September 18, 2025

Rate Cut Sparks Market Questions: Sellers Pull Back as Luxury Homes Make Headlines

The long-awaited rate cut is here. This week, the Federal Reserve issued its first rate cut of 2025, finally lowering the federal funds rate after holding steady for months. However, mortgage professionals weren’t shocked when mortgage rates didn’t follow the script—in fact, they ticked up slightly, prompting a “Lock Alert” from MBS Highway. Zillow’s latest data shows sellers pulling back and price reductions rising, potentially hinting at a shift toward a new seller’s market in early 2026. And in luxury news, a historic Tudor mansion hits the market, showing that unique properties continue to defy broader market trends.

Fed Announces First Rate Cut of 2025

Read the Full Story → MPA

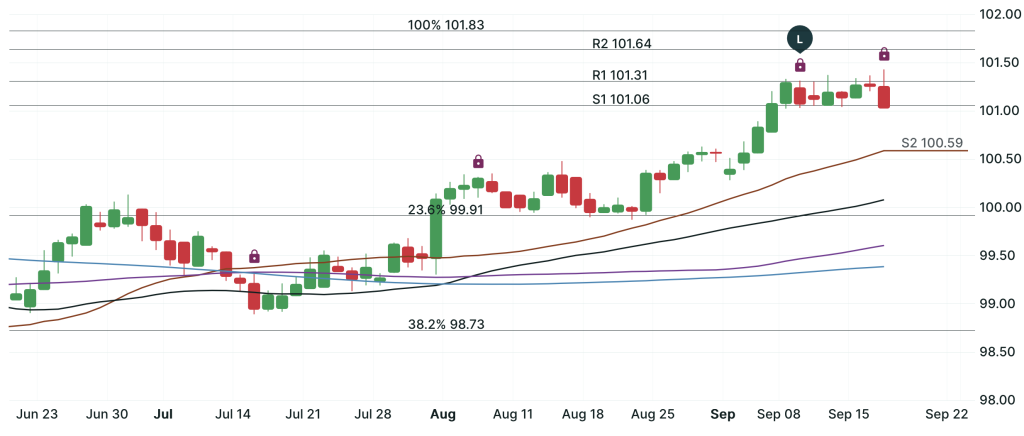

After holding rates steady since late 2024, the Federal Reserve has finally made a move, cutting the benchmark rate by 25 basis points to a range of 4.00% to 4.25%. The decision comes amid signs of a cooling labor market and inflation that remains above target but has moderated.

While the Fed’s decision typically signals potential relief for mortgage borrowers, rates actually bumped up slightly after the announcement. This reaction prompted a “Lock Alert” from MBS Highway, reminding professionals that mortgage rates often respond more to bond market activity than Fed headlines.

The Fed’s own projections suggest more cuts may be on the horizon, but the central bank remains cautious. One member even pushed for a larger cut now, citing the need to stay ahead of economic slowdown. For now, professionals are watching closely as the market digests this first move.

Zillow Data Shows Sellers Retreating

Read the Full Story → Zillow Research

Zillow’s August 2025 Market Report shows that more than 27% of active listings had price cuts—the highest rate since they began tracking in 2018. At the same time, homes are taking longer to sell, and inventory is increasing as new listings slow and some sellers pull their homes entirely.

Realtor.com data backs this up with a year-over-year spike in delistings of over 57%, pointing to a growing trend of seller hesitation. Many homeowners appear to be testing the market only to back out when they don’t get the offers they hoped for.

The mix of higher inventory and retreating sellers suggests the market could be brewing a new kind of seller’s market—especially if mortgage rates ease and buyer demand returns in 2026. But for now, many buyers are holding back, watching both rates and inventory carefully.

Bausch & Lomb Heiress Lists Tudor Mansion

Read the Full Story → Realtor.com

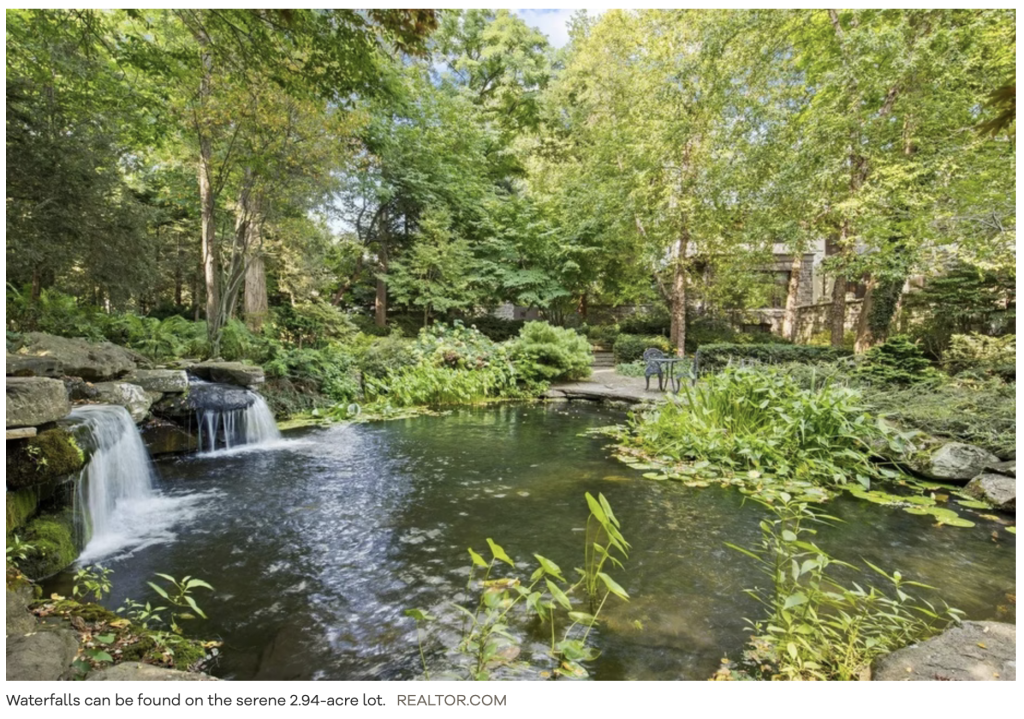

A piece of Rochester history is up for grabs as the former home of a Bausch & Lomb heiress hits the market. The Tudor-style estate, known as “Twin Gables,” spans over 9,300 square feet and combines vintage charm with thoughtful updates.

Listed at $3.4 million, the home features original woodwork, intricate brick details, and spacious grounds. It’s the kind of luxury listing that tells a story—something unique-home buyers crave, even in shifting markets.

While this listing might not reflect national trends, it’s a reminder that high-end homes with character often march to the beat of their own drum. For the right buyer, this one’s a gem.

Loan Officer Perspective

Loan officers should view the rate cut as both a market update and a client conversation starter. Even though mortgage rates didn’t drop as some consumers hoped, this is an opportunity to educate clients on why that happens and what to expect going forward. The “Lock Alert” proves how nuanced rate movements can be.

As more sellers reduce prices or leave the market, buyers may find better opportunities—if they’re ready. A well-timed lock or float decision could make a big difference. Lean into your advisory role now and be ready with tools like MBS Highway to guide your borrowers confidently.

Also, don’t sleep on unique homes. High-end buyers may still be active, especially when rates improve. Having a pulse on these listings can help you stand out.

Real Estate Agent Perspective

Agents, this is a key moment to revisit pricing strategies with sellers. As Zillow reports more price cuts and delistings, setting the right list price from the start is crucial. Educate your clients early to prevent frustration later.

For buyers, the shifting inventory offers more choice and potential leverage. It may not feel like a buyer’s market yet, but we’re seeing more balance—especially in markets where inventory is rising faster than sales.

Unique homes like the Tudor mansion remind us that storytelling sells. Luxury buyers want a narrative, not just a floor plan. If you’re listing a standout property, make sure the marketing lives up to the home.

Home Buyer & Seller Perspective

Buyers may have heard about the Fed’s rate cut and expected big savings, only to learn that mortgage rates didn’t move as hoped. That’s normal—mortgage rates often lag behind. The good news? Most forecasts still expect rates to improve through 2025 and into 2026.

If you’re considering buying, this could be a window to prepare—especially with price reductions increasing and sellers growing more flexible. Sellers, meanwhile, need to be realistic: price it right, stage it well, and move fast before more competition returns.

Not sure what your next move should be? Reach out to the loan officer or real estate agent who shared this post with you—they’ll help you game-plan your next step.

Frank’s Thoughts

Even though the Fed finally cut rates, mortgage rates didn’t play along—and that’s no surprise for those of us in the trenches. Clients will call, texts will fly, but it’s just part of the ride. Our job is to help them understand the difference between headlines and real-life loan pricing.

I think we’re still on track for more meaningful mortgage rate improvements by the end of the year and into 2026. That, coupled with sellers pulling back, could tighten up supply and create a whole new seller’s market early next year.

And that mansion? Man, I might dump some crypto and make my way to Rochester! It’s a great example of how luxury properties can still steal the show—especially when they’ve got style, history, and solid value. Somebody’s gonna scoop that one up fast.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 17, 2025

Mortgage Rates, Millennial Momentum & Builder Confidence: Signs of a Busy 2026?

Mortgage rates continue to shape the outlook across housing and lending sectors, and the latest updates point to growing optimism. Builder confidence is holding steady while future sales expectations are rising. Mortgage applications for new homes show year-over-year gains. Millennials remain a key engine of market activity, and talk of a Fed rate cut has everyone asking what’s next for borrowing costs. While there’s always headline noise, a deeper read suggests business momentum is quietly building. For loan officers, real estate agents, and buyers alike, the signs are pointing to a potentially strong 2026.

Builder Confidence Steady but Future Sales Expectations Hit Six‑Month High

Read the Full Story → NAHB

Builder sentiment in September remained at 32, unchanged from August, according to the NAHB/Wells Fargo Housing Market Index. That keeps confidence in the same narrow band it’s been in for months—but importantly, it’s not slipping.

Even more telling: expectations for future sales climbed two points to 45, reaching their highest level since March. Builders are clearly more hopeful about what’s ahead, particularly as mortgage rates have dipped in recent weeks.

The average 30-year fixed rate has eased by about 23 basis points, helping prospective buyers. Builders are also sweetening deals through incentives and limited price cuts—signs they’re motivated and expecting activity to pick up.

August New Home Purchase Mortgage Applications Increased 1.0 Percent

Read the Full Story → MBA

New home mortgage applications rose 1% year-over-year in August, according to the MBA’s Builder Application Survey. Although activity dipped slightly month-over-month, the annual uptick is a positive sign for fall.

MBA estimates that 730,000 new single-family homes were sold in August on a seasonally adjusted basis, up from 685,000 in July. These aren’t boom numbers, but they show buyers haven’t disappeared.

With builder inventory increasing, the trend may improve affordability and offer buyers more negotiating power. That’s a helpful combo, especially as many still battle rising costs and limited resale supply.

Millennials Still Driving Big Share of Mortgage Inquiries Despite Affordability Challenges

Read the Full Story → MPA

Millennials still account for a massive share of mortgage inquiries—around 50% across major metro areas—despite continued affordability struggles. Their share is slightly down from last year, but still dominant.

In metros like San Jose, Seattle, and San Francisco, millennial demand is particularly high. On the flip side, markets like Louisville and Tampa are seeing some declines, but the generational appetite to buy hasn’t faded.

Millennials bring a digital-first mindset and are highly payment-conscious, making them receptive to tech-forward lenders and smart planning tools. Their behavior sets the tone for future market engagement.

A Fed Rate Cut Is Imminent. But Will It Lower Mortgage Rates?

Read the Full Story → Scotsman Guide

Economists expect the Fed to deliver a 25-basis-point rate cut soon, but its impact on mortgage rates is murky. That’s because mortgage rates are driven more by Treasury yields and inflation expectations than the Fed’s short-term rate alone.

Some experts argue that markets have already priced in the rate cut, meaning we may not see much movement in mortgage rates unless other macro factors shift. In fact, uncertainty around inflation, deficits, and global trade could keep mortgage rates sticky.

Still, the potential for a lower-rate environment is welcome news—and even if the drop is modest, sentiment tends to improve when the Fed eases.

Loan Officer Perspective

The mix of steady builder confidence, solid millennial demand, and expected Fed action is a great conversation starter with your pipeline. It’s the kind of news that reassures hesitant buyers that opportunity still exists—and that rates may not spike. This is a smart time to follow up with fence-sitters and get creative with product solutions that match today’s market.

Real Estate Agent Perspective

With builder sentiment improving and inventory loosening, agents should start planning for a more competitive 2026. Partner with lenders who can support millennial buyers—especially those focused on tech-savvy solutions and affordability education. Staying ahead of Fed developments can help you guide your clients through rate conversations with confidence.

Home Buyer & Seller Perspective

While headlines can feel overwhelming, the truth is: more inventory is coming, rates are easing a bit, and lenders are staying flexible. If you’re thinking about buying or selling, this is a good time to gather your options and make a plan. Talk to the loan officer or real estate agent who shared this blog with you to explore next steps. They can help you navigate the current trends and position yourself for success.

Frank’s Thoughts

Mortgage and real estate news has been on a real positive streak lately. Sure, you’ll still find the occasional “crash is coming” article, but those don’t tell the whole story. We’re seeing real momentum—especially if you look past the headlines.

When you dig into the details, builders are feeling better, buyers are engaging, and the millennial generation is still very much in the game. That’s a solid foundation heading into 2026.

I think loan officers, Realtors, and consumers all have reason to be encouraged. Keep putting in the work now, because it looks like a wave of business is heading our way.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 16, 2025

$90 Billion and Growing: Construction Financing Demand Surges in 2025

Construction financing is seeing renewed demand in 2025, with loan volume rising for the first time in two years. Other significant stories this week include how rent payments are increasingly being used to build credit, and an eye‑catching property in Oregon making waves for its unique graffiti art. The focus keyword: construction financing, as we explore what’s happening in lending, credit, and the real estate scene.

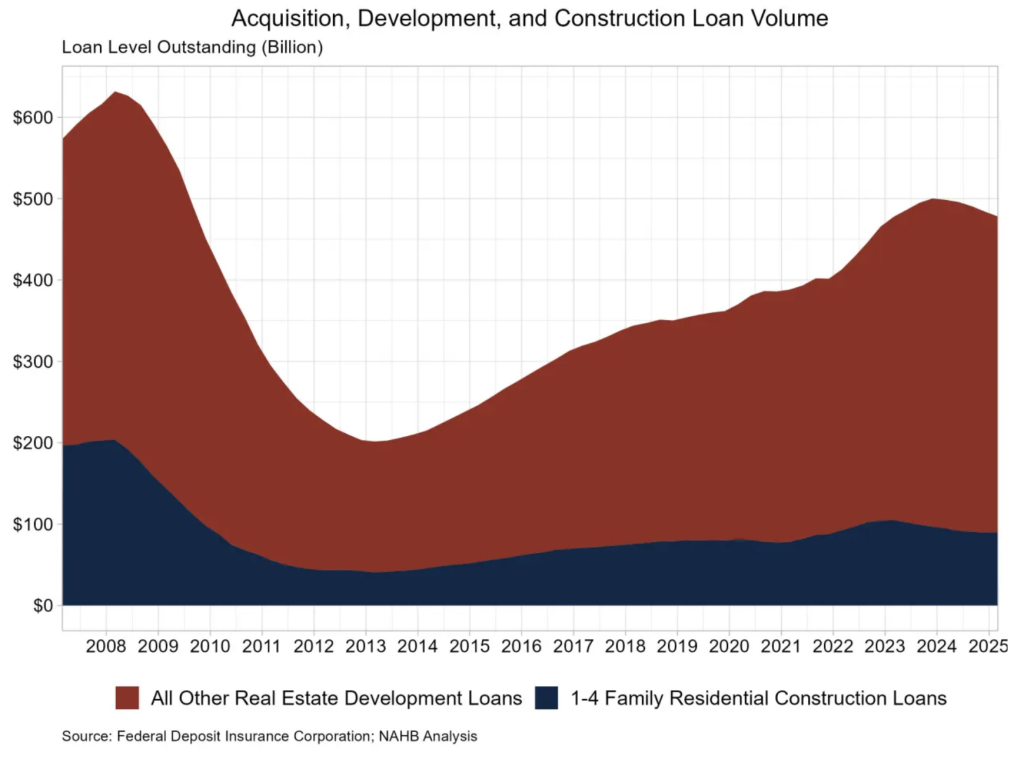

Construction Loan Demand Surges Nationally

New data shows that 1‑to‑4 family residential construction loan volume rose for the first time in two years during the first quarter of 2025. According to FDIC‑reported figures cited by Eye On Housing, outstanding construction and land development loans in this category reached $90.0 billion, up slightly (0.6%) from the previous quarter despite being down compared to a year before.

Justin Hubbert, President of Park Place Finance, says the firm has felt that upward shift. “We’re seeing significantly more demand for construction financing this year, which mirrors what the national data are showing,” Hubbert said. “Many banks have pulled back in construction lending in key markets, which opens the door for lenders who can move quickly. Our process is streamlined to help construction loans reach the finish line much faster.”

For loan officers and realtors, the growth in construction financing reflects a broader market. Builders and investors are turning to new projects to meet affordability demands. With traditional banks scaling back, alternative lending sources are playing a larger role in keeping these projects funded and moving forward.

If you or your clients need fast, reliable construction loan options, reach out to Justin Hubbert’s team via workwithparkplace.com.

Using Rent Payments to Boost Credit Scores

A new piece from CNBC highlights that many Americans pay rent on time each month, yet their rent payments are not reported to credit bureaus—and thus don’t help build credit. Reporting rent payments, however, can boost credit scores for those who participate.

Credit reporting systems like FICO 9 and FICO 10 now allow rent payments (when reported) to be included in credit history. This gives renters—especially those with thin or no credit files—an opportunity to demonstrate a pattern of on‑time payments. It’s an incremental but potentially impactful lever for improving creditworthiness.

That said, participation depends on landlords, reporting services, and whether the lender or credit model considers these data points. Not all institutions use FICO 9/10; many still rely on older score versions that ignore rent history.

Read the Full Story → CNBC

Oregon Graffiti House: Uniqueness Selling Fast

A Salem, Oregon home filled with bold graffiti art is proving hugely popular among buyers. What started as a quirky, artistic property has become a hot ticket: multiple offers are already flooding in.

The house blends street art and residential architecture in a way that breaks the mold. It’s a reminder that aesthetic uniqueness and bold design statements can transcend conventional buyer expectations—and in certain markets, even enhance value.

Potential buyers in such cases are drawn not just to square footage or neighborhood, but to story, character, and visual intrigue. Features like art installations or unconventional style can become key selling points—especially in markets where inventory is otherwise similar.

Read the Full Story → Realtor.com

Frank’s Thoughts

I’ve been getting more and more calls about construction financing lately. Just this weekend, a small builder reached out needing $10 million for a multifamily project. He was ready to go and didn’t want to deal with his bank’s delays and red tape.

Last week, a past client contacted me about funding for two lots he picked up in Southern California. These kinds of projects are popping up more often—and they’re ready for action now. It’s clear that construction financing isn’t just bouncing back—it’s opening real doors for real people.

And that Oregon house? I had to include it. It’s just too cool. A perfect example of how personality and story can turn a property into something unforgettable.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 15, 2025

Fed Rate Cut, Crypto Mortgages, Malibu Luxury & Housing Hotspots

This week’s biggest stories in mortgage and real estate news highlight a shifting tide: a potential Fed Rate Cut could unlock over $20,000 in savings for homebuyers, while cryptocurrency creeps further into the mortgage world. Meanwhile, a $21 million Malibu estate hits the auction block, and a staggering one-third of the nation’s $55 trillion housing wealth is concentrated in just nine cities. These themes remind us that market movement is coming—and fast. Mortgage pros, agents, and consumers alike should be ready to act.

Fed Rate Cut Could Unlock Over $20K in Savings for Homebuyers

Read the Full Story → MPAMAG

A new analysis by HomeAbroad and Ziffy.ai found that a potential Fed Rate Cut from 6.29% to 6.00% could save homebuyers over $20,000 across a 30-year mortgage. For many, 6% is a psychological milestone that may re-energize buyer demand.

The biggest winners? Buyers in high-cost markets like Nantucket and Vineyard Haven, MA, where lifetime savings could exceed $200,000. Even in more affordable metros like Canton, IL, the average buyer could save around $4,800. The impact varies significantly across regions, with the West seeing the greatest monthly savings.

Lower rates would also ease income requirements, potentially unlocking homeownership for more middle-income earners. And with just 11% of Americans relocating in 2024—one of the lowest rates in recent history—the market is primed for a revival if the Fed Rate Cut materializes.

Malibu Vineyard Estate Heads to Auction With a $21 Million Reserve

Read the Full Story → Realtor.com

A Tuscan-style estate in Malibu with 5 acres of working vineyards is now on the auction block for $21 million. The nearly 38-acre estate is home to Malibu Rocky Oaks wine and includes a 7,665-square-foot home with five bedrooms, dramatic windows, and luxe amenities like an infinity-edge pool.

Originally purchased for $3.5 million in 2005, the estate was once listed at $43 million. It’s now being auctioned by Paramount Realty USA. Due to local zoning laws preventing new wineries, the property’s value is also tied to its rarity.

While the brand isn’t included in the sale, the vineyard, irrigation systems, and iconic views are. With its fire-resistant design and breathtaking architecture, it stands as one of Malibu’s most unique luxury opportunities.

Nine Cities Hold One-Third of $55 Trillion U.S. Housing Value

Read the Full Story → Scotsman Guide

According to Zillow, just nine U.S. metro areas hold more than one-third of the nation’s $55 trillion housing value. These include major hubs like New York, Los Angeles, San Francisco, Washington, D.C., Boston, Seattle, San Diego, Chicago, and Miami.

Shifting dynamics post-pandemic have changed where gains and losses are happening. Smaller markets now play a larger role in value increases, especially as affordability and inventory pressures reshape buying patterns.

The Midwest and Northeast are emerging as price gain leaders, while Sun Belt boomtowns like Phoenix and Nashville see price corrections. With investor activity high and inventory slowly building, even a modest Fed Rate Cut could reheat the market quickly.

How Crypto Is Creeping Into the Mortgage Market

Read the Full Story → Sherwood

Thanks to regulatory changes and new products, cryptocurrency is gaining legitimacy in mortgage underwriting. A major move came when the FHFA directed Fannie Mae and Freddie Mac to explore crypto as a reserve asset.

Companies like Milo and Figure are already issuing crypto-backed mortgages and HELOCs. For crypto holders, this offers a chance to leverage their digital assets without triggering taxable events. However, experts warn of volatility and risk.

With Gen Z and Millennials already tapping crypto for down payments, the door is opening wider. But questions remain about whether this will drive broader access or simply benefit wealthier crypto investors looking for tax advantages.

Loan Officer Perspective

Loan officers, the message here is clear: be ready. A Fed Rate Cut could trigger a wave of qualified buyers even if it’s just perception for buyers and sellers. Now is the time to reconnect with pre-approved clients, update affordability estimates, and educate your network about crypto and alternative financing tools.

Use stories like the Malibu estate to spark interest—luxury markets move quickly when rates fall. And stay informed on new underwriting options, especially as crypto-backed tools inch toward the mainstream.

Real Estate Agent Perspective

Agents, opportunity is knocking. Inventory is growing, prices are softening in key areas, and buyers are watching rates closely. This is the time to sharpen your market insights, especially in the nine high-value cities and emerging Midwestern hubs.

Even high-end properties like Malibu’s vineyard estate could attract renewed interest as liquidity returns (everybody loves looking at amazing homes). Stay flexible and ready to educate clients on how to act fast if a Fed Rate Cut becomes reality.

Home Buyer & Seller Perspective

If you’ve been waiting for the right moment, it’s almost here. A Fed Rate Cut could mean thousands in savings, and new tools like crypto-backed mortgages may open doors you didn’t know were available.

Whether you’re buying your first home or selling in a shifting market, talk to the loan officer or real estate pro who shared this post. They can help you make sense of what’s next—and how to move when the time is right.

Frank’s Thoughts

Let’s hope the Fed Rate Cut keeps heading our way. A sub-6% mortgage could light up this market fast—and when it does, you’ll want to be ready. This is the calm before the storm. Smart pros are laying groundwork now.

Also, can we all agree to pool our funds and buy that Malibu vineyard? I mean, seriously—look at that pool. That view. That wine! OK, back to work…

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 12, 2025

Falling Mortgage Rates Open the Door to Market Momentum

As we enter fall 2025, the mortgage and housing industry is beginning to feel a welcome shift in momentum. This week’s headlines reveal improving mortgage credit availability, easing mortgage rates, and renewed political focus on housing affordability. These developments suggest the long-frozen market could finally be thawing. For loan officers, real estate agents, and hopeful buyers and sellers, the focus keyword mortgage rates signals the start of new opportunity.

Mortgage Credit Availability Inches Up

Read the Full Story → MBA

August brought a modest yet notable increase in mortgage credit availability, according to the Mortgage Bankers Association. The MCAI rose 0.1%, marking the first upward movement in several months.

This shift was led by a 0.3% increase in conventional credit availability, with conforming loan products improving by 0.7%. More adjustable-rate mortgage (ARM) offerings are playing a role here, providing additional flexibility for borrowers as mortgage rates evolve.

While the gains aren’t massive, they signal cautious optimism from lenders and may open the door slightly wider for more borrowers.

Mortgage Rates Fall and Market Begins to Thaw

Read the Full Story → Business Insider

Mortgage rates have quietly dropped to their lowest levels in nearly a year, according to market analysts. After months of stagnation, the market is showing signs of movement.

Lower mortgage rates are reviving both refinance and purchase activity. Borrowers stuck with higher rates are eager to refinance, while prospective buyers are finding affordability slightly more within reach.

For sellers paralyzed by “lock-in” syndrome, the improved environment may finally give them confidence to list, potentially boosting inventory in a tight market.

First-Time Buyers Face National Housing Emergency

Read the Full Story → Realtor.com

First-time buyers remain one of the hardest-hit segments of the housing market. Rising prices, low inventory, and competition have created a challenging environment.

Realtor.com reports the situation as a “national housing emergency,” prompting policymakers to take the issue seriously. There’s early talk of strategies to expand affordability and access.

If those efforts gain traction, they could create an uptick in consumer confidence and eventually lead to meaningful improvements for new buyers trying to enter the market.

Loan Officer Perspective

This week’s news should energize loan officers. Refinances are likely to ramp up as borrowers seek to lock in lower mortgage rates. Those who build strong pipelines now will benefit from the uptick.

More credit options and rising consumer confidence will also give LOs more flexibility in structuring deals and reaching underserved markets.

Now’s the time to sharpen your marketing, reconnect with past clients, and prepare for a more active close to the year.

Real Estate Agent Perspective

Agents should view this market as an opening. Sellers who were once stuck due to low rates might now be convinced to list, expanding inventory and creating new opportunities.

Encouraging hesitant buyers with improved affordability metrics and available mortgage rate options can help close deals.

With affordability and confidence both rising, this is a great moment to reach out to past leads and re-engage your sphere.

Home Buyer & Seller Perspective

Buyers who felt priced out may want to reassess. Mortgage rates are lower, and credit is a touch more accessible. Sellers may now have the freedom to make that move they put off.

If you’ve been waiting for the right time, it might just be arriving. Talk to the loan officer or agent who shared this post to see what’s possible for your goals.

Whether you’re ready to buy or sell, there are more tools and more favorable conditions emerging.

Frank’s Thoughts

Man, it finally feels like a real shift is happening. We’ve been grinding through a tight market for so long, and these stories are giving off real tailwind vibes.

Refis coming back, more buyers re-entering, sellers testing the waters again—this is the kind of momentum we’ve been waiting on. And with affordability getting attention at the national level, things could get even better.

Let’s stay sharp. Loan officers and agents who stay proactive right now are going to ride this next wave well. Feels good to have some wind at our backs.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 11, 2025

Refinance Surge, Lumber Drops, and Girl Scouts Tease a New Cookie

This week’s mortgage and real estate headlines serve up a little something for everyone. A refinance surge is underway as rates dip slightly, and non-QM loans are capturing more of the market than ever. Builders are celebrating a steep drop in lumber prices, which could revive home construction activity. Meanwhile, the Girl Scouts are stirring up nostalgia—and appetites—with a new rocky-road-inspired cookie flavor. Whether you’re a mortgage pro, agent, buyer, or seller, there’s opportunity (and maybe a snack) on the horizon. Our focus keyword this week: refinances surge.

Refinance Surge in August While Non-QM Lending Breaks Records

Read the Full Story → Scotsman Guide

Refinance activity made a strong comeback in August, with rate-and-term refinance locks rising a stunning 69.8% from July. This marks a notable shift in borrower behavior as they move quickly to capture lower rates.

At the same time, the average 30-year fixed mortgage rate dipped from 6.75% in mid-July to 6.56% by late August, helping to fuel the increase in refis. Purchase loan locks, however, declined 9.8%, showing the continued challenges in the purchase market.

Non-QM lending hit another milestone, climbing to 8.34% of total originations—the highest on record. This shows a growing appetite for alternative financing solutions amid tighter traditional lending standards.

Wholesale Inflation Drops, Increasing Pressure on Fed to Cut Rates

Read the Full Story → Realtor.com

The Producer Price Index (PPI), a key measure of wholesale inflation, dropped 0.1% in August, surprising many economists who had predicted an increase. Core PPI, excluding food and energy, also fell.

These figures suggest that inflation may be cooling across the supply chain, which could influence the Federal Reserve’s future decisions on interest rates. A Fed rate cut could become more likely if this trend continues.

Lower wholesale inflation has broad implications for lending, as it may lead to reduced borrowing costs over time. For now, it’s a strong signal that the economy may be stabilizing.

Lumber Prices Plummet, Builders Call It “Absolutely Crazy”

Read the Full Story → MPA

Lumber prices have seen a dramatic decline due to overproduction and lagging demand, even as Canadian sawmills face higher production costs. Experts are calling the drop “absolutely crazy.”

The plunge in prices comes at a time when construction has been sluggish, and this may be the jolt needed to get projects moving again. Builders now have a cost advantage that hasn’t existed in months.

For anyone considering new construction or major renovations, the current market may offer a rare opportunity to act before prices rebound.

Girl Scouts Introduce New Cookie Flavor: Exploremores

Read the Full Story → SAN

The Girl Scouts are adding a new flavor to their 2026 cookie lineup: Exploremores. This rocky-road-inspired cookie features chocolate wafers with a marshmallow and toasted almond-flavored creme filling.

The new cookie will replace S’mores and Toast-Yay!, both of which will be retired after the 2025 season. It’s a nostalgic twist that taps into classic ice cream flavors.

Though not real estate news, this cultural moment is lighthearted and fun—something we could all use a little more of.

Loan Officer Perspective

This week’s news is a strong signal to loan officers: now is the time to re-engage past clients and prospects. The refinance surge shows borrowers are paying attention, and a slight dip in rates could be your foot in the door. Non-QM growth also opens the door for clients who don’t fit the traditional mold.

With inflation indicators improving, there’s a positive narrative to share—especially for clients concerned about timing. Sharing these stories shows you’re informed and ready to act.

Real Estate Agent Perspective

Agents can highlight the declining lumber costs to inspire buyers who’ve been considering new construction. This is a window of opportunity to build at a discount.

Refinancing activity often signals homeowner movement, so stay connected with lenders who can point to clients looking to list. And don’t overlook the cookie news—posting cultural content builds engagement and humanizes your brand.

Home Buyer & Seller Perspective

Lower lumber prices and falling inflation could lead to more affordable home builds and lower interest rates in the future. If you’re looking to buy or build, this might be your window to act.

If you’re considering refinancing or selling, these trends signal it may be a good time to talk to your loan officer or real estate agent.

And when those Exploremores hit the shelves, grab a box. Or three. Meanwhile, reach out to the pro who shared this blog post with you—they’re here to help you get started.

Frank’s Thoughts

There’s some genuinely good news this week. Whether it’s the refinance surge or lumber drop, mortgage and real estate professionals have a lot to talk about with clients.

These market shifts are more than stats—they’re real moments where you can create opportunity for the people you serve.

And come on, let’s be honest—this new Girl Scout cookie sounds amazing. Bring those babies on!

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 10, 2025

Trump Housing Plan, CPI Outlook, and Multifamily Surge Signal Market Shifts

This week’s headlines revolve around the Trump Housing Plan, which promises to expand homeownership access for millions of Americans. As we approach the election season, housing is emerging as a central policy issue. Alongside this, Zillow’s CPI forecast hints at potential rate relief, and the MBA reports a 17% surge in multifamily lending activity. These developments showcase how political, economic, and sector-specific trends are converging to reshape housing opportunities—making now a great time for mortgage and real estate professionals to stay engaged and proactive.

Trump Vows to Expand Homeownership to Millions

Read the Full Story → Realtor.com

Donald Trump is placing homeownership front and center in his campaign messaging, pledging to help millions more families buy homes. His plan includes cutting regulations and pushing for lower interest rates to make housing more accessible.

He emphasized rolling back policies he believes have made it harder for everyday Americans to buy a home. By engaging with banks and regulators, Trump says his goal is to “unlock the American Dream” through housing.

Whether or not his promises come to fruition, this renewed focus on housing policy could spark broader discussions and potentially pave the way for meaningful reforms.

Zillow Predicts Continued Cooling in Inflation

Read the Full Story → Zillow

Zillow’s August CPI forecast shows continued signs of inflation cooling, which could nudge the Federal Reserve closer to considering interest rate cuts. Their outlook sees CPI dipping below 3% in early 2026.

If these trends hold, mortgage rates may trend lower, giving more buyers an opportunity to enter the market. That’s especially important in a landscape where affordability remains a top concern.

Zillow notes that shelter inflation is still a significant piece of the CPI puzzle. A slowdown in housing cost growth could further accelerate overall CPI declines and improve conditions for buyers.

Multifamily Lending Jumps 17% in 2024

Read the Full Story → MBA

Multifamily lending hit $289 billion in 2024, up 17% year over year, according to the Mortgage Bankers Association. That growth signals strong investor confidence and consistent rental housing demand.

Lenders are leaning into multifamily projects as urban and suburban rental needs continue to rise. Developers are also actively building to meet this demand, especially as many buyers remain priced out of single-family homes.

This segment has proven to be a resilient and adaptive piece of the housing economy. For professionals not yet active in multifamily, now may be the time to get involved.

Loan Officer Perspective

The Trump Housing Plan puts homeownership on the political map again, which can drive both policy and public sentiment. Loan officers should be ready to explain how current and future rate trends affect affordability. The multifamily lending surge is also an open door—learning that space can diversify your loan offerings.

Real Estate Agent Perspective

It’s encouraging to see housing policy back in the headlines. Real estate agents can use these stories to start conversations with buyers who may feel stuck on the sidelines. Also, agents working with investors should take note of multifamily trends—it’s becoming an increasingly smart play.

Home Buyer & Seller Perspective

If you’re thinking about buying or selling, these headlines point to momentum. Policy shifts, inflation trends, and sector strength are all aligning. Want to know how this affects you? Reach out to the real estate or mortgage pro who shared this post—they’re here to help you get started.

Frank’s Thoughts

I’m glad to see the President has housing in his crosshairs. He’s saying good things, and I’m hopeful we’ll see millions more Americans become homeowners if these ideas come to life. That’s a win for everyone involved in the housing industry.

Anytime housing becomes part of the political dialogue, that’s good news for us. It gives professionals a new reason to talk to their networks and re-engage cold leads. People want to know what this means for them—so let’s tell them.

Also, I really liked the MBA multifamily story. If you’re not working in that space yet, now’s a good time to learn. Multifamily has been a consistent bright spot this year—and it’s not slowing down.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 9, 2025

Big Rate Cuts Coming? Fed Shifts, Expert Critiques, and Housing Market Hits $55T

This week’s real estate headlines are packed with big moves. Signs are pointing to Big Rate Cuts as the Federal Reserve responds to weaker job data. Meanwhile, renowned economist Mohamed El‑Erian is calling out the Fed’s delays and misreads. Add to that the U.S. housing market reaching a staggering $55.1 trillion in value, and you’ve got a week full of market shifts and strategic opportunities. For mortgage pros, real estate agents, and clients alike, these updates could signal the start of a high-impact season.

Are Big Federal Reserve Rate Cuts on the Way?

Read the Full Story → MPA

Recent employment data is softening fast—only 22,000 jobs were added in August, falling well below projections. The unemployment rate also ticked up to 4.3%, the highest it’s been since late 2021.

Economists are reading the tea leaves and many are expecting Big Rate Cuts from the Fed, possibly as soon as September. Now a possible 50-basis-point move is on the table, with more to follow if inflation stays contained.

This could be the signal many homebuyers and refi prospects have been waiting for. If mortgage rates follow suit, affordability and application volume could both rise quickly.

Top Economist Says the Fed Got It Wrong Again

Read the Full Story → Yahoo Finance

Mohamed El‑Erian didn’t mince words this week, calling out the Federal Reserve for repeatedly being too slow and reactive in its policy decisions. His claim? The Fed keeps “getting it wrong”—misjudging inflation, delaying necessary action, and now potentially overcorrecting.

He warned that the latest economic indicators show a cooling economy, but the Fed’s slow shifts in policy risk making things worse. His message echoed throughout the financial world: if Big Rate Cuts are needed, the Fed shouldn’t wait too long.

While opinions vary, his take adds fuel to growing pressure for the Fed to get ahead of the curve—not behind it again.

U.S. Housing Market Value Hits $55.1 Trillion

Read the Full Story → Zillow

The total value of the U.S. housing market has hit an all-time high—$55.1 trillion. That’s a $20 trillion increase since 2020, though recent growth has slowed to just 1.6% over the past year.

What’s fascinating is the shift in where value is growing. Big states like California, Florida, and Texas actually saw housing wealth drop, while areas like New York, New Jersey, Illinois, and Pennsylvania surged.

Also notable: major metros like New York and LA now hold a smaller share of overall gains. The wealth is spreading, and mid-size markets are rising. That’s good news for buyers and pros focused outside the usual hot spots.

Loan Officer Perspective

The signs are lining up for a powerful rebound in both purchase and refinance activity. If Big Rate Cuts land, even in small steps, loan officers should be ready to act. Reconnect with your database, prep your marketing, and most importantly—check in with your realtor partners. This kind of shift could be the launchpad for Q4 wins and strong 2026 pipelines.

Real Estate Agent Perspective

Agents have a window to re-engage buyers who’ve been priced out or discouraged by rates. With potential Big Rate Cuts coming, there may soon be more qualified buyers in the pipeline. Now’s the time to identify the loan officers who have stayed consistent and collaborative. When purchase volume spikes, loyal partnerships will be key to keeping transactions smooth and fast.

Home Buyer & Seller Perspective

If you’ve been waiting for better conditions to buy or refinance, this may be your moment. The Fed is under pressure to cut rates soon, and that could bring better loan options your way. For sellers, shifting value in certain states and metros may also mean new demand. Got questions? Reach out to the mortgage or real estate pro who shared this post—they’re here to help you move forward confidently.

Frank’s Thoughts

Man, this is shaping up to be the refi surge we’ve been waiting for. Loan officers—don’t sleep on this moment. If rates drop meaningfully, you’ll need to be first in line with your clients, but there’s one other thing, DON’T FORGET YOUR REALTOR PARTNERS!

And realtors—take note of which LOs stuck with you during the slow season. The purchase boom that follows Big Rate Cuts will be huge, and those relationships will carry a lot of weight.

Let’s be loyal to each other’s success. There’s room for everyone to win here. The smart pros will prep now and ride the wave together.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 8, 2025

Trigger Bill Passes, GSE Debate Heats Up & 3D Housing Affordability

Today’s mortgage headlines are packed with policy shifts and innovation, starting with the long-awaited signing of the Trigger Bill, putting a stop to unsolicited borrower solicitations. Meanwhile, 46 independent mortgage banks rally to prevent a Fannie-Freddie merger, arguing it would undercut smaller lenders. And in Houston, 3D-printed homes are turning heads as a real solution to affordable, sustainable housing. Whether you’re in lending, real estate, or just housing-curious, this week’s updates matter for how we work, sell, and live.

Trigger Bill Signed Into Law, Banning Most Trigger Leads

Read the Full Story → MPAMAG

On September 5, 2025, President Trump signed the Trigger Bill—officially called the Homebuyers Privacy Protection Act—into law. Starting March 5, 2026, credit bureaus will be restricted from selling consumer mortgage credit data, commonly known as trigger leads, without the consumer’s permission or unless it’s their current mortgage company making the offer.

The law is a major win for loan officers, many of whom have long criticized the practice as deceptive and predatory. Organizations like the National Association of Mortgage Brokers and the Independent Community Bankers of America backed the legislation, applauding its consumer-first approach.

With the Trigger Bill becoming law, mortgage professionals will need to lean harder into relationship-building and trusted partnerships—less robo-dialing, more real conversations.

Independent Lenders Oppose Fannie-Freddie Merger

Read the Full Story → Scotsman Guide

A group of 46 independent mortgage banks has formally opposed the idea of merging Fannie Mae and Freddie Mac. The move came in a signed letter to FHFA Director Bill Pulte and Treasury Secretary Scott Bessent, urging them to maintain competition between the two entities.

The letter warns that combining the GSEs under a proposed “Great American Mortgage Corporation” model would reduce lender choice, diminish access for smaller IMBs, and harm borrower pricing. These smaller lenders are especially concerned about losing the pricing power and cash window access that keeps them competitive.

By keeping Fannie and Freddie separate, advocates argue we can maintain a healthy, diversified lending ecosystem—one that serves more communities, not fewer.

3D-Printed Homes Bring Affordability and Innovation to Houston

Read the Full Story → Realtor.com

In Houston, a new development called Zuri Gardens is building 80 homes using 3D-printing technology from Hive 3D and partners. With prices in the high $200,000s and up to $125,000 in down payment assistance available, this project is redefining what affordable housing looks like.

Each home offers modern layouts—2 beds, 2.5 baths, office space, and a covered patio—all in about 1,360 square feet. Beyond affordability, these homes are being praised for energy efficiency, durability, and their ability to stand up to extreme weather conditions.

As the housing market looks for scalable solutions to the affordability crisis, 3D-printed construction is emerging as a serious contender—not a novelty.

The Data Advocate

This week, I’m sharing a must-watch video from The Data Advocate featuring Tristan Ahumada, Saul Klein, and John Reilly. It’s one of the best breakdowns of the legal and economic shifts happening in real estate right now—timely, relevant, and packed with clarity.

They dig into why buyer agent commissions didn’t crash post-settlement (in fact, many went up), what’s really going on with the NAR vs DOJ conflict, and how lawsuits like Sitzer and Gibson could reshape the future of agent compensation and MLS structures.

The conversation also covers the RealPage case and the growing competition in the MLS and listing space. If you’re a broker, agent, or just trying to stay informed, this isn’t doom—it’s your heads-up on where the puck is headed. Definitely worth your time.

Loan Officer Perspective

The Trigger Bill is a big deal. It shifts the game from noisy marketing to meaningful relationships. That means your personal brand and referral network matter more than ever. Use this as an opportunity to double down on trust-based growth.

The GSE battle is something to watch closely. Should Fannie and Freddie stay separate, access to competitive products and fair pricing stays strong—especially important for smaller shops. That’s a win for consumers, and a win for you.

And if you’re in Texas—or watching trends—those 3D homes hint at a future where affordability doesn’t mean cutting corners. Lenders who understand these new builds early can guide more buyers into ownership.

Real Estate Agent Perspective

Agents now have a powerful new talking point: clients’ information will be better protected thanks to the Trigger Bill. No more buyers complaining about being bombarded after a credit pull—this builds confidence in the process you walk them through.

The GSE drama may feel like background noise, but it affects product availability and the overall cost to borrow. Staying current helps you advise with clarity and confidence.

And those 3D homes? They’re not just cool—they’re proof that innovation can create high-quality, budget-friendly listings. That’s a message today’s affordability-focused buyers want to hear.

Home Buyer & Seller Perspective

If you’re buying a home, the new Trigger Bill means fewer surprise calls and more control over your personal information. That’s a win for your peace of mind.

Policy debates like the Fannie-Freddie merger might sound like D.C. jargon, but they impact the mortgage options available to you—and how competitive those options are.

And in places like Houston, 3D-printed homes are showing how design, technology, and affordability can come together. If you’re curious about what this means for your home goals, contact the real estate or mortgage pro who shared this post—they’d love to help.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 5, 2025

Housing Market Forecast, Rocket’s Stock Moves, AI & Homeownership, and Buyer Bargains Despite Rates

The housing market forecast is looking up, even amid high mortgage rates and economic headwinds. This week’s stories explore a bright long-term projection for home values, Rocket Companies’ recent stock activity, a deep dive into AI’s growing role (and risks) in the mortgage industry, and a refreshing silver lining for buyers navigating today’s stubborn rates. These insights reveal an evolving market where professionals can still thrive, buyers can find value, and technology is reshaping the landscape in ways both promising and problematic.

2030 Housing Market Forecast Predicts Major Gains

Read the Full Story → Newsweek

A new report from real estate analytics firm Pulsenomics offers an optimistic long-term outlook, predicting a 36.8% increase in home values by 2030. The panel of over 100 economists and housing experts revised their forecasts upward, citing continued supply constraints and resilient demand.

Short-term price growth will remain modest, with only a 2.4% increase expected through the end of 2024. However, as interest rates gradually ease and demographic demand strengthens, appreciation is expected to accelerate in subsequent years.

Despite affordability concerns today, this forecast highlights homeownership’s continued strength as a long-term wealth-building tool. For professionals and consumers alike, the takeaway is clear: don’t lose sight of the big picture.

Rocket Companies Stock Jumps After Better-Than-Expected Earnings

Read the Full Story → Yahoo Finance

Rocket Companies surprised investors with stronger-than-anticipated Q2 results, pushing its stock higher. The mortgage giant reported $1.2 billion in revenue, up from $958 million a year ago, along with a 57% increase in net income.

Executives credited strong cost-cutting measures and improved margins, especially in purchase originations, for the gains. Rocket is also focusing on tech innovations like AI and automation to streamline its lending process and improve consumer experience.

While the industry remains challenging, Rocket’s performance shows that scale, efficiency, and innovation can yield real momentum even in a tough rate environment.

AI Tool Eases Path for Hispanic Homebuyers

Read the Full Story → AP News

A new bilingual AI platform built on ChatGPT, called Wholesale Search, is helping mortgage professionals better serve Hispanic homebuyers—particularly those who speak limited English or lack a traditional credit history. The tool pulls lender requirements from over 150 lenders into one interface, significantly speeding up and simplifying their workflow.

The nonprofit behind the tool, the Hispanic Organization of Mortgage Experts (HOME), also offers a training program—Home Certified—to upskill loan officers on topics like intercultural communication, compliance, and credit and income analysis.

Users have reported faster approvals: instead of contacting dozens of lenders manually, they can now narrow down options quickly. One loan officer noted that from the first meeting to closing took only about six weeks in one case. The platform also includes features to flag misinformation and stays current by syncing directly with lenders.

Market Balance Offers Opportunities Despite Mortgage Rates

Read the Full Story → MPA

While mortgage rates remain elevated, the housing market has shifted toward better balance between supply and demand, offering an overlooked advantage to today’s buyers. Less competition and more options mean smart buyers can negotiate better deals.

Many homeowners are staying put due to “rate lock,” reducing inventory. But builders and some motivated sellers are offering incentives to move properties. Combined with less bidding war pressure, it creates a surprisingly friendly environment for patient, prepared buyers.

This isn’t the hot market of 2021, but it offers its own set of unique advantages—especially for those working with savvy professionals.

Loan Officer Perspective

This week’s news is a great reminder that opportunity is still out there. The long-term housing market forecast supports the message that buying now, even at higher rates, can lead to future gains. Rocket’s earnings also demonstrate that lenders who adapt and focus on client experience can succeed. Loan officers should lean into education, helping clients look beyond today’s rates and understand the bigger picture. Tech insights also highlight the value of human expertise in an increasingly digital world.

Real Estate Agent Perspective

For agents, the message is clear: this market may be tough, but it’s workable. With prices stabilizing and inventory slowly shifting, agents who understand local trends and stay proactive can help buyers find great opportunities. The long-term forecast also supports the value of real estate as an investment, which should be part of your buyer consultations. And as AI tools enter more stages of the transaction, your personal guidance is more valuable than ever.

Home Buyer & Seller Perspective

If you’re thinking of buying or selling a home, this week’s stories show there are reasons to be optimistic. Home values are expected to rise significantly over the next five years. Buyers today might face higher rates, but they also have less competition and more power to negotiate. Sellers can still benefit from strong long-term demand. If you have questions or want to explore your options, contact the loan officer or real estate pro who shared this post with you.

AI News: Humans Hired to Fix AI Mistakes

NBC News tech reporter Angela Yang explores a growing trend: freelancers and creative professionals are being hired to clean up sloppy AI-generated content.

Once worried about losing jobs to automation, many now find themselves in demand to fix what AI can’t get quite right. The video highlights how the human touch is still essential, even in an AI-driven economy, particularly in creative industries like design and media.

Powered by: Mortgage Marketing Animals

Important Links