September 4, 2025

Mortgage Market Shifts: Rate Cuts, Homeownership Dips, and Insurance Migration

As the housing and mortgage market continue to react to economic pressures, four key stories this week shed light on the shifting landscape. Our focus keyword: Rate Cuts. The federal government plans to offload part of its Fannie Mae and Freddie Mac stake, signaling a slow move toward privatization. Fed Governor Waller calls for immediate rate cuts, while skyrocketing insurance premiums are pushing buyers to relocate. Finally, new data shows homeownership dipped in Q2 as more Americans turned to renting. Let’s dive into what these updates mean for the industry—and for your clients.

Government Plans to Sell 5% Stake in Fannie Mae and Freddie Mac

Read the Full Story → CityBiz

The U.S. Treasury announced plans to sell a 5% stake in Fannie Mae and Freddie Mac as part of a long-anticipated effort to reduce federal control. This marks the first major move toward privatization since the government took over the GSEs during the 2008 financial crisis.

According to the FHFA, the sale will take place gradually to avoid disruption. The hope is that by allowing private investment, the entities can operate with more efficiency and less political interference.

This decision doesn’t mean full privatization is around the corner, but it does signal momentum. Industry leaders are watching closely for how this affects investor confidence and mortgage availability.

Homebuyers Relocating to Avoid Soaring Insurance Costs

Read the Full Story → Realtor.com

High homeowners insurance premiums are reshaping where people choose to live. States like California and Florida have seen sharp premium hikes due to climate risk, while buyers are increasingly drawn to areas with lower insurance costs like Ohio and Wisconsin.

Many buyers are factoring insurance quotes into their affordability equation. Some have walked away from dream homes due to unaffordable premiums, particularly in wildfire- or flood-prone regions.

Insurance isn’t just an afterthought anymore—it’s influencing real estate trends. With prices and rates already squeezing budgets, insurance is the latest variable shaping migration.

Fed Governor Waller Urges Immediate Rate Cuts

Read the Full Story → MPA

Federal Reserve Governor Christopher Waller has publicly advocated for the Fed to begin cutting interest rates immediately, citing cooled inflation and economic stability. His comments increase speculation that Rate Cuts could happen sooner than expected.

Waller’s remarks are notable because he was previously one of the more hawkish voices on inflation. His pivot signals that the Fed may be more confident that inflation is under control.

If the Fed acts soon, we could see meaningful relief in mortgage rates. This would be a welcome change for borrowers and the housing market as a whole.

Homeownership Rate Dips While Renting Surges

Read the Full Story → Scotsman Guide

The U.S. homeownership rate declined slightly in Q2 2025, dropping to 65.5%. Meanwhile, the number of renter households increased by over 1 million, signaling a shift in consumer behavior amid affordability concerns.

Younger buyers and first-time homeowners continue to be sidelined by high home prices and tight inventory. This has driven more people into renting, even as rents continue to rise.

While the dip is small, it’s part of a larger trend suggesting many would-be buyers are still waiting on Rate Cuts or better affordability before entering the market.

Loan Officer Perspective

This week’s news offers both caution and opportunity. The potential for Rate Cuts gives LOs a reason to re-engage rate-sensitive clients. The Fannie/Freddie sell-off might not have immediate effects, but it’s a conversation starter for long-term housing finance changes. Use these updates in your client outreach—particularly to explain how today’s renters could become tomorrow’s buyers.

Real Estate Agent Perspective

Now’s the time to stay sharp on migration trends and affordability factors. Insurance costs are actively shaping buyer decisions, and agents can position themselves as local experts on which areas offer the best value and protection. The Rate Cuts discussion gives reason to stay in touch with cold leads who may re-enter the market soon.

Home Buyer & Seller Perspective

If you’re feeling priced out or overwhelmed by premiums, you’re not alone. Many are adjusting their plans based on these same concerns. The good news? Relief may be on the horizon if Rate Cuts happen. Be proactive—contact the loan officer or real estate agent who shared this post with you to talk about your options today.

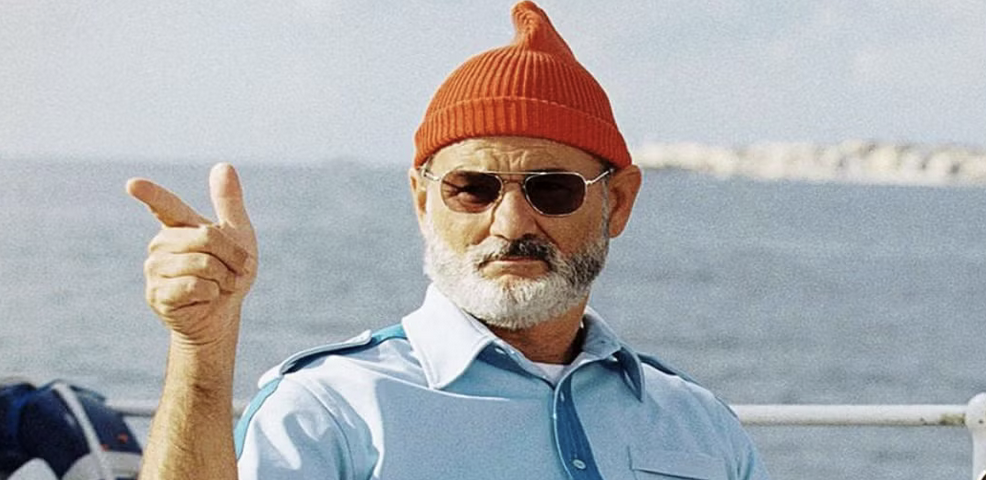

Someone Needs to Make This…

Look, the mortgage market might be unpredictable, but one thing is certain: Frank wants Scotch Pies. This week’s blog comes with a culinary twist. When things get too serious, baking a buttery, meaty pie from Scotland might be the most productive thing you can do.

Here’s a video on how to make Scotch Pies the traditional way. Pro tip: use lard, not butter, for the crust. It’s a game-changer.

So whether you’re watching the Fed or watching your oven timer, enjoy the flavors of good news and good food. Now that’s a tasty combo.

Man I want these….

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 3, 2025

Housing Affordability Efforts: Tariff Relief, GSE Stability & Job Market Confidence

This week’s economic news puts housing affordability back in the spotlight. From the Trump administration’s push to cut construction costs, to Senate Democrats defending access to mortgage credit, and economists calming fears around a crashing job market—there’s encouraging movement across multiple fronts. For industry pros, these developments offer new ways to advise clients and prepare for what’s next in housing.

Trump Eyes Tariff Relief to Boost Housing Supply

Read the Full Story → Axios

Treasury Secretary Scott Bessent announced that the Trump administration is actively considering tariff exclusions for home construction materials, such as steel and lumber. This move is part of a broader push to address the nation’s housing crisis and could even include a formal housing emergency declaration this fall.

The goal? To lower material costs, speed up new construction, and reduce regulatory red tape. Bessent also floated ideas like simplified zoning laws and reduced closing costs to get buyers back in the market.

If implemented, these changes could have a rapid and direct impact on affordability—helping both builders and buyers at a critical moment in the housing cycle.

Senate Democrats Say GSE Privatization Will Hurt Borrowers

Read the Full Story → SAN

A group of Senate Democrats is sounding the alarm over efforts to privatize Fannie Mae and Freddie Mac. Their concern is that removing the GSEs from federal oversight could increase mortgage rates and limit access for low- and middle-income borrowers.

The GSEs currently back nearly 70% of all U.S. mortgages, providing critical liquidity and stability. Lawmakers argue that privatization would shift the focus from public service to private profit, possibly hurting the very people the system is meant to help.

This pushback signals a broader desire in Washington to protect affordability and access to credit—especially while rates remain elevated and housing inventory tight.

Future Careers May Be Out of This World

Read the Full Story → Yahoo News

Yahoo’s latest article takes a creative look at where the job market might be headed—and it’s not just toward remote work, but possibly off-planet. From Elon Musk to Jeff Bezos, tech leaders are pushing the boundaries of space exploration, and some experts believe Gen Z could end up working among the stars.

While it sounds futuristic, the underlying message is that the job market is evolving rapidly, with new technologies and industries creating opportunities we couldn’t imagine a decade ago. Space may be the hook, but the point is broader: innovation drives economic expansion.

For the housing world, that means staying tuned in. As industries shift and remote capabilities expand, housing demand will follow—sometimes into unexpected places. Keeping up with the future of work is key to understanding the future of where people will want to live.

Loan Officer Perspective

This week’s news is a great reminder that we’re still in a dynamic market—but one full of opportunity. Possible tariff relief could improve builder margins and lead to more affordable new construction. Continued GSE stability means lending guidelines likely won’t tighten anytime soon. And job market normalization supports borrower confidence. Now’s the time to reach out to clients with education on affordability programs and rate strategies.

Real Estate Agent Perspective

For agents, there’s strong messaging here: affordability solutions are being actively discussed, and housing is top-of-mind for policymakers. The potential for increased inventory and stable financing means more chances to match buyers with homes. As the job market holds steady, buyers will feel more confident—and sellers will feel more motivated. Position yourself as the expert who connects the dots.

Home Buyer & Seller Perspective

If you’re thinking about buying or selling, this week’s news should encourage you. Leaders are taking action to lower costs and protect mortgage access. The job market is holding firm, which supports home values and buyer eligibility. Want to explore your options or get clarity on what’s next? Contact the real estate or mortgage pro who shared this post—they’re here to help you move forward.

Frank’s Thoughts

Man, I loved seeing the Trump housing story. Whether or not you agree with his politics, the idea of cutting tariffs, fast-tracking zoning reforms, and even declaring a housing emergency shows real intention. That’s encouraging.

I also like the tone coming out of the job market reports. Things are cooling, but not crashing. That gives our clients the confidence to act—and gives us pros a chance to lead with clarity.

Also, I’m sharing a video from Tristan Ahumada, a guy I really respect. His updates are always insightful and worth listening to.

He covers a few other key headlines this week that tie in nicely with everything here. Give it a watch—he’s one of the best at breaking this stuff down in a way that makes sense.

Quote of the Day:

“People who think they know everything are a great annoyance to those of us who do.”

~ Isaac Asimov

Powered by: Mortgage Marketing Animals

Important Links

Share this:

September 2, 2025

New Home Prices Drop Below Existing Homes: Malibu Fire Sales & VantageScore 4.0

In an unexpected twist, new home prices are now less expensive than existing ones, flipping a long-standing trend and shaking up buyer dynamics. Meanwhile, luxury lots scorched by Malibu wildfires are hitting the market, offering both opportunity and concern. And in a notable credit shift, major private mortgage insurers have committed to implementing VantageScore 4.0 for loans backed by Fannie Mae and Freddie Mac. This week’s stories offer crucial insights into evolving new home prices, fire-driven real estate dynamics, and the changing credit landscape—all key signals for industry pros and clients alike.

New Home Prices Now Lower Than Existing Homes

Read the Full Story → [SAN]

For the first time in over a decade, new home prices have dropped below those of existing homes. According to Redfin, new construction homes are selling for about $3,000 less than existing homes nationwide.

This reversal is driven by builder incentives, including mortgage rate buy-downs, which are helping new builds stay competitive. Many existing homeowners are reluctant to sell due to their low locked-in mortgage rates, keeping inventory tight and prices high in the resale market.

Homebuilders have also ramped up construction in recent years, creating more inventory and allowing them to offer better deals—especially as they look to keep sales moving despite higher interest rates. The trend in new home prices could create a lasting shift in buyer preferences.

Malibu Wildfire Lots Hit the Market

Read the Full Story → [Realtor.com]

In the wake of the 2018 Woolsey Fire, numerous vacant residential lots in Malibu have come up for sale. These properties, previously home to luxury estates, are now being sold at a steep discount.

Interestingly, the sellers are a mix of longtime California homeowners and investors. Some owners have opted not to rebuild, either due to cost, age, or the emotional toll of the disaster. Others see the opportunity to cash out amid rising land values.

One developer, Mowbray, and a company called Zuru Tech have shown particular interest in acquiring these fire-damaged lots to introduce pre-fabricated luxury housing, signaling a new development model for high-end rebuilds.

USMI Members to Implement VantageScore 4.0

Read the Full Story → [Scotsmanguide]

The U.S. Mortgage Insurers (USMI) trade group announced that all its members are prepared to adopt VantageScore 4.0 for loans purchased by Fannie Mae and Freddie Mac.

VantageScore 4.0 includes more inclusive credit evaluation models, incorporating trended data and excluding some medical debt, which may benefit a broader range of borrowers.

The move aligns with FHFA’s push to diversify credit scoring options beyond the traditional FICO models and is expected to create a more equitable mortgage approval process, particularly for younger or credit-thin applicants.

Loan Officer Perspective

These stories present excellent talking points for loan officers looking to educate and engage clients. The trend in new home prices flipping below resale homes provides a strong case for promoting builder relationships and exploring incentives that benefit buyers. With VantageScore 4.0 in play, it’s also a good time to revisit credit education strategies with potential borrowers who may now qualify under the new scoring models.

Real Estate Agent Perspective

Agents can leverage this week’s news to guide both buyers and sellers. New home prices becoming more affordable than existing ones makes new builds a more viable option, particularly for first-time buyers. Meanwhile, Malibu’s land listings offer an intriguing angle for clients open to development or investment opportunities. These stories allow agents to demonstrate market insight and forward-thinking strategies.

Home Buyer & Seller Perspective

Buyers should know they may find better deals on new home prices than resales—a reversal that could change how they approach their home search. For sellers, especially in high-demand areas, this is a signal to price competitively. And with VantageScore 4.0 on the horizon, it’s worth checking in with your loan officer to see if qualification may have improved. Have questions or ready to start? Reach out to the real estate pro who shared this post with you!

Frank’s Thoughts

The Malibu story struck me. It’s not just about land sales—it’s about resilience, choices, and reinvention. Some homeowners are stepping away after the trauma of wildfire loss, while others are seizing the moment to build something new. It’s bittersweet but full of possibility.

What’s fascinating is how companies like Zuru Tech are looking to rebuild Malibu using prefab construction. It might not be the Malibu of old, but it could be a new model for luxury development that balances efficiency with style. Definitely worth keeping an eye on.

The larger lesson? Even out of destruction, opportunity can rise. As professionals, we can help guide people through these transitions—whether it’s rebuilding a dream home or finding a fresh start elsewhere.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

August 29, 2025

Off-Grid Living, Cannabis Debt, and Boomer Moves: August Mortgage Trends

The mortgage world is never boring, and this week is no exception. Our latest roundup highlights a surge in rural mortgage applications driven by a growing interest in Off Grid Living. Meanwhile, the cannabis sector is facing a wave of maturing debt with refinancing challenges ahead. Older buyers continue migrating to sunny states, and there’s a bright spot in affordability as homebuyer purchasing power improves. These stories shape the ever-evolving landscape of real estate and lending. Whether you’re advising clients or exploring market shifts, there’s something here to guide your next conversation.

Off Grid Living Gains Traction Among Homebuyers

Read the Full Story → Realtor.com

More Americans are ditching city life in favor of rural escapes and self-sufficient living. Mortgage applications for homes in remote locations have seen a notable uptick.

This trend is fueled by interest in solar panels, rainwater collection systems, and the allure of privacy and nature. The modern homestead isn’t just about chickens and crops—it’s a lifestyle pivot that’s catching on. Off Grid Living is no longer a fringe choice—it’s an emerging lifestyle.

Lenders are adapting by offering financing options tailored to unconventional properties. As borrowers pursue Off Grid Living dreams, loan officers and agents have an opportunity to guide them through this unique market.

Cannabis Sector Faces $6 Billion Debt Wave

Read the Full Story → MJBizDaily

Cannabis companies across the U.S. are staring down nearly $6 billion in debt set to mature by the end of 2026. Major players like Curaleaf, Ayr Wellness, and Trulieve are racing to refinance and restructure.

Tight credit conditions and a lack of federal banking reform complicate refinancing efforts. While some operators are pursuing sale-leasebacks or asset sales, others face potential default risks.

Real estate professionals should note that many cannabis operations are tied to commercial real estate. This financial pressure could spark movement in certain property types, especially in states with legal cannabis markets.

Older Buyers Are Heading to the Coasts

Read the Full Story → Realtor.com

Boomers are still on the move, and they’re heading for the coasts. California and Florida dominate the list of top destinations for older homeowners.

This demographic shift could influence everything from housing inventory to community planning. Coastal metros with warmer climates, health services, and recreational amenities are seeing a steady inflow.

Agents should consider the unique needs of older buyers—accessibility, HOA rules, and proximity to care facilities—when serving this growing client base.

Need Investor Funding? CLICK BELOW!

Homebuyer Purchasing Power on the Rise

Read the Full Story → Scotsman Guide

In July, homebuyer purchasing power improved as median monthly mortgage payments dropped from $2,172 to $2,127. That’s a 2.1% dip month-over-month, offering buyers a bit more breathing room.

While affordability remains a challenge, this marks the second consecutive month of positive movement. Lower mortgage rates and slightly higher income levels contributed to the change.

The Mortgage Bankers Association anticipates rates will hold steady in the 6.5% to 7% range through year-end, which could maintain this trend into fall.

Loan Officer Perspective

This week’s stories show opportunities in unexpected places. Whether it’s Off Grid Living lending or commercial loans tied to cannabis operators, being aware of niche markets can open new pipelines. The slight affordability gain is a perfect talking point for rekindling conversations with hesitant buyers.

Real Estate Agent Perspective

Aging buyers, alternative living, and debt-driven commercial activity are all market movements agents can leverage. Whether helping retirees relocate or helping buyers evaluate Off Grid Living properties, these trends present multiple angles to add value.

Home Buyer & Seller Perspective

If you’re dreaming of a quieter life through Off Grid Living or making a coastal retirement move, now’s a good time to explore your options. Lower mortgage payments in July may help stretch your budget. Want to see what’s possible? Reach out to the loan officer or real estate pro who shared this post.

Frank’s Thoughts

Who knew the cannabis industry and Off Grid Living had so much in common? Both are green, unconventional, and, well, kinda fun.

As Bill Murray once said, “I find it quite ironic that the most dangerous thing about weed is getting caught with it.” In real estate, sometimes the most interesting stories bloom where regulation and rebellion intersect. Keep an open mind and an eye on the fringe—that’s often where the cool stuff happens.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

August 28, 2025

Housing Accessibility Shifts: Legacy Gifts, Cash Trends, and Bilingual Breakthroughs

The housing market continues to evolve as affordability challenges, shifting demographics, and legacy-driven generosity reshape the landscape. This week’s focus keyword is housing accessibility—and each featured story speaks to how access is being won, lost, or redefined. From a Wisconsin landlord’s donation that expands affordable housing, to a bilingual training initiative combating HUD’s English-only policy, and from Zillow’s affordability insights to Miami’s all-cash dominance, we’re covering key movements that matter. Whether you’re advising clients or planning your next strategy, these developments point to both opportunity and urgency in expanding who gets to participate in homeownership.

Appleton Landlord Leaves Behind 20-Unit Legacy to Fight Homelessness

Read the Full Story → FOX11News

Richard “Dick” Reetz, a lifelong Appleton WI landlord, made a transformational gift upon his passing: he donated 10 rental properties—20 units in total—to the nonprofit Pillars to help combat homelessness. The gift increases the organization’s property portfolio by 26%.

Pillars plans to use the homes to house at least 40 individuals and families in need. The donation marks the nonprofit’s largest property addition since 2017 and aligns squarely with their mission to reduce homelessness through housing access.

Reetz’s legacy demonstrates how individual generosity can contribute significantly to housing accessibility at the local level—providing a model for impact through estate planning and community partnerships.

In Miami Luxury Real Estate, Cash Still Rules

Read the Full Story → Realtor.com

Miami’s high-end market remains one of the most cash-driven in the country. More than 50% of homes over $1 million are sold without financing, and for properties above $10 million, nearly 59% are all-cash transactions, according to new data from Realtor.com.

This trend is pushing prices higher and extending time on market, yet sellers are showing little fear. With minimal mortgage dependency, delisting is more common than price reductions. In July, 59 homes were delisted for every 100 new listings—far outpacing other major markets.

Global wealth continues to flow into Miami, buoyed by tax advantages and international appeal. This solid cash foundation creates a uniquely stable—if exclusive—real estate climate that reinforces housing accessibility for the ultra-wealthy while creating barriers for financed buyers.

Zillow: Affordable Listings Rise—But Real Affordability Still Lags

Read the Full Story → Zillow

In July 2025, Zillow reported that affordable home listings reached their highest count since August 2022, with roughly 439,000 homes qualifying as affordable to median-income buyers. That’s a 20% year-over-year increase, signaling a slight inventory recovery.

Still, only 31.7% of active listings are truly affordable, down from over 50% in 2020. While Midwest metros like Buffalo and Pittsburgh offer over 50% affordability, coastal cities like Los Angeles remain dire, with just 3% of listings falling within reach of the average buyer.

Zillow warns that significant affordability improvements will require large-scale policy changes or a major economic shift. For now, the modest gains in housing accessibility remain regionally dependent and highly uneven.

New Training Platform Empowers Spanish-Speaking Loan Officers.

Read the Full Story → Scotsman Guide

In response to HUD’s recent elimination of translated documents, the nonprofit HOME (Hispanic Organization of Mortgage Experts) has launched a bilingual training system for Spanish-speaking loan officers. The platform, HOME Certified, is designed to help diversify the industry and increase cultural accessibility for Hispanic borrowers.

The self-paced platform covers everything from credit analysis to compliance and is paired with an AI-powered search tool that matches borrowers with 150 wholesale lenders. HOME aims to close the representation gap—only 1% of loan officers today are Hispanic—and make homeownership more accessible for Spanish-speaking communities.

This initiative underscores how technology and education can play a major role in improving housing accessibility across underserved populations.

Loan Officer Perspective

Housing accessibility isn’t just a consumer issue—it’s a strategic opportunity. With affordable listings climbing and bilingual tools expanding, now’s the time to position yourself as an advocate and educator. Share updates on regional affordability and promote your ability to work with diverse client bases. New tools like HOME Certified show where the industry is headed: more inclusive, tech-enabled, and ready for growth.

Real Estate Agent Perspective

This week’s stories spotlight multiple ways to connect with clients: from affordable markets in the Midwest to luxury listings in Miami. Build relationships with landlords who may want to create legacy impact, like Dick Reetz. Educate clients on shifting affordability, and highlight your network’s reach—including trusted Spanish-speaking partners. The more you know about access issues, the more value you offer.

Home Buyer & Seller Perspective

Whether you’re entering the market or selling, housing accessibility affects your timeline, options, and financial strategy. More listings are affordable—but challenges remain. Sellers in hot markets can still hold firm, while buyers need strategic guidance to act confidently. That’s why your loan officer or agent is so valuable. Reach out today to discuss your next move or clarify what’s possible in your budget.

Frank’s Corner

Let’s take a breather from housing headlines and get weird—in a good way. Ever heard of Chocolate Salami? It’s a no-bake, slice-and-serve dessert that looks like salami but tastes like rich, fudgy heaven. This thing’s got cocoa, crushed cookies, and nuts—and it’s as fun to make as it is to eat.

Trust me: serve it at an open house and you’ll have buyers staying an extra 15 minutes just to ask for the recipe. No oven required. Just chill it, slice it, and enjoy the laughs. Curious? Check out the Chocolate Salami recipe here.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

August 27, 2025

Zillow Home Sales Forecast Predicts Price Dip as Market Braces for Next Mortgage Shift and AI Shakeups

The new Zillow Home Sales Forecast shows a modest price decline through 2025, giving buyers and sellers important signals about what’s ahead. Lenders are also being urged to prepare for future rate movement, while breaking developments in AI—from Musk’s lawsuit against Apple and OpenAI to YouTube’s behind-the-scenes video edits—are forcing conversations about transparency and tech. Whether you’re in lending, real estate, or just watching the market, this roundup keeps you informed and ready.

Zillow Home Sales Forecast Through 2025

Read the Full Story → Zillow Research

The latest Zillow Home Sales Forecast projects that U.S. home values will decline by 0.9% by the end of 2025, while existing home sales are expected to rise by approximately 0.6% compared to 2024. The report also shows rent growth slowing to 2.5%, down from 4.5% in 2024.

This points to a softening market shaped by affordability concerns and sustained high rates. It’s not a crash, but a signal of a slow, steady rebalancing that buyers, sellers, and real estate pros can work with.

For mortgage professionals and real estate agents, the Zillow Home Sales Forecast provides actionable insight to guide pricing, buyer conversations, and marketing strategies for the coming year.

4 Steps to Take Before the Next Mortgage Market Shift

Read the Full Story → HousingWire

The mortgage market is shifting again, and now is the time for lenders to prepare. The article recommends reviewing internal workflows and eliminating bottlenecks that could slow down loan volume when demand picks up.

It also emphasizes making the most of your existing tech. Training staff to fully use loan origination systems and automation tools can streamline operations without additional spending.

Lastly, it’s smart to assess vendor relationships and have backup financing channels ready. These steps help protect lenders and improve responsiveness in a changing rate environment.

xAI Sues Apple and OpenAI Over Alleged Antitrust Practices

Read the Full Story → Straight Arrow News

Elon Musk’s xAI is suing Apple and OpenAI, claiming Apple’s integration of ChatGPT into its platforms gives OpenAI unfair access to users while shutting out competitors like Grok, xAI’s chatbot.

The suit argues this behavior restricts innovation and violates antitrust laws. If successful, it could change how large tech platforms distribute AI tools and which companies get access to users.

For industries adopting AI—including real estate and lending—this case could influence future access to digital assistants, automation features, and consumer-facing tools.

YouTube Caught Quietly Altering Videos Using AI

Read the Full Story → Straight Arrow News

YouTube confirmed it has tested AI tools that modify video content—such as denoising and sharpening—without notifying the creators. The changes are non-destructive, but the lack of consent stirred backlash.

While YouTube insists it’s not generative AI, the controversy touches on transparency. Creators argue they should know exactly how their videos are being modified after upload.

In real estate, where video marketing is critical, this raises concerns. Agents and lenders should be transparent about AI enhancements in listing or promotional content to maintain trust and credibility.

Loan Officer Perspective

The Zillow Home Sales Forecast gives you a strong talking point with clients who’ve been waiting for better timing. A slight dip in values and flat rent growth could help hesitant buyers finally take action.

This is also a great time to improve back-end efficiency. Use this slower period to upgrade training, maximize your LOS features, and prep for volume increases when the rate environment shifts again.

The AI legal headlines may seem far removed, but many of your tools—from credit pulls to verifications—are using similar technologies. Clients appreciate transparency, so talk openly about how you use AI in your process.

Real Estate Agent Perspective

Use the Zillow Home Sales Forecast to set client expectations and provide strategic advice. A price dip doesn’t mean worry—it means buyers get a little more leverage and sellers need to price smart.

This is also a reminder to stay closely aligned with lenders who are upgrading their systems and staying agile. Faster, smoother financing creates better experiences and more referrals.

With AI being tested behind the scenes on platforms like YouTube, now’s a good time to audit your own media. If you’re enhancing listing photos or videos, be upfront with clients about what’s real and what’s retouched.

Home Buyer & Seller Perspective

The Zillow Home Sales Forecast shows a slight dip in prices and slower rent growth ahead. If you’re thinking about buying, this could be your moment. More favorable conditions and slightly more inventory might be coming your way.

Sellers should also stay sharp. Pricing based on up-to-date forecasts can help you move your home faster while avoiding prolonged listing times.

And as tech becomes a bigger part of home marketing, ask your agent or lender how they use AI. A little clarity goes a long way toward making smart, confident choices.

Frank’s Corner…

“One advantage of talking to yourself is that at least somebody’s listening…”

~ Franklin P. Jones

Powered by: Mortgage Marketing Animals

Important Links

Share this:

August 26, 2025

Farmers Insurance Data Breach and Mortgage Market Update: Sales, Delinquencies, and Security Risks

The recent Farmers Insurance data breach affecting over 1.1 million individuals highlights growing cybersecurity risks in financial services—just one of several important stories impacting the mortgage market this week.

We also cover new‑home sales trends showing surprising resilience and updated delinquency figures revealing both progress and ongoing FHA-related pressure. Whether you’re in lending, real estate, or looking to buy or sell, these stories offer timely insights—and we round it out with a fun “Just Because…” history fact you won’t want to miss.

Farmers Insurance Data Breach Affects Over 1.1 Million Customers

Read the Full Story → BleepingComputer

Farmers Insurance began notifying affected individuals on August 22, 2025, after discovering a cybersecurity breach tied to broader Salesforce-related attacks. The incident compromised sensitive data—including names, addresses, dates of birth, driver’s license numbers, and partial Social Security numbers—of 1,111,386 customers.

The breach is part of a coordinated mid‑2025 intrusion into Salesforce environments, which impacted numerous high‑profile companies across sectors such as insurance, technology, and consumer goods.

This incident underscores how vulnerable customer data can be when third-party systems are compromised. Mortgage and insurance professionals should proactively reassure clients, offering guidance on protective steps like fraud alerts, credit freezes, or monitoring services.

New Home Sales Show “Upside Surprise” but Remain Weak

Read the Full Story → (MPA)

In July, new single‑family home sales dipped 0.6% to an annualized rate of 652,000, yet the figure exceeded expectations—earning a label of “upside surprise” from First American deputy chief economist Odeta Kushi. June’s sales were revised sharply upward to 656,000, offering an upbeat twist amid the decline.

High mortgage rates remain a drag on demand, and affordability continues to challenge the market despite this temporary glimmer. Inventory levels remain elevated, and homebuilders are deploying incentives—such as rate buydowns and price cuts—to attract buyers.

This suggests nuanced opportunity: while overall demand is subdued, tactical incentives could make new home inventory more accessible in certain segments.

Mortgage Delinquency Rate Improves—but FHA Loans Still Strained

Read the Full Story → Scotsman Guide

July’s national mortgage delinquency rate (30+ days past due, not in foreclosure) fell 8 basis points month-over-month to 3.27%, a 9 basis point improvement year-over-year and 58 basis points below pre‑pandemic levels.

However, foreclosure starts edged higher—up 4.3% month-over-month and 7.6% year-over-year—and FHA loans remain disproportionately stressed. Though down 5 basis points month-over-month, FHA loan delinquencies remain 15 basis points above last year’s level and account for 52% of serious (90+ days) delinquencies.

Overall, serious delinquency volumes rose by about 30,000 year-over-year—the smallest uptick since November 2024—suggesting easing pressure from recent natural disasters. These trends point to encouraging borrower resilience, but also highlight ongoing risk hotspots in certain loan categories and segments.

Just Because…

First Televised MLB Game – August 26, 1939

On August 26, 1939, a quiet revolution unfolded at Ebbets Field in Brooklyn, New York. The Cincinnati Reds and the Brooklyn Dodgers played a doubleheader that day—not particularly notable in baseball history—except that it became the first Major League Baseball game ever televised.

The broadcast was handled by W2XBS, an experimental television station that would later become WNBC-TV, and only about 400 television sets existed in the New York area to receive the transmission.

The equipment was rudimentary by today’s standards. Two stationary cameras were used—one behind home plate and another along the third base line. The broadcast was short, black-and-white, and without the production elements we now take for granted—no instant replay, no graphics, no commentary overlays. Still, the novelty of watching a live baseball game from one’s living room was groundbreaking. For many who saw it, it must have felt like peering into the future.

This first televised game marked the beginning of a seismic shift in how Americans would consume sports and, eventually, all forms of entertainment. It set the stage for the massive media rights deals, multi-angle camera shots, and global fanbases we see today. Television didn’t just bring baseball to more people—it helped transform it into the national pastime.

More broadly, August 26, 1939, symbolizes how even modest beginnings can have monumental ripple effects. From a low-tech experiment watched by a few hundred, we now live in a world where every major game is streamed, analyzed, and celebrated in real-time by millions. It’s a testament to how innovation often starts quietly—before changing everything.

Loan Officer Perspective

The Farmers Insurance breach serves as a timely reminder for loan officers to proactively engage with clients about financial safety and identity protection. By offering support such as credit monitoring tips or partnering with services that safeguard client data, you can position yourself as a trustworthy advisor during uncertain times.

The news on new-home sales, while mixed, suggests some resilience in the market—especially where builders are offering incentives. This creates an opening for LOs to connect with buyers who may be on the fence due to affordability concerns.

Meanwhile, the gradual improvement in overall delinquency rates is encouraging and can help loan officers promote a more stable lending environment, while remaining mindful of FHA borrowers who may still be under stress.

Real Estate Agent Perspective

For real estate agents, the data breach story offers an opportunity to check in with clients—especially those involved in transactions that intersect with insurance—while reinforcing your role as a full-service, client-first advisor.

The sales data from July provides a useful talking point with both buyers and sellers: while the market remains tight, builder incentives and slight improvements in demand suggest pockets of opportunity. Agents can use this moment to spotlight listings where incentives apply or help clients understand how current market conditions may work in their favor.

With delinquency rates continuing to stabilize overall, you can also help reassure hesitant buyers and sellers that the housing market is not in decline but adjusting and becoming more balanced.

Home Buyer & Seller Perspective

For buyers, this week’s news underscores the importance of having a knowledgeable loan officer or agent by your side. A major insurance breach like the one at Farmers is a reminder that your financial safety should always be protected—and the right professionals can help guide you through every step with care.

If you’re considering a new home, builder incentives could make the difference in affordability right now, even with higher rates. For sellers, understanding how delinquency improvements and buyer behavior are evolving can help you price your home effectively and attract motivated purchasers.

If you have questions or want to explore your options, reach out to the loan officer or real estate agent who shared this post with you—they’re ready to help.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

August 25, 2025

Redfin CEO Sees Buyer Demand Rebounding in Next 6–9 Months

A wave of renewed buyer activity could be on the horizon, according to Redfin’s CEO—and timely developments in mortgage rates and regulatory debates may offer support.

Redfin CEO Glenn Kelman sees buyer demand returning to the housing market within the next six to nine months—a hopeful signal amid lingering affordability challenges. At the same time, housing analysts are flagging how upcoming mortgage rate shifts could reshape market dynamics in 2025.

Meanwhile, the Community Home Lenders of America (CHLA) is pushing back against a proposed Fannie Mae‑Freddie Mac merger, arguing that keeping the two GSEs separate preserves competition and protects smaller mortgage lenders. Together, these developments suggest a potential turning point in both housing demand and industry structure.

Redfin CEO Sees Buyer Demand Returning Within 6–9 Months

Glenn Kelman, CEO of Redfin, shared on CNBC that he expects homebuyer activity to bounce back in the next six to nine months, provided that mortgage rates ease and inventory stabilizes. He framed this as a potential relief for the sluggish pace seen earlier in 2025.

Despite elevated mortgage rates, Kelman’s optimism centers on a gradual normalization of market conditions—highlighting how sentiment can pivot quickly with appointment-level rate shifts or policy changes.

This outlook sets a hopeful tone for lenders and real estate professionals, suggesting the end of a prolonged buyer drought may be in sight.

Analyst: Mortgage Rate Shifts Could Reshape 2025 Housing Market

Read the Full Story → TheStreet

A housing analyst featured by TheStreet warns that even modest changes in mortgage rates could significantly alter the trajectory of the housing market in 2025. High rates have suppressed demand—and so any reduction, however incremental, might reignite purchasing activity.

The timing of these shifts appears critical. Analysts emphasize that markets are “feeling the squeeze” from rising home prices and elevated borrowing costs, implying that improved affordability could unlock pent‑up demand.

This aligns with Kelman’s timeline, suggesting that rate movements may not just underpin demand revival but could actively trigger it.

CHLA Pushes Back Against Proposed Fannie-Freddie Merger

Read the Full Story → Scotsman Guide

The Community Home Lenders of America (CHLA) issued a letter—postdated September 6—urging Treasury Secretary Bessent and FHFA Director Pulte to reject a proposed merger of Fannie Mae and Freddie Mac into a new entity dubbed the “Great American Mortgage Corporation.” CHLA argues that keeping the two GSEs separate is essential for preserving competition and protecting small and midsize independent mortgage banks (IMBs).

The association also calls on the GSEs to maintain the competitive cash window and G-fee parity—both of which benefit smaller lenders—and to continue support for diverse housing products, including those for manufactured homes, rural areas, and second homes.

CHLA’s push underscores industry tensions over how structural reforms in the secondary mortgage market could impact lending diversity and consumer access.

Loan Officer Perspective

- Be poised to serve returning buyer demand—prepare marketing strategies and borrower pre‑approvals now.

- Monitor policy developments around GSE structure—changes could impact product availability and fee structures.

- Emphasize competitive options if a merger moves forward; educate borrowers on how smaller lenders may offer advantages.

Real Estate Agent Perspective

- Anticipate increased buyer traffic toward autumn or winter—start engaging with potential clients early.

- Watch for shifts in buyer affordability—rate changes could spur urgency.

- Stay informed on lending environment developments, especially concerning Fannie and Freddie, to advise clients accurately.

Home Buyer & Seller Perspective

- Buyers: this could be a good time to get pre‑qualified and stay ready—if demand picks up, homes may move fast.

- Sellers: you might encounter more buyers in the months ahead—plan showings and pricing with that in mind.

- Questions? Reach out to the lending and real estate professionals who shared this post—they can help you align strategy with upcoming market changes.

Frank’s Thoughts

The Coconut and the Call

In 1943, a young John F. Kennedy, long before he became president, commanded a small PT boat in the Pacific. One night, his PT-109 was sliced in half by a Japanese destroyer. Two of his crew died instantly. The others were left clinging to wreckage in the dark waters.

Kennedy was only 26. He could have let fear win. Instead, he made a decision to lead. He swam miles through dangerous currents, towing a badly injured crew member by the strap of his life jacket clenched in his teeth. For nearly a week, he kept his crew alive on coconuts and rainwater, swimming again and again at night in search of help. Finally, he carved a message on a coconut shell and entrusted it to local islanders who brought it to Allied forces. That coconut shell became the lifeline that saved his men.

Years later, when John F. Kennedy was President of the United States, he kept that very coconut on his desk in the Oval Office. Not as a decoration, but as a reminder of what courage looks like when everything is on the line.

Now, let’s pause and think about this. Kennedy faced exhaustion, pain, hunger, and the possibility of death. He had every reason to give up—but he didn’t.

And here we are, staring at a phone. The “battle” we face is call reluctance. Fear that someone might say no. Fear that someone might not like what we say. Compared to towing a wounded man through shark-infested waters or leading a stranded crew with no food or shelter, that phone call is nothing.

This isn’t to minimize the real feelings that come with reluctance—we all feel them. But let’s keep perspective. What Kennedy endured was life and death. What we face is a moment of discomfort that could lead to opportunity, to new relationships, to saving a deal, to building a business.

If Kennedy could push past his fear in the middle of the Pacific, we can push past the fear of dialing a number. If he could etch words into a coconut and trust it would carry hope, we can trust that our calls carry value for the people on the other end.

That coconut sat on the President’s desk as a daily reminder: courage is doing the hard thing even when fear is present. For us, courage is picking up the phone and making the call.

So let’s be honest—making calls isn’t hard. Kennedy showed us what hard really looks like. Our calls are easy by comparison. And the results? They might just be the “coconut” that carries your business forward.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

August 22, 2025

Home Buyers Reality Check: Mortgage Rates, Fed Cuts, and the Staggering Wealth Gap

Not everyone is in a position to buy a home right now—and that’s completely okay. But for those who can afford to purchase and are simply waiting for a better deal, this post is your home buyers reality check—in the most encouraging way possible. Mortgage rates have already dropped to their lowest levels in nearly three years, with the expected Fed rate cut already priced in. Add to that the massive wealth gap between renters and homeowners, and it’s clear: this moment offers a powerful opportunity to build financial stability through homeownership.

Mortgage Rates & the Fed: Already Priced In

Many buyers are waiting on a Federal Reserve rate cut before making a move, thinking it will bring mortgage rates down. But here’s what most don’t realize—mortgage rates have already dropped in anticipation of that move. In fact, the bond market typically reacts weeks or even months before the Fed actually takes action.

As of now, mortgage rates are at their lowest point in nearly three years. That rally didn’t happen by accident—it’s the market pricing in what it believes the Fed is going to do. So, if you’re holding out for rates to drop after the Fed makes its move, you may already be too late.

This is why industry experts stress: today’s rates are the post-cut rates. The opportunity is here, not down the road.

Homeowners vs. Renters: The Wealth Gap in Numbers

The numbers speak for themselves:

- Median net worth:

- Homeowners: approximately $400,000

- Renters: just $10,400

→ That’s nearly 40 times more wealth for homeowners.

- Average net worth:

- Homeowners: about $1,530,900

- Renters: around $154,900

→ That’s 10× the wealth on average.

Research from the Urban Institute and other sources confirms this stark difference. Whether you look at median or mean net worth, owning a home is a major factor in long-term financial growth. The takeaway is clear: renting may be a short-term necessity, but ownership is the long-term strategy for wealth.

The longer someone delays homeownership, the longer they delay building equity and financial security.

Loan Officer Perspective

This is an ideal moment to guide buyers toward action. Rates have already responded to market expectations, and the data shows just how much financial advantage homeownership can offer. It’s a perfect opportunity to educate clients, dispel myths about Fed cuts, and get them pre-approved before demand rises again.

Real Estate Agent Perspective

For agents, this post arms you with talking points that combine urgency and value. Use it to overcome buyer hesitation, especially for those who are “waiting for rates to fall.” You can show them they’re already there—and back it up with data that proves buying now builds real wealth over time.

Home Buyer & Seller Perspective

If you’ve been waiting for the right moment to buy a home, this could be it. Mortgage rates have already hit their low point for this cycle, and homeowners are building significantly more wealth than renters every year.

This is your home buyers reality check—a friendly nudge that the market may already be in your favor. Reach out to your loan officer or real estate agent today and talk through your options. Whether you’re buying your first home or ready to move up, the time to act is now.

Frank’s Thoughts

I’m genuinely encouraged by what this data reveals. First, mortgage rates have rarely been this favorable—waiting for “just a little more” may cost more than it gains. Second, that wealth gap is a stark reminder: homeownership isn’t simply about having a place to live—it’s a potent path to financial security.

For consumers, this isn’t just advice—it’s empowerment. You’re not just buying walls; you’re building equity, stability, and long-term prosperity. For loan officers and agents, these stats give you substance—build trust, prompt action, and serve real value to clients.

These gains don’t happen overnight. But they start with one decision—and that decision could be made today.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

August 21, 2025

Zillow Revises Price Forecast, Buffett Bets on Builders, Housing Starts Rise—and a Must-Read for Moving Families

Zillow’s updated forecast, Buffett bets on builders, and a fresh housing starts report paint an optimistic picture for the second half of 2025. Meanwhile, a compelling AP article highlights how moves affect children, offering a valuable resource for professionals and families alike. In this roundup, mortgage and real estate pros will find timely insights and actionable angles that both inform and inspire.

Zillow Nudges Forecast into Positive Territory

Read the Full Story → Fast Company

Zillow has adjusted its U.S. home price forecast upward, now projecting a 0.4% gain through July 2026. This marks a notable shift from its previous expectation of a 1.7% decline issued just a few months earlier.

The revision comes as affordability improves modestly and buyer activity shows signs of stabilization. Stronger local price trends in markets with greater housing supply also influenced the new forecast.

While the change is modest, it reflects a broader trend of cautious optimism as the market adjusts to persistent economic pressures and inventory dynamics.

Buffett Bets on Builders with $1 Billion Investment

Read the Full Story → Realtor.com

Warren Buffett’s Berkshire Hathaway has made a bold move, investing over $1 billion in three of the nation’s largest homebuilders: D.R. Horton, Lennar, and NVR. The investments signal confidence in the long-term strength of the U.S. housing market.

Despite ongoing affordability challenges and cautious consumer sentiment, Buffett’s team is betting on the continued demand for housing and the ability of these companies to profit through new supply.

This high-profile move is already generating buzz and could boost sentiment among developers, investors, and housing professionals alike.

Housing Starts Up in July, Showing Builder Resilience

Read the Full Story → Realtor.com

New residential construction is showing signs of strength. U.S. single-family housing starts increased by 2.8% in July, reaching a seasonally adjusted annual rate of 939,000 units.

This marks a positive continuation of gradual growth in the construction sector, despite higher interest rates and tighter lending conditions. Builders are responding to demand and preparing for future buyer activity.

Regionally, the South led the way, while other areas showed more modest gains. The data suggests that homebuilders remain cautiously optimistic heading into fall.

Moving with Kids: Understanding the Emotional Impact

Read the Full Story → AP News

Moving is consistently ranked as one of life’s most stressful events, and for children, the emotional impact can be even greater. Changes in environment, routine, and school can trigger anxiety and behavioral shifts.

The article highlights advice from child development experts on how to help kids cope. Key strategies include open communication, maintaining routines, and giving children a sense of control in the process.

A recommended children’s book, Freeda the Frog Is on the Move, provides an approachable way for families to ease the transition. It’s a thoughtful tool for agents and loan officers to share with relocating clients.

Loan Officer Perspective

- Regarding the Zillow story, “eh, so what…”—yet knowing even a slight tilt upward helps keep us well‑rounded and informed as professionals in the market.

- Buffett investing in homebuilders? That’s a clear signal we all understand—if the Oracle of Omaha is betting big, there’s confidence in future housing strength.

- Housing starts rising is always comforting news—it means supply is responding, which steady minds appreciate.

- And the AP story? Absolutely great to have handy. It’s useful for realtors and loan officers to share with clients, and for parents going through a move—it shows you care about more than the deal.

Real Estate Agent Perspective

Zillow’s soft bump in pricing supports stable listing strategies. Buffett’s billion-dollar move reinforces confidence in the industry—use it as proof of market strength in client conversations. Housing starts on the rise means more inventory soon, and the AP story is a powerful piece to provide added emotional value to families with children considering a move.

Home Buyer & Seller Perspective

The market is showing signs of stability, and even industry giants like Warren Buffett are betting on housing. Builders are picking up activity, which may bring more options for buyers.

If you’re planning a move with kids, take a moment to read the AP article—then connect with the loan officer or agent who shared this post to talk through your next steps.

Frank’s Thoughts

Zillow’s forecast shift? Nothing groundbreaking, but it’s the kind of industry tidbit that helps us stay sharp and informed. It’s not the headline of the year, but good background knowledge for everyday conversations.

Buffett’s move into homebuilders? That’s the real headliner here. You don’t drop a billion dollars into housing unless you’re confident about where it’s going. For all of us on the front lines, it’s a major vote of confidence.

Housing starts are always worth tracking—supply is key to everything we do. And that AP story? Love it. It’s something we can genuinely share with clients to help their families—not just their finances.

Powered by: Mortgage Marketing Animals

Important Links