Place Finance could offer faster approvals and more flexibility. Questions? Talk to the pro who shared this post with you and see how you can take advantage of today’s market shifts.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 29, 2025

VantageScore Gains Approval, Barry Habib Live, and Market Movers

This week’s mortgage and housing news centers on access, insight, and market flow. The FHFA’s approval of VantageScore for Fannie/Freddie underwriting opens the credit door to millions of new borrowers. Industry icon Barry Habib is set to join Loan Officer Breakfast Club with top-tier market and sales insight. Meanwhile, small-scale real estate investors are stepping in to support home sales, and property tax revenues continue rising—even as they shrink as a share of local funding. For mortgage and real estate pros, this week’s stories offer fresh ways to grow and serve.

VantageScore Now Accepted for Mortgages Backed by Fannie & Freddie

Read the Full Story → Yahoo Finance

The Federal Housing Finance Agency (FHFA) has officially approved the use of VantageScore 4.0 in underwriting loans for Fannie Mae and Freddie Mac. This move introduces competition into the credit scoring space, long dominated by FICO.

This shift benefits potential borrowers who lack traditional credit profiles, such as renters and younger adults with consistent payment records but thin credit files. By incorporating rent, utility, and telecom payments, VantageScore may qualify millions more buyers.

According to analysts, this could unlock up to $1 trillion in new lending opportunity, creating ripple effects for lenders, agents, and housing markets eager for demand.

Barry Habib Joins Loan Officer Breakfast Club Sept 30

Join the Live Call → LOBC

Legendary mortgage market forecaster Barry Habib is set to appear live on Loan Officer Breakfast Club this Tuesday, Sept 30 at 8:30am ET. Habib, a frequent CNBC guest and the founder of MBS Highway, brings decades of award-winning insights into housing and finance.

This session promises a blend of industry forecasts, sales tips, and mindset strategies—tailored to loan officers navigating today’s evolving market. His guidance on rate trends, scripting, and personal branding has proven invaluable to originators across the U.S.

Professionals can join live at breakfastclubzoom.com Early-morning inspiration, strategy, and community—served daily with your coffee.

Real Estate Investors Are Keeping Markets Afloat

Read the Full Story → Scotsman Guide

As traditional homebuyer activity softens, investors are taking up more market share. Investors made 26% of all single-family purchases earlier this year, with smaller landlords dominating the segment.

Roughly 87% of investor-owned homes are held by those with five properties or fewer—dispelling myths of “corporate landlords” dominating local markets. Many are buy-and-hold investors, helping to meet ongoing rental demand.

While some fear displacement, the presence of investor activity is helping sustain home sales volume in many metro areas. This is particularly crucial in a high-rate, low-affordability environment.

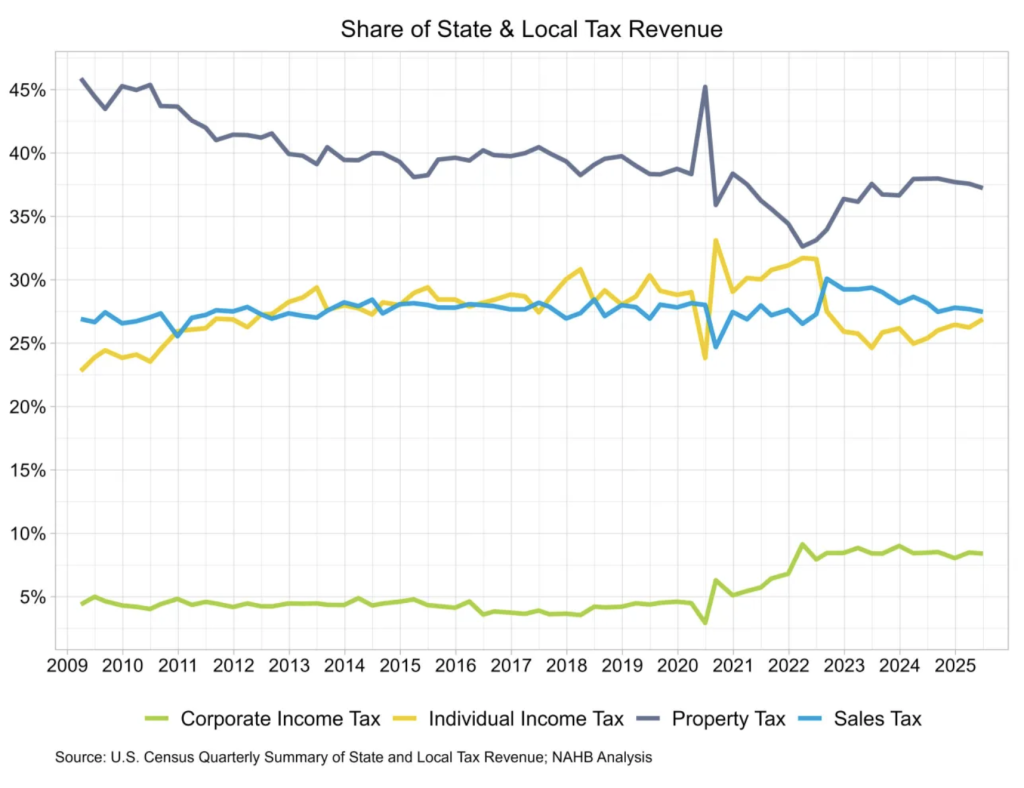

Property Tax Revenues Rise, But Play Smaller Role

Read the Full Story → NAHB

State and local governments collected $203.4 billion in property tax revenue in Q2 2025—a modest 0.7% bump from the prior quarter.

However, as a share of total tax revenues, property taxes fell to 37.2%, the third straight quarterly decline. This reflects the faster growth of other tax streams like income and corporate taxes.

Even with rising real estate valuations, broader tax diversification means local governments are becoming less dependent on property taxes. That could shape future budgeting, zoning, and homeowner costs in nuanced ways.

Loan Officer Perspective

- The VantageScore news is massive: it creates an opening for loan officers to serve credit-invisible or underbanked clients. Start marketing to renters and gig workers who now stand a better chance.

- Barry Habib’s upcoming LOBC session is a can’t-miss. His forecasts and scripting advice help sharpen your messaging and market strategy—especially in a rate-sensitive climate.

- With investor demand staying strong, offer financing solutions that meet their needs—DSCR, bank statement loans, or portfolio options can open new pipelines.

Real Estate Agent Perspective

- The FHFA’s VantageScore ruling means more clients might now qualify, especially those previously dismissed due to “no score.” Work closely with lenders to re-engage old leads.

- Promote Barry Habib’s LOBC appearance to your mortgage partners—it’s a great opportunity to align messaging and strategy.

- Investor presence means listing agents should think beyond retail buyers—what’s appealing to a landlord, a flipper, or a short-term rental operator?

Buyer & Seller Perspective

- If you’ve been told you “don’t have enough credit,” VantageScore might change that. New rules allow rent and utility data to help qualify you for a home loan.

- Sellers should understand investors are a big part of today’s demand. If your home isn’t selling fast, pricing for investor appeal might unlock a sale.

- Want to explore your eligibility or market strategy? Reach out to the mortgage pro or real estate agent who shared this post—they can walk you through next steps.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 26, 2025

Rate Cuts in Question as Strong GDP, Metro Market Rebounds, and Application Trends Collide

This week’s headlines underscore a shifting narrative around rate cuts in the mortgage and housing market. A surprising upward revision to Q2 GDP growth complicates expectations for further Federal Reserve easing. Meanwhile, several metro areas may experience housing boosts if rates dip—even slightly. On the ground, August brought a small but welcome decline in average mortgage application payments, highlighting how sensitive the market remains to affordability shifts. If you’re a mortgage or real estate professional, understanding how these threads tie into the rate cuts conversation is key to staying ahead.

US Q2 GDP Revised Sharply Upwards, Clouding Case for More Fed Rate Cuts

Read the Full Story → MPA

The U.S. economy grew faster than previously reported in Q2—up 3.8 % annually—fueling speculation that the Federal Reserve may hold off on further rate cuts. The revision was largely due to stronger-than-expected consumer spending and a shrinking trade gap.

This economic strength throws cold water on hopes for near-term monetary easing. With inflation still sticky in places, the Fed may choose to pause or move more cautiously with rate cuts into 2026.

For mortgage professionals, this makes a strong case for preparing clients for a “higher for longer” environment, even if smaller rate dips still emerge.

Several Metro Areas Poised to Benefit as Mortgage Rates Drop

Read the Full Story → FOX

Metros like Washington, D.C., Denver, Virginia Beach, and Raleigh could see a noticeable bump in housing activity with any meaningful rate cuts, according to Realtor.com data. These markets have high concentrations of mortgage-holding homeowners.

As mortgage rates dip into the low-6 % range, buyer interest in these areas could rise sharply. The local dynamics amplify how even modest rate cuts could influence real estate behavior.

Conversely, cities with more paid-off homes, such as Buffalo and Miami, may respond less to falling rates. For agents and LOs, market-specific messaging is key.

Mortgage Application Payments Decreased in August

Read the Full Story → MBA

The Mortgage Bankers Association reported a slight decrease in average monthly payments for new mortgage applications in August. This is partly due to lower loan amounts and rate shifts.

Despite the small decline in costs, overall application activity remains modest, suggesting that many buyers are still hesitant—possibly waiting for deeper rate cuts or more inventory.

Still, this dip is a positive sign. It may indicate that affordability is stabilizing for some segments, especially first-time buyers or those looking to refinance.

Loan Officer Perspective

Rate volatility and economic strength create a complex backdrop—but also an opportunity. Be proactive with pre-approvals, especially in metros likely to benefit most from even slight rate cuts.

Use this period to educate clients on scenarios. If rate cuts don’t materialize soon, can they afford to wait? If rates tick down slightly, are they ready to act?

Refinance opportunities, particularly cash-outs and ARM resets, also deserve renewed attention. With payment relief showing up in the data, some clients may be more open to creative financing paths.

Real Estate Agent Perspective

Buyers in metro-heavy markets like Raleigh or D.C. may be closer to moving forward than they appear. Focus your outreach on explaining how small rate cuts can create meaningful affordability shifts.

Position listings accordingly—especially where buyers are rate-sensitive. For sellers, timing a listing around market optimism tied to rate cuts may improve outcomes.

Don’t forget quieter markets. Even without large waves of rate-driven buyers, local insights and strategic pricing can still win.

Home Buyer & Seller Perspective

Buyers, keep an eye on rates but don’t wait forever. If your payment goals are within reach now, don’t delay hoping for bigger rate cuts that may not arrive soon.

Sellers, if your local market is mortgage-heavy, even a small rate drop could boost buyer traffic. That’s a great window to list with confidence.

Want to explore your timing or affordability options? Contact the real estate agent or loan officer who shared this blog—they can help you act smarter in a shifting market.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 25, 2025

New Home Sales Surge, Mortgage Applications Increase & Rent Growth Slows

New Home Sales surged dramatically in August, defying expectations and turning heads across the housing industry. With a 20.5% jump in new construction purchases, the market is signaling a possible shift as builder incentives begin to pay off. This week’s headlines also include a major guest appearance on LOBC Live, fresh data showing a rise in mortgage applications, and signs of slowing rent growth in the single-family space. For mortgage and real estate professionals, this is a pivotal moment to refocus on new builds, rate trends, and how market psychology is shifting as we head into Q4.

New Home Sales Post Unexpected Large Gain in August

Read the Full Story → NAHB

Sales of newly built single-family homes jumped 20.5% in August to a seasonally adjusted annual rate of 800,000 units, per the U.S. Census Bureau and HUD. Year-over-year, that marks a 15.4% increase. Though year-to-date sales are still slightly below 2024 levels, this spike is catching attention.

The number of new homes for sale dropped slightly to 490,000 units, representing a 7.4-month supply at the current sales pace. Builders are actively using incentives to move inventory, with 66% offering sales incentives and 37% cutting prices.

Builder sentiment remains cautious, but this rebound suggests their aggressive pricing and marketing strategies may be working. Still, analysts caution that this data series is volatile and subject to revision.

LOBC Live Today: Owen Lee Brings Insider Insight.

Join the Live Call → LOBC

The Loan Officer Breakfast Club will feature a powerful industry voice today: Owen Lee, MBA’s 2025 Vice Chairman nominee. Lee brings deep insight into mortgage banking policy and leadership, having served on numerous MBA committees and initiatives.

He co-chairs the MBA’s Independent Mortgage Bankers Executive Council and plays a key role in shaping policy and advocacy for the mortgage industry. Lee’s nomination to the MBA Vice Chair role signals broad respect and recognition from peers nationwide.

You can catch his live industry update on the free LOBC coaching Zoom call, Today, from 8:30AM to 9:00AM ET at breakfastclubzoom.com. Don’t miss this opportunity to get the pulse of the market from a key insider.

Mortgage Applications Increased in Latest MBA Weekly Survey

Read the Full Story → MBA

Mortgage applications rose 29.7% for the week ending September 12, driven largely by a surge in refinance activity, which jumped 58%. Purchase applications saw a modest 3% gain.

The average 30-year fixed mortgage rate dipped to 6.39%, the lowest level in nearly a year. That drop helped motivate homeowners to refinance and gave prospective buyers a little more breathing room.

The uptick in activity suggests borrowers are highly rate-sensitive and ready to act when the market moves in their favor, even slightly.

Single-Family Rent Growth Is Starting to Show New Weakness

Read the Full Story → CNBC

The single-family rental market is seeing softening rent growth, with July numbers up just 2.3% year-over-year compared to 3.1% a year earlier. This marks a slowdown from pandemic highs and reflects affordability fatigue among renters.

Demand remains, but tenants are pushing back on escalating rents. This could signal a shift in leverage back to renters or foreshadow more rental-to-owner migration.

The moderation in rents might also ease inflationary pressures and could help the Fed maintain or cut rates if the trend continues.

Loan Officer Perspective

New Home Sales are back on the move, and that’s good news for originators who work the new home market. Builders are still offering incentives, giving smart loan officers opportunities to partner with small to mid-sized home builders. Partnering with agents and builders to package incentives with loan options can be a winning strategy.

Owen Lee’s upcoming LOBC appearance is a must-attend. He has the pulse on industry trends, regulation, and market forces. His insights could help guide your Q4 game plan.

Also, don’t ignore the refinance bump. As soon as rates move, borrowers react. Be proactive with past clients and ready to reengage those who waited out higher rates.

Real Estate Agent Perspective

The resurgence in New Home Sales means agents should take a fresh look at new construction partnerships. Inventory is slimming down a bit, but incentives are still alive and well—and buyers love options.

With Owen Lee speaking this week, it’s a chance to get industry insights directly from the top. This kind of access helps you better advise your clients and anticipate policy shifts.

Rent growth slowing could mean more renters look to buy. Make sure your outreach includes rental households who may now be closer to being ready—and able—to buy.

Home Buyer & Seller Perspective

If you’re a buyer, now is a good time to explore new construction. Builders are offering deals, rates have dipped, and the market is active. You might find more flexibility and value than in the resale market.

Sellers, take note: new builds are back in demand, so your pricing and presentation need to compete. Understand what’s happening locally and work with your agent to position your home smartly.

If you’re considering buying or selling, reach out to the mortgage or real estate professional who shared this post with you. The landscape is shifting, and a quick chat could uncover a great opportunity.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 24, 2025

Fannie Sees Sub 6% Rates Ahead: Fixer-Uppers Rise and Realtors Push Back

Fannie Mae’s latest forecast suggests we could see sub 6% mortgage rates by the end of 2026—a potential game changer for buyers, sellers, and the professionals who serve them. Meanwhile, homebuyers are increasingly hunting for fixer-uppers to stretch their dollars in a high-cost housing market. And on the legal front, a new antitrust lawsuit alleges the National Association of Realtors (NAR) has been unfairly burdening agents. This week’s stories show a real estate landscape in motion, filled with opportunity, disruption, and changing consumer behavior—all revolving around the potential of sub 6% rates.

Fannie Mae Eyes Sub 6% Mortgage Rates in 2026

Read the Full Story → Scotsman Guide

Fannie Mae now predicts that 30-year mortgage rates could dip below 6% by late 2026, an update from their earlier estimate of 6.4%. This shift reflects expectations of slowing inflation and softer economic growth.

They’ve also revised their existing-home sales forecast slightly downward, projecting 4.72 million units for 2025 and 5.16 million in 2026. Even as rates decline, affordability challenges and tight inventory will continue to play a role.

The agency expects GDP growth of 1.5% in 2025 and 2.1% in 2026, with inflation trending toward the Fed’s 2% goal. If realized, sub 6% rates could reignite demand and reshape buyer behavior in a big way.

Fixer-Uppers Gain Ground as Homebuyers Turn to Sweat Equity

Read the Full Story → Scotsman Guide

Listings labeled as “fixer-upper” are pulling in 52% more online views compared to similar homes without that tag. In today’s pricey market, buyers are turning to sweat equity as a path to homeownership.

The median list price for a fixer-upper in July 2025 was $200,000—less than half the national average. But there are risks: profit margins for flippers are down, and renovation costs remain high.

Still, inventory in this segment is up nearly 19% from 2021, suggesting opportunity for those who know how to navigate it. Lenders, agents, and buyers can all win if they play this niche right.

LOBC Live 8:30AM Eastern

Join the Call → breakfastclubzoom.com

We’ve got a killer session lined up for today’s LOBC Live Zoom Call from 8:30 to 9:00 AM ET—featuring two heavy hitters who crushed it last month: Marty Guy Fink and Melissa Rishel. These top producers didn’t just have good months—they topped their companies. And now, they’re pulling back the curtain to share what’s working right now.

We’ll dive into their daily systems, lead sources, mindset shifts, and exactly how they’re winning business in today’s market. No fluff—just real, practical insights from the field. Think of it as 30 minutes of rocket fuel for your morning.

Whether you’re a seasoned pro or building momentum, this call is pure gold. It’s free, fast, and sharp. Bring your coffee, your questions, and your notepad. Just hit breakfastclubzoom.com

NAR Has ‘Bled Realtors Dry,’ New Antitrust Suit Alleges

Read the Full Story → Real Estate News

A new lawsuit accuses the National Association of Realtors (NAR) and its affiliates of anti-competitive practices. The plaintiff, a Maryland broker, claims NAR forces agents to pay multiple dues and limits MLS access.

The suit seeks damages and reforms, arguing that these practices hinder competition, raise costs, and stifle business growth. The pressure is mounting on NAR, which is already under scrutiny for other industry practices.

If successful, the suit could lead to major structural changes in how MLS access is granted and how dues are assessed—potentially lowering costs for agents and brokers.

Loan Officer Perspective

If sub 6% mortgage rates are truly on the horizon, now’s the time to prep buyers who are sitting on the fence. Get your pre-approval pipelines ready and consider marketing strategies that anticipate renewed interest.

The fixer-upper trend is also a huge opportunity. Renovation loans, 203(k)s, and other creative financing options can help borrowers fund both the purchase and the updates—making LOs a key part of the value chain.

Finally, stay informed on regulatory issues. If the NAR suit results in cost shifts or MLS changes, it could impact how real estate partners operate—so collaborative LOs will stand out.

Real Estate Agent Perspective

Sub 6% rates would make a massive difference in buyer activity. Start prepping now: nurture leads, create targeted content, and have strategies in place for when buyers jump back in.

Fixer-uppers are a gold mine for creative agents. Know the renovation process, build contractor partnerships, and highlight potential—not just problems. You can unlock value for budget-conscious buyers.

The NAR lawsuit is worth watching. It could lead to reduced fees or simplified access across regions. That might mean leaner operations and broader market reach in the long run.

Home Buyer & Seller Perspective

For buyers: Sub 6% rates would improve your purchasing power, but you don’t have to wait. Exploring fixer-uppers now could save you big—just make sure you understand the risks and the renovation process.

For sellers: A home needing work might be more marketable than you think. Highlighting it as a fixer-upper could attract buyers looking for a deal—and willing to do the work.

Questions about rates, renovation loans, or what these changes mean for your plans? Talk to the loan officer or agent who shared this post with you. They’re ready to help you get started.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 23, 2025

Weak Jobs, Trade Demand, and Falling Birth Rates: Housing’s Subtle Shift

This week’s news uncovers the quieter trends shaping the housing industry. The weak jobs outlook, highlighted by Jerome Powell, especially among Gen Z, is now paired with unexpected optimism from the NAHB, which reports a surge in demand for skilled trades. Meanwhile, Realtor.com reports that declining birth rates—linked to home unaffordability—could reshape long-term housing demand. When taken together, these stories speak to deeper changes in who’s buying homes, who’s working on them, and how affordability will influence family and housing decisions.

Jerome Powell Warns About Weak Job Prospects for Younger Workers

Read the Full Story → Yahoo Finance

Federal Reserve Chair Jerome Powell isn’t mincing words: while unemployment rates remain low on paper, the labor market is tightening in all the wrong places. Specifically, weak jobs growth is being felt most by entry-level candidates, including recent college grads.

This cooling effect isn’t just anecdotal. Economists note that firms are pulling back on adding new, inexperienced talent. And as AI tools become more commonplace, lower-tier roles are increasingly being replaced or deemed unnecessary.

The bottom line: while the jobs picture isn’t collapsing, it’s uneven. And for young buyers trying to enter the housing market, weak job security may now be a bigger obstacle than interest rates.

Today on LOBC LIVE – 8:30am to 9:00am ET

Join Today’s Live Call Here → LOBC Live

LOBC Live is your daily boost of mortgage coaching—completely free and always relevant. This daily Zoom session runs Monday through Friday from 8:30AM to 9:00AM ET and is designed to keep loan pros sharp, focused, and growing.

Today’s featured guest is Credit Coach Jeanne Kelly, known for her appearances on The Today Show, CNN, and more. Jeanne will dive into Vantage Score 4.0 and share insights on what she’s seeing right now in consumer credit.

She’ll also reveal what’s surprisingly working well for her clients—and how mortgage pros can benefit from those strategies. Click the “Live Streaming Image” below to join, or hop straight into the call by visiting BreakfastClubZoom.com.

NAHB Spotlights Trades With Strong Demand and Rising Wages

Read the Full Story → NAHB

In contrast to the Fed’s outlook, the National Association of Home Builders (NAHB) is highlighting where the opportunities are. Their latest piece lists nine associate-level construction jobs with growing demand and rising salaries.

These roles—like carpentry, HVAC, plumbing, and welding—don’t require a four-year degree but are seeing a surge in job postings and wage increases. As of June 2025, over 246,000 construction jobs were open nationwide.

NAHB is essentially saying: there are plenty of jobs—just not always the kind being tracked in the traditional white-collar labor data. In this way, trade careers are bucking the trend of weak jobs.

Fewer Babies, Higher Prices: Housing Is a Barrier to Family Planning

Read the Full Story → Realtor.com

The U.S. birth rate fell again in 2024, reaching just 1.6 children per woman—well below replacement levels. Realtor.com connects this to housing affordability: younger families are delaying or forgoing children because they can’t afford homes large enough for growing families.

Many would-be parents are also battling weak jobs or uncertain incomes. Paired with rising home prices, the cost of raising a child in 2025 is becoming prohibitive for many households.

Demographic shifts like this matter. Fewer babies means slower population growth, which eventually softens housing demand. It also may mean smaller homes will become more popular, even in suburban areas.

Loan Officer Perspective

This is a moment to lean into education. Help younger borrowers—especially Gen Z—understand their loan options even with uncertain job prospects. FHA, VA, and other supportive programs may be more relevant than ever.

Those in the trades may represent an increasingly reliable borrower class. Steady job demand and wage growth in construction means a segment of buyers with improving income potential.

Stay up to date on demographic shifts. Fewer children may influence the types of homes people want to buy—this could be a chance to promote more compact, affordable financing solutions.

Real Estate Agent Perspective

First-time buyers may be feeling discouraged, but this is where real estate professionals shine: guiding buyers toward homes that match their reality, not their wish list.

Agents should also understand the upswing in skilled trades. These clients might have better income stability right now and could be looking for homes near job sites or renovation opportunities.

Long-term, shrinking family sizes could mean rising interest in smaller homes, ADUs, and condos. Agents who understand this trend will have a leg up when it comes to future-proofing their business.

Home Buyer & Seller Perspective

If you’re a buyer—especially a younger one—know that weak jobs don’t mean “no hope.” There are still smart pathways into homeownership, especially if you’re in a field like construction or trades.

Sellers should understand that affordability is top-of-mind for many buyers. Homes that are reasonably priced, modest in size, and located near job centers will likely move faster in this environment.

Have questions about how this market affects you? Reach out to the mortgage or real estate professional who shared this post—they’re here to help you sort out your options.

Frank’s Thoughts

According to Powell and others, there aren’t many jobs out there—but the NAHB seems to think otherwise. Their list of high-demand trade roles is a refreshing reminder that the labor market isn’t one-size-fits-all.

Realtor.com’s piece adds another twist: if we’re not making as many new people, eventually, we’ll need fewer homes. That could reshape how we all think about growth in the industry.

Kind of a slow news day overall, but still a good reminder that subtle shifts in labor, affordability, and demographics can ripple through housing in powerful ways. Let’s see what tomorrow brings.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 22, 2025

Zillow Lawsuit, Secure 2.0, and FHA Condo Push: Big Shifts in Real Estate

This week’s mortgage and housing news brings into focus a growing theme: legal and regulatory shake-ups with major implications. The headline is the new Zillow lawsuit, a class-action case that accuses the listing giant of deceptive agent practices tied to its Flex program. At the same time, updates from the Secure 2.0 Act offer new implications for retirement-age homeowners navigating housing decisions. And finally, industry advocates are calling on the FHA to expand access to condo financing in line with Fannie and Freddie. If you’re in real estate, it’s a good week to pay attention.

Class-Action Zillow Lawsuit Alleges Agent Deception

Read the Full Story → The Seattle Times

A new Zillow lawsuit filed in Washington claims the platform misleads homebuyers through its “Flex” agent program. The suit argues that when consumers click “Contact Agent” on a Zillow listing, they’re routed to agents who pay Zillow a referral fee, not to the actual listing agent as many assume.

The lawsuit says these agents often give up nearly 40% of their commission to Zillow in exchange for leads—fees that aren’t disclosed upfront to buyers or sellers. The plaintiffs argue this setup reduces buyer leverage, inflates transaction costs, and lacks necessary transparency.

If this Zillow lawsuit succeeds or gains momentum, it could lead to stricter disclosure requirements across the industry, not just for Zillow. Either way, it’s another spotlight on agent transparency and compensation models.

Secure 2.0 Act Brings Homeowner Implications

Read the Full Story → Realtor.com

The Secure 2.0 Act has introduced retirement changes that go beyond 401(k)s. It includes adjustments to Required Minimum Distributions (RMDs), catch-up contributions, and tax incentives—all of which intersect with homeownership and retirement planning.

For aging homeowners, changes to withdrawal timelines and penalty rules could affect cash flow, property tax planning, or even when to downsize. More flexibility in accessing retirement funds might offer opportunities to better align home and financial goals.

It’s a law that will roll out in phases, so homeowners—especially retirees—should speak with advisors about how Secure 2.0 might shape their housing decisions.

Advocacy Groups Push for Expanded FHA Condo Access

Read the Full Story → Scotsman Guide

Industry advocates are urging the FHA to allow loans on condo units already approved by Fannie Mae and Freddie Mac, even if they don’t meet the FHA’s stricter criteria. The current approval process shuts out many otherwise viable condos from FHA financing.

With condos being more affordable than single-family homes in many areas, expanding FHA access could help more first-time and low- to moderate-income buyers get into the market. This is especially crucial in high-cost metros.

The proposed change would align FHA policy more closely with the GSEs, potentially unlocking a new wave of condo inventory for FHA-backed buyers.

Loan Officer Perspective

The Zillow lawsuit reminds us that transparency is critical—and being upfront with clients about who’s getting paid and how can build long-term trust. As more borrowers become aware of referral structures, proactive explanation can be a major value-add.

Secure 2.0 is a unique opportunity to help older clients think holistically about their finances and home strategy. And if FHA expands its condo policy, loan officers will be key in guiding buyers through new financing options as more units become eligible.

Real Estate Agent Perspective

Real estate pros not working with platforms like Zillow Flex may find this Zillow lawsuit is a great way to differentiate themselves as local and fully transparent. It’s a chance to showcase trust and clarity.

Agents should also keep an eye on Secure 2.0—not just for their own planning, but for clients asking financial questions. A little understanding goes a long way.

And when it comes to condos, now’s the time to check whether your favorite buildings are FHA-eligible. If changes happen, you’ll want to move fast with buyers ready to jump.

Home Buyer & Seller Perspective

For buyers, the Zillow lawsuit is a reminder to always ask: Who is this agent? Are they affiliated with the listing? Who’s paying who? More transparency means fewer surprises and better decisions.

Retirees should look into Secure 2.0’s changes. If you’re selling, moving, or downsizing, these rules may affect your timeline and tax planning.

If you’re looking at condos, you may soon have more FHA options. That could open up inventory and improve affordability. Questions about these topics? Contact the loan officer or agent who shared this post—they can help clarify what these changes mean for you.

Frank’s Thoughts

Seems like real estate is the go-to industry for class-action lawsuits lately. If you’re not getting sued, are you even in the game? All jokes aside, these suits tend to follow where the money flows—and there’s a lot of it in referral systems.

Honestly, I find it hard to believe most buyers didn’t know the agent they were talking to wasn’t the listing agent. That said, when trust is lost in any part of the process, people start calling lawyers. The industry should take note.

Still, it’s a bit much. Someone should file a class-action lawsuit against law firms—for filing too many class-action lawsuits. But seriously, we all need to keep ahead of these changes, because they’re coming fast and they will reshape the way we do business.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 19, 2025

Fed Rate Cut, Housing Inventory & New Construction with Tristan Ahumada

The LOBC News Podcast launches with a timely discussion featuring Tristan Ahumada, founder of Lab Coat Agents and A Brilliant Tribe. In this episode, we break down the September 17, 2025 Fed Rate Cut and what it means for mortgage professionals, real estate agents, and consumers alike. While many expected relief, the market reaction has been anything but simple, making it essential to understand the broader implications.

Beyond the Fed Rate Cut, Tristan and I dive into the challenges of housing inventory and affordability that continue to shape today’s market. With limited supply and rising demand, buyers and sellers are navigating an increasingly competitive landscape. Tristan shares his perspective on how these factors are impacting real estate professionals on the ground and what to watch for as we head into the final months of 2025.

We also take a look at new construction, which is becoming a critical piece of the puzzle as affordability challenges persist. Tristan, who reports daily on industry news across Instagram and other platforms, offers valuable insight into how builders are responding to market pressures and what that could mean for buyers in 2026. If you want to stay connected to Tristan’s daily updates, you can follow him here: Tristan Ahumada on Instagram

Looking for a lending partner who can move fast and deliver? Park Place Finance specializes in Construction, Fix & Flip, DSCR, and Bridge loans. As a true no tax return private capital lender, their process is fast, easy, and designed to keep your deals moving without unnecessary red tape.

Whether you’re a builder, investor, or mortgage professional, Park Place Finance offers competitive programs that help you close more deals and serve your clients better. Connect with them today at workwithparkplace.com and see how simple private capital lending can be.

Powered by: Mortgage Marketing Animals

Important Links