The mortgage industry is buzzing after a major political move—White House Budget Director wants the CFPB gone. That’s just one of several impactful developments this week. We’re also watching President Trump’s latest executive orders that could reshape the FHFA’s housing policy, and new data from Zillow shows rents are still sliding across the country. From regulatory shakeups to rental trends, here’s what mortgage and real estate pros need to know now. This week’s focus keyword: CFPB.

White House Budget Director Aims to Shut Down the CFPB

Read the Full Story → Scotsmanguide

A major headline emerged this week as the White House Budget Director announced his desire to eliminate the Consumer Financial Protection Bureau (CFPB). The bold move signals a potential shift in how consumer protections are managed in the mortgage and financial sectors.

His argument? The agency is unconstitutional and an overreach. He believes consumer protections should fall under the purview of the Federal Trade Commission (FTC), which has a multi-member leadership and is accountable to Congress.

The CFPB was created in the aftermath of the 2008 financial crisis and has been a lightning rod ever since. Supporters argue it plays a vital role in preventing predatory lending. If it’s shut down, we may see a rollback to pre-2008 regulatory conditions.

Join the Daily LOBC Live Call

Each weekday morning, top-producing mortgage pros hop on Zoom to sharpen their edge—and you can too. The LOBC Daily Live Call runs Monday through Friday, 8:30–9:00 AM ET, delivering actionable insights, scripts, and strategies you can use immediately.

Led by industry veterans and guest speakers, these sessions are focused, fast-paced, and packed with value. Whether you’re looking to refine your marketing, navigate rate environments, or sharpen your scripting, this free call is a must-attend.

Bring your coffee, your questions, and your curiosity. You’ll leave each day more prepared than the last. Click the live stream image to join the call.

Trump Executive Orders Reshape FHFA Housing Strategy

Read the Full Story → Scotsmanguide

President Trump is once again shaking up the housing conversation. A new wave of executive orders outlines a sweeping strategy to reorient the Federal Housing Finance Agency’s (FHFA) direction.

The plan includes a rollback of affordability mandates and a renewed push to privatize Fannie Mae and Freddie Mac. Critics say this could reduce access to affordable housing, while proponents argue it would reduce government risk and create a more competitive market.

For now, these orders set the tone for the 2025 campaign trail—but if implemented, they could have long-term consequences on housing finance as we know it.

Zillow Reports Rents Dropped Again in September

Read the Full Story → Zillow

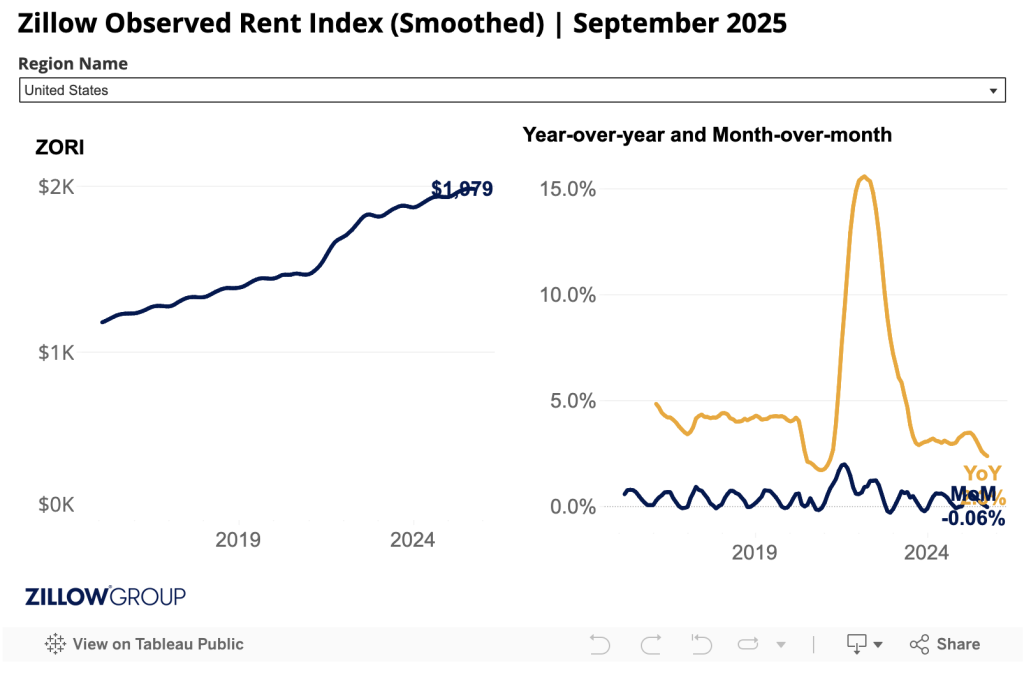

Zillow’s latest Rent Report for September 2025 shows a continued national decline in rental prices, now marking the fifth consecutive month of downward movement. Median rent is down 0.6% month-over-month and 1.2% from this time last year.

Sun Belt cities saw the biggest drops, with places like Austin and Phoenix leading the decline. Meanwhile, rental demand remains soft due to high home affordability issues and a robust pipeline of multifamily completions hitting the market.

While lower rents may make renting more attractive short-term, buyers concerned about future rent hikes or looking for stability may still consider homeownership as a long-term solution—especially with rising inventory and softening prices in some markets.

Loan Officer Perspective

Loan officers should keep an eye on regulatory changes like the potential CFPB closure and the FHFA policy shifts. These stories aren’t just headlines—they could directly impact how you do business. Stay informed and proactive with clients who might have concerns.

The rental market story is also an opportunity. As rents slide, you can reframe homeownership as a path to long-term financial stability. Educate your database with data-driven messaging about why now might be the time to act.

And don’t forget—calls like the LOBC Daily Live Call give you a community and a knowledge edge. Plug in and keep leveling up.

Real Estate Agent Perspective

If the CFPB is dismantled or FHFA direction changes, mortgage products and consumer confidence could shift. Stay connected with your lending partners to anticipate changes and advise clients wisely.

Falling rents may delay some renters from entering the buyer pool, but it’s a perfect time to focus on educating potential buyers about long-term equity and stability. Partner with lenders to craft strong rent-vs-own messaging.

Also, use these stories in your weekly client updates. Educating your audience positions you as the go-to market expert.

Home Buyer & Seller Perspective

This week’s news underscores why staying informed matters. If the CFPB were shut down, consumer protections could look very different. Buyers and sellers should work with professionals who stay on top of these changes.

For renters seeing lower prices, now might be a good time to save or reconsider timing—but also weigh the long-term benefits of owning a home in markets where buying is becoming more feasible.

Have questions or want to talk through your next steps? Contact the loan officer or real estate agent who shared this post. They’re here to help.

Frank’s Thoughts

Let’s be clear: removing the CFPB entirely wouldn’t be a win for loan officers. The agency may have its flaws, but it also brought clarity and structure after the chaos of 2008. Without it, we risk reverting to a messy, pre-crisis regulatory landscape.

Many forget that before the CFPB, the patchwork of rules we had was not only inconsistent—it was hostile to originators. Enforcement varied wildly, and loan officers were often the ones caught in the crossfire.

Rather than scrapping the CFPB, let’s talk about smart reform. Change the parts that need fixing, but don’t throw the whole thing away. A better path forward protects both consumers and professionals.

Powered by: Mortgage Marketing Animals

Important Links