Rising rates are once again shaping the mortgage and housing conversation as we enter October. Paired with FICO’s announcement of new alternative pricing models and a surprising trend in Starbucks store closures, the real estate industry faces both fresh challenges and new opportunities. While buyers react to shifting affordability, lenders and agents can use this moment to sharpen their messaging and strategies. From macro finance to neighborhood coffee shops, these stories connect to one larger theme: change is here, and those who stay informed will thrive.

Mortgage Rates Climb for Second Straight Week

Read the Full Story → SAN

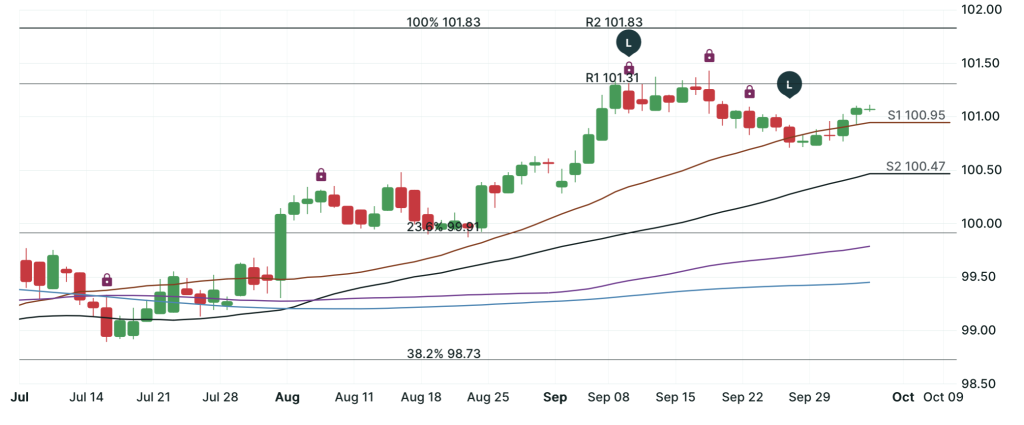

Freddie Mac’s latest report shows the average 30-year fixed mortgage rate has climbed to 6.34%, with the 15-year fixed now at 5.55%. While still below last year’s peak, this marks the second consecutive week of increases.

Mortgage applications have dropped significantly, falling 12.7% in just one week—suggesting buyers are responding quickly to even slight rate fluctuations.

Experts say volatility may continue as markets respond to broader economic data. Investors are watching inflation and Fed policy closely, with many unsure where rates will land in Q4.

MBA Reacts to FICO’s New Alternative Pricing Models

Read the Full Story → MBA

FICO’s new pricing models aim to make mortgage credit access more equitable by using alternative data and refined risk tiers.

The Mortgage Bankers Association welcomed the move with cautious optimism, urging validation and transparency as lenders consider these tools.

These models could offer borrowers with less traditional credit histories better pricing—but widespread adoption will depend on regulatory clarity and industry alignment.

Starbucks Store Closures & Local Property Value Implications

Read the Full Story → Realtor.com

Starbucks has begun shuttering hundreds of locations nationwide, focusing on store performance and shifting consumer habits.

In some communities, the closure of a Starbucks can signal declining walkability or neighborhood appeal—both of which can affect residential property values.

Real estate experts caution that while the closures aren’t inherently bad news, empty retail spaces must be quickly repurposed to avoid negative knock-on effects.

Loan Officer Perspective

The conversation around rising rates is a chance to show leadership. Educate clients on timing strategies, rate lock options, and programs that provide payment relief in a higher-rate environment. Be proactive—reaching out before they panic means they see you as the solution, not just a vendor.

FICO’s changes could be a game-changer for underserved borrowers. If you work with clients who are on the edge of qualifying, start following how your lenders adapt to these models. Staying ahead of the curve could open doors for buyers who previously didn’t have a shot.

Lastly, don’t sleep on the Starbucks closures. For condo buyers or urban clients, a disappearing coffee shop could mean more than caffeine—it may reflect larger economic shifts in that neighborhood. Keep an eye out and use it as a conversation starter.

Real Estate Agent Perspective

This week’s rising rates news doesn’t have to be a deal killer. It’s a chance to coach buyers through affordability tactics or help sellers understand the urgency buyers may feel. The more you inform, the more you build trust.

FICO’s new pricing models are exciting because they may expand the pool of pre-approved buyers. Partner with lenders who understand these shifts and can guide your clients through the evolving credit landscape.

As for the Starbucks story—it’s more than just a frappuccino loss. It signals opportunity. Use closures as a reason to spotlight upcoming development or highlight thriving local businesses. Buyers want to know what’s next, not just what’s gone.

Home Buyer & Seller Perspective

Rising rates may feel intimidating, but they don’t mean the window has closed. They do make it more important to get pre-approved and know your numbers before shopping. If you’re ready, now is still a good time—especially if you work with a pro who understands rate timing.

If you’re selling, the rate narrative can work in your favor. Buyers may feel pressure to act quickly before financing costs go higher. Highlight your home’s affordability and neighborhood strengths to stay competitive.

Concerned about a Starbucks closing nearby? You’re not alone. But one store doesn’t define a neighborhood. Talk to your agent or loan officer about what’s happening in the area. New businesses often fill the gap quickly. If you have questions or want to explore your next steps, reach out to the professional who shared this post with you.

Powered by: Mortgage Marketing Animals

Important Links