This week’s mortgage and housing news centers on access, insight, and market flow. The FHFA’s approval of VantageScore for Fannie/Freddie underwriting opens the credit door to millions of new borrowers. Industry icon Barry Habib is set to join Loan Officer Breakfast Club with top-tier market and sales insight. Meanwhile, small-scale real estate investors are stepping in to support home sales, and property tax revenues continue rising—even as they shrink as a share of local funding. For mortgage and real estate pros, this week’s stories offer fresh ways to grow and serve.

VantageScore Now Accepted for Mortgages Backed by Fannie & Freddie

Read the Full Story → Yahoo Finance

The Federal Housing Finance Agency (FHFA) has officially approved the use of VantageScore 4.0 in underwriting loans for Fannie Mae and Freddie Mac. This move introduces competition into the credit scoring space, long dominated by FICO.

This shift benefits potential borrowers who lack traditional credit profiles, such as renters and younger adults with consistent payment records but thin credit files. By incorporating rent, utility, and telecom payments, VantageScore may qualify millions more buyers.

According to analysts, this could unlock up to $1 trillion in new lending opportunity, creating ripple effects for lenders, agents, and housing markets eager for demand.

Barry Habib Joins Loan Officer Breakfast Club Sept 30

Join the Live Call → LOBC

Legendary mortgage market forecaster Barry Habib is set to appear live on Loan Officer Breakfast Club this Tuesday, Sept 30 at 8:30am ET. Habib, a frequent CNBC guest and the founder of MBS Highway, brings decades of award-winning insights into housing and finance.

This session promises a blend of industry forecasts, sales tips, and mindset strategies—tailored to loan officers navigating today’s evolving market. His guidance on rate trends, scripting, and personal branding has proven invaluable to originators across the U.S.

Professionals can join live at breakfastclubzoom.com Early-morning inspiration, strategy, and community—served daily with your coffee.

Real Estate Investors Are Keeping Markets Afloat

Read the Full Story → Scotsman Guide

As traditional homebuyer activity softens, investors are taking up more market share. Investors made 26% of all single-family purchases earlier this year, with smaller landlords dominating the segment.

Roughly 87% of investor-owned homes are held by those with five properties or fewer—dispelling myths of “corporate landlords” dominating local markets. Many are buy-and-hold investors, helping to meet ongoing rental demand.

While some fear displacement, the presence of investor activity is helping sustain home sales volume in many metro areas. This is particularly crucial in a high-rate, low-affordability environment.

Property Tax Revenues Rise, But Play Smaller Role

Read the Full Story → NAHB

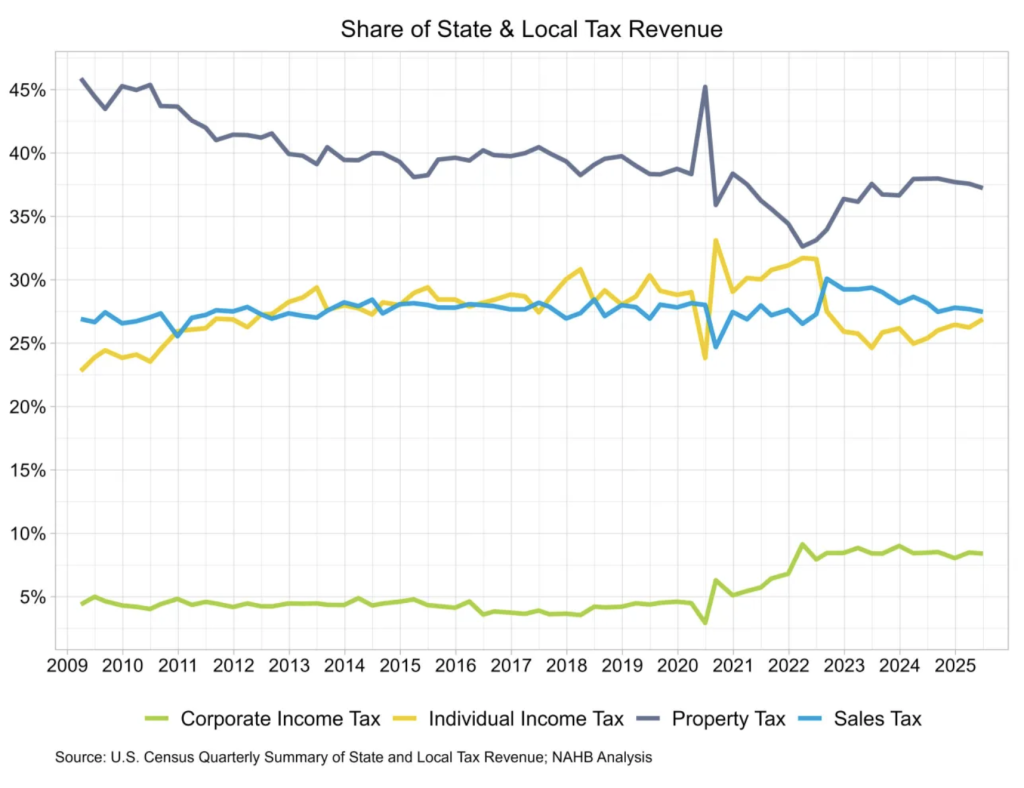

State and local governments collected $203.4 billion in property tax revenue in Q2 2025—a modest 0.7% bump from the prior quarter.

However, as a share of total tax revenues, property taxes fell to 37.2%, the third straight quarterly decline. This reflects the faster growth of other tax streams like income and corporate taxes.

Even with rising real estate valuations, broader tax diversification means local governments are becoming less dependent on property taxes. That could shape future budgeting, zoning, and homeowner costs in nuanced ways.

Loan Officer Perspective

- The VantageScore news is massive: it creates an opening for loan officers to serve credit-invisible or underbanked clients. Start marketing to renters and gig workers who now stand a better chance.

- Barry Habib’s upcoming LOBC session is a can’t-miss. His forecasts and scripting advice help sharpen your messaging and market strategy—especially in a rate-sensitive climate.

- With investor demand staying strong, offer financing solutions that meet their needs—DSCR, bank statement loans, or portfolio options can open new pipelines.

Real Estate Agent Perspective

- The FHFA’s VantageScore ruling means more clients might now qualify, especially those previously dismissed due to “no score.” Work closely with lenders to re-engage old leads.

- Promote Barry Habib’s LOBC appearance to your mortgage partners—it’s a great opportunity to align messaging and strategy.

- Investor presence means listing agents should think beyond retail buyers—what’s appealing to a landlord, a flipper, or a short-term rental operator?

Buyer & Seller Perspective

- If you’ve been told you “don’t have enough credit,” VantageScore might change that. New rules allow rent and utility data to help qualify you for a home loan.

- Sellers should understand investors are a big part of today’s demand. If your home isn’t selling fast, pricing for investor appeal might unlock a sale.

- Want to explore your eligibility or market strategy? Reach out to the mortgage pro or real estate agent who shared this post—they can walk you through next steps.

Powered by: Mortgage Marketing Animals

Important Links