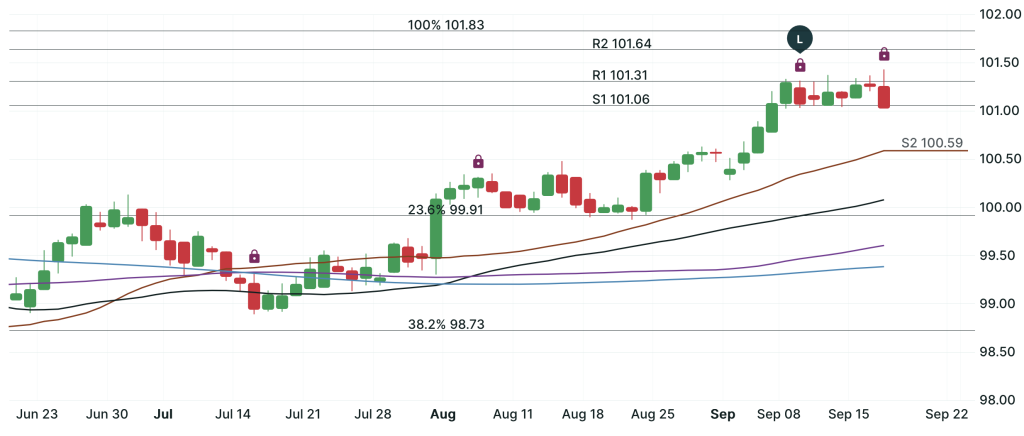

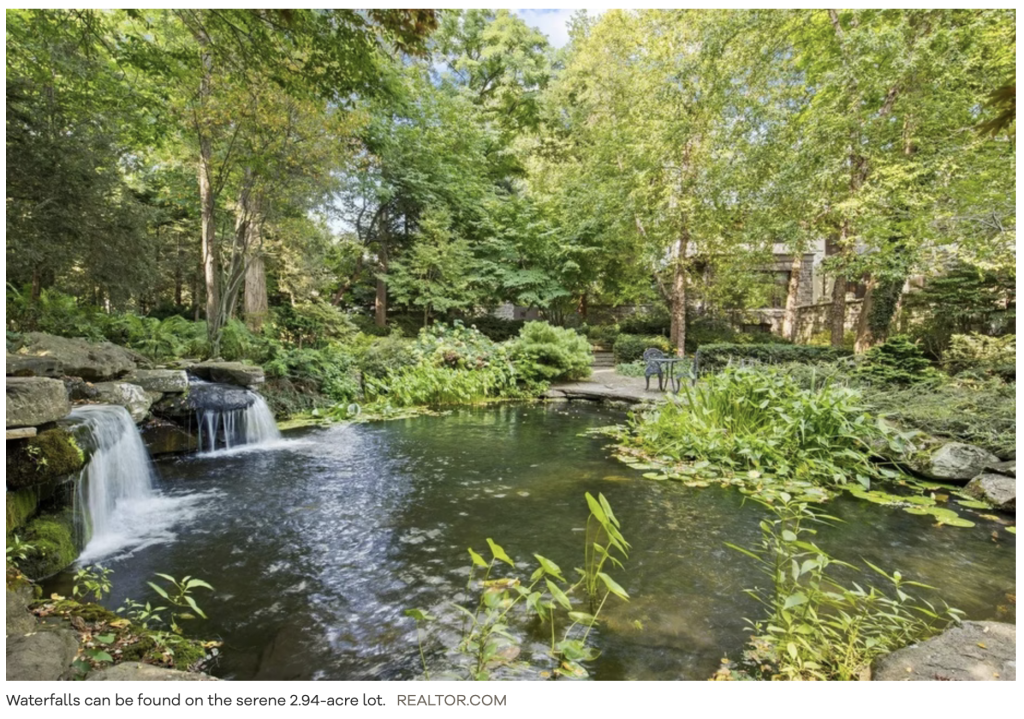

The long-awaited rate cut is here. This week, the Federal Reserve issued its first rate cut of 2025, finally lowering the federal funds rate after holding steady for months. However, mortgage professionals weren’t shocked when mortgage rates didn’t follow the script—in fact, they ticked up slightly, prompting a “Lock Alert” from MBS Highway. Zillow’s latest data shows sellers pulling back and price reductions rising, potentially hinting at a shift toward a new seller’s market in early 2026. And in luxury news, a historic Tudor mansion hits the market, showing that unique properties continue to defy broader market trends.

Fed Announces First Rate Cut of 2025

Read the Full Story → MPA

After holding rates steady since late 2024, the Federal Reserve has finally made a move, cutting the benchmark rate by 25 basis points to a range of 4.00% to 4.25%. The decision comes amid signs of a cooling labor market and inflation that remains above target but has moderated.

While the Fed’s decision typically signals potential relief for mortgage borrowers, rates actually bumped up slightly after the announcement. This reaction prompted a “Lock Alert” from MBS Highway, reminding professionals that mortgage rates often respond more to bond market activity than Fed headlines.

The Fed’s own projections suggest more cuts may be on the horizon, but the central bank remains cautious. One member even pushed for a larger cut now, citing the need to stay ahead of economic slowdown. For now, professionals are watching closely as the market digests this first move.

Zillow Data Shows Sellers Retreating

Read the Full Story → Zillow Research

Zillow’s August 2025 Market Report shows that more than 27% of active listings had price cuts—the highest rate since they began tracking in 2018. At the same time, homes are taking longer to sell, and inventory is increasing as new listings slow and some sellers pull their homes entirely.

Realtor.com data backs this up with a year-over-year spike in delistings of over 57%, pointing to a growing trend of seller hesitation. Many homeowners appear to be testing the market only to back out when they don’t get the offers they hoped for.

The mix of higher inventory and retreating sellers suggests the market could be brewing a new kind of seller’s market—especially if mortgage rates ease and buyer demand returns in 2026. But for now, many buyers are holding back, watching both rates and inventory carefully.

Bausch & Lomb Heiress Lists Tudor Mansion

Read the Full Story → Realtor.com

A piece of Rochester history is up for grabs as the former home of a Bausch & Lomb heiress hits the market. The Tudor-style estate, known as “Twin Gables,” spans over 9,300 square feet and combines vintage charm with thoughtful updates.

Listed at $3.4 million, the home features original woodwork, intricate brick details, and spacious grounds. It’s the kind of luxury listing that tells a story—something unique-home buyers crave, even in shifting markets.

While this listing might not reflect national trends, it’s a reminder that high-end homes with character often march to the beat of their own drum. For the right buyer, this one’s a gem.

Loan Officer Perspective

Loan officers should view the rate cut as both a market update and a client conversation starter. Even though mortgage rates didn’t drop as some consumers hoped, this is an opportunity to educate clients on why that happens and what to expect going forward. The “Lock Alert” proves how nuanced rate movements can be.

As more sellers reduce prices or leave the market, buyers may find better opportunities—if they’re ready. A well-timed lock or float decision could make a big difference. Lean into your advisory role now and be ready with tools like MBS Highway to guide your borrowers confidently.

Also, don’t sleep on unique homes. High-end buyers may still be active, especially when rates improve. Having a pulse on these listings can help you stand out.

Real Estate Agent Perspective

Agents, this is a key moment to revisit pricing strategies with sellers. As Zillow reports more price cuts and delistings, setting the right list price from the start is crucial. Educate your clients early to prevent frustration later.

For buyers, the shifting inventory offers more choice and potential leverage. It may not feel like a buyer’s market yet, but we’re seeing more balance—especially in markets where inventory is rising faster than sales.

Unique homes like the Tudor mansion remind us that storytelling sells. Luxury buyers want a narrative, not just a floor plan. If you’re listing a standout property, make sure the marketing lives up to the home.

Home Buyer & Seller Perspective

Buyers may have heard about the Fed’s rate cut and expected big savings, only to learn that mortgage rates didn’t move as hoped. That’s normal—mortgage rates often lag behind. The good news? Most forecasts still expect rates to improve through 2025 and into 2026.

If you’re considering buying, this could be a window to prepare—especially with price reductions increasing and sellers growing more flexible. Sellers, meanwhile, need to be realistic: price it right, stage it well, and move fast before more competition returns.

Not sure what your next move should be? Reach out to the loan officer or real estate agent who shared this post with you—they’ll help you game-plan your next step.

Frank’s Thoughts

Even though the Fed finally cut rates, mortgage rates didn’t play along—and that’s no surprise for those of us in the trenches. Clients will call, texts will fly, but it’s just part of the ride. Our job is to help them understand the difference between headlines and real-life loan pricing.

I think we’re still on track for more meaningful mortgage rate improvements by the end of the year and into 2026. That, coupled with sellers pulling back, could tighten up supply and create a whole new seller’s market early next year.

And that mansion? Man, I might dump some crypto and make my way to Rochester! It’s a great example of how luxury properties can still steal the show—especially when they’ve got style, history, and solid value. Somebody’s gonna scoop that one up fast.

Powered by: Mortgage Marketing Animals

Important Links