December 19, 2025

2025 Market Report: Housing, Inflation, and Policy Moves

The 2025 Market Report reveals important signals for mortgage and real estate professionals as economic and policy forces shift heading into 2026. Zillow’s latest comprehensive housing data underscores inventory gains and price patterns, the November CPI inflation report shows cooling inflation trends with implications for rates and affordability, and a major bipartisan housing bill has advanced in Congress, aiming to expand supply and improve housing policy. Here’s what to know from the latest housing data, inflation context, and legislative momentum in the 2025 Market Report.

Zillow’s 2025 Market Report: Inventory & Price Dynamics

Zillow’s November 2025 market data shows that U.S. housing inventory has continued rising, marking sustained supply growth amid changing buyer activity. Inventory is up year‑over‑year, even as active listings growth slows and time on the market extends slightly compared with recent years. Sellers and buyers are navigating a landscape where inventory has improved relative to pandemic lows but still remains tight by historical standards.

National price trends show modest shifts, with some markets experiencing slight price dips and others holding steady as affordability pressures persist. The report also highlights how these dynamics vary regionally, with the West and South leading in inventory gains while some Northeast and Midwest metros show slower growth.

This nuanced interplay between supply and pricing reflects a market adapting to elevated mortgage rates and shifting buyer preferences.

CPI & Inflation Context Impacting the 2025 Market Report

The latest inflation data through November 2025 shows that headline consumer prices rose about 2.7% year‑over‑year, lower than many economists expected and suggesting a moderation in price pressures. Core inflation also decelerated, offering signs that inflationary momentum may be cooling.

While inflation remains above the Federal Reserve’s 2% target, the slower pace could influence the central bank’s policy decisions early next year. A more moderate inflation trajectory—especially in sectors like shelter—could improve affordability over time and shape expectations for interest rate movements, impacting mortgage demand.

The delayed release of CPI data due to a lengthy government shutdown has complicated comparisons, but year‑over‑year figures offer meaningful context for how inflation intersects with housing costs and consumer choice.

Bipartisan Housing Bill Advances Amid 2025 Market Report Trends

Amid these economic trends, a major bipartisan housing bill moved through the House Financial Services Committee, signaling legislative momentum to address housing supply constraints and affordability. This bipartisan package aims to modernize federal housing programs, streamline regulatory barriers, and expand financing options for development projects.

The bill’s provisions include updates to FHA multifamily loan limits, streamlined financing for rural housing, and efforts to reduce construction barriers. This aligns with themes in the 2025 Market Report that highlight ongoing supply challenges and the need for long‑term policy solutions.

Industry stakeholders see the bill as a critical step toward unlocking supply, improving affordability, and preparing the market for future demand—especially as mortgage rates and inflation trends remain key factors for buyers and sellers.

Loan Officer Perspective

For loan officers, the 2025 Market Report offers valuable insights into current market conditions. Rising inventory and moderating price trends point to opportunities for buyers who might find increased options, while evolving inflation dynamics could affect borrower purchasing power and interest rate expectations. Staying informed on how legislative efforts may reshape housing policy will help loan officers guide clients through eligibility, financing options, and timing decisions in early 2026.

Real Estate Agent Perspective

Real estate agents can leverage insights from the 2025 Market Report to better counsel clients on market conditions. Understanding inventory shifts, regional variations, and inflation’s influence on buyer affordability are key to pricing and marketing strategies. Additionally, agents who keep abreast of bipartisan housing policy developments can position themselves as trusted advisors on how future regulations may impact housing supply, local market opportunity, and longer‑term affordability.

Source Links

Zillow | Realtor.com | Scotsman Guide

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 18, 2025

Drop Tri‑Merge: MBA Pushes Credit Reform as Mortgage Activity Shifts

This week’s housing and mortgage news spotlights the drop tri-merge debate as the Mortgage Bankers Association (MBA) intensifies its push to overhaul the outdated tri‑merge credit report requirement used for government‑sponsored enterprise (GSE) loans. Alongside this policy fight, mortgage application volume showed a downward trend in the latest MBA weekly data, and the broader U.S. job market is showing signs of slowing—factors that all intersect with credit access and housing demand. Here’s what mortgage and finance professionals should understand about these developments and what they could signal for early 2026.

MBA’s Call to Drop Tri‑Merge Mandate

The Mortgage Bankers Association is urging the Federal Housing Finance Agency to drop tri‑merge credit score requirements for loans sold to Fannie Mae and Freddie Mac, calling the three‑bureau credit pull system outdated, costly, and anticompetitive.

MBA leaders argue the mandatory use of tri‑merge reports drives up credit report costs year after year, with little added value compared to single‑report models in other areas of consumer finance. They contend that simplifying the credit data requirements could lower lender costs, increase competition among bureaus, and ultimately benefit borrowers.

This move aligns with broader industry trends toward modernizing underwriting processes and reducing operational friction in mortgage lending.

Mortgage Applications Dip in Latest MBA Weekly Survey

Mortgage application activity declined for the week ending December 12, with the MBA’s Market Composite Index down roughly 3.8%. Both refinance and purchase applications saw declines—refinances by about 4% and purchases by around 3%.

These drops reflect continued rate sensitivity and seasonal slowdowns, though purchase demand remains higher year‑over‑year. Volatility has been common throughout the latter half of 2025 as borrowers respond quickly to changing rate environments.

These figures serve as a reminder that originators need to remain agile, adjusting strategies to meet shifting borrower sentiment and economic realities.

Job Market Shows Signs of Cooling

Recent employment data shows that job growth is slowing, with fewer new jobs added in November and previous months’ gains being revised downward. The unemployment rate has ticked slightly higher, suggesting a gradual cooling in the labor market.

This trend could dampen consumer confidence heading into 2026, especially among would‑be homebuyers considering long‑term financial commitments. However, slower job growth could also ease inflation pressures and encourage the Federal Reserve to lower rates sooner, which would support future mortgage activity.

As always, the connection between jobs and housing remains vital—what happens on the employment front can ripple quickly into the real estate market.

Loan Officer Perspective

Loan officers should take note of the MBA’s efforts to drop tri-merge as a signal that credit access reform is gaining traction. If adopted, these changes could streamline the application process, reduce borrower costs, and make approvals more predictable—potentially unlocking more business. Additionally, monitoring job market cooling and rate movements will be key for timing outreach and helping clients navigate both purchase and refinance opportunities.

Real Estate Agent Perspective

Real estate agents can benefit from staying informed on credit and economic policy updates, especially as changes like a tri‑merge rollback could impact buyer qualification timelines and closing efficiency. A cooling job market may influence buyer urgency, but it also opens doors for value‑focused conversations. Agents who can help buyers and sellers understand how economic shifts intersect with financing will stand out as informed, trusted advisors.

Source Links

Scotsman Guide | MBA | Eye on Housing

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 17, 2025

Capital Gains Fix Could Unlock Housing Market

Capital gains has become a central theme in U.S. housing market discussions as policymakers and industry experts debate how tax reform could unlock inventory and ease affordability constraints. This week’s market data shows a modest rise in new home purchase mortgage applications, a slight uptick in the homeownership rate, and persistent debate around capital gains tax rules that may be influencing seller behavior and home supply. We cover the latest trends in mortgage activity, homeownership rates, and how calls for a capital gains fix resonate across housing policy and market activity.

Mortgage Activity: New Home Purchase Apps Up 3.1%

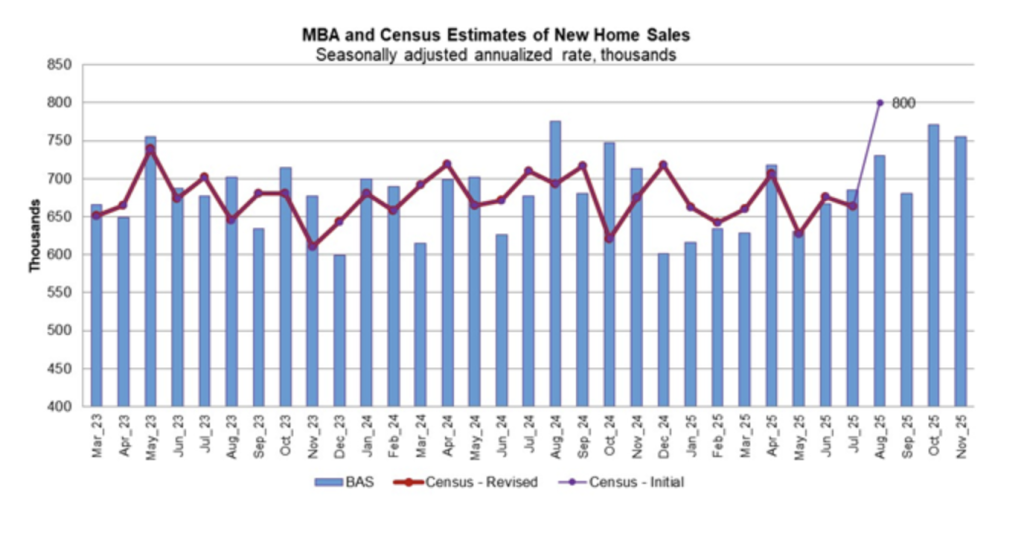

In November 2025, new home purchase mortgage applications increased 3.1% year‑over‑year, according to the Mortgage Bankers Association’s Builder Application Survey.

Builders and lenders point out that while the annual gain is positive, applications were lower compared with the typical seasonal pattern late in the year, illustrating ongoing volatility tied to mortgage rates and buyer affordability.

For mortgage and real estate pros, this metric suggests that some prospective buyers are still pressing ahead with purchases despite headwinds, indicating that underlying housing demand hasn’t completely softened.

Homeownership Rate Inches Up, but Affordability Still Tight

The U.S. homeownership rate rose to 65.3% in the third quarter of 2025, according to the Census Bureau’s Housing Vacancy Survey analyzed by Eye On Housing.

Although this represents a slight increase from earlier in 2025, the rate remains close to prior quarters and highlights that long‑term affordability and supply issues persist.

Mortgage rates that have stayed elevated and limited active listings continue to constrain first‑time buyers and move‑up households, factors which directly tie to slower overall homeownership growth.

Capital Gains Fix: The Policy Debate Heating Up

A key part of the housing policy conversation involves updating the capital gains exclusion on home sales. Currently, the federal home sale exclusion remains at $250,000 for single filers and $500,000 for married couples—thresholds that haven’t budged since 1997 despite significant home price appreciation.

Advocates argue that this outdated exclusion functions as a de facto tax on equity, discouraging sellers from listing homes and contributing to low inventory and high prices.

Several proposals are now gaining bipartisan attention in Washington:

- Indexing the capital gains exclusion for inflation, so only real gains are taxed, not phantom gains created by decades of price growth.

- Doubling the exclusion limits and adjusting them periodically to reflect market conditions.

- No Tax on Home Sales Act, which would eliminate federal capital gains tax on primary residence sales entirely.

Proponents contend that a capital gains fix could unlock millions of homes from sellers who are “locked in” to current properties to avoid large tax bills, improving turnover and easing pressure on prices.

What Market Participants Are Saying

Industry analysts highlight that without reform, more sellers could face a capital gains tax bill when they move, which weakens their ability to afford a new home and suppresses for‑sale inventory.

Some forecasts suggest that removing or significantly adjusting capital gains taxes could especially benefit move‑up buyers and retirees who hold long‑term equity, potentially stimulating activity and adding listings to the market.

At the same time, debates continue about who benefits most from changes and whether reforms should target specific homeowner segments.

Loan Officer Perspective

Loan officers should monitor the capital gains policy discussion closely, as any reform could shift seller and buyer behaviors, affecting origination volumes. A capital gains fix could spur more move‑up purchases, refinancing to fund renovations, and increased demand for jumbo financing as homeowners leverage equity. Clear communication with clients on how tax rules impact their net proceeds can be a differentiator in building trust.

Real Estate Agent Perspective

For real estate agents, the capital gains narrative offers a timely opportunity to educate sellers about the tax implications of moving and how proposed reforms might affect their equity strategy. Helping clients understand tax exposures and planning around them can position agents as trusted advisors. Additionally, tracking local inventory trends in response to policy shifts will be essential for pricing and listing strategies.

Source Links

MBA | Eye On Housing | Realtor.com

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 16, 2025

Rate Cut Insight: Fed Dissent, Linkybot Lead Strategy & New Housing Legislation

his week’s mortgage and real estate headlines are centered on rate cut debate within the Federal Reserve, an actionable lead‑gen strategy spotlighted on The Mortgage Loan Officer Podcast using Linkybot.ai, and the unveiling of major, industry‑backed housing legislation. These developments matter for mortgage pros refining their borrower guidance, growth tactics, and long‑term business plans. We break down why one Fed policymaker dissented on the latest rate cut, how Linkybot is helping originators generate real conversations and appointments, and what the new bipartisan housing bill proposes.

Goolsbee Explains His Rate Cut Dissent

Read the Full Story → Scotsman Guide

Chicago Fed President Austan Goolsbee recently explained why he dissented from the Federal Reserve’s recent rate cut decision, despite the move by most Fed officials to lower interest rates. Goolsbee said he was “uncomfortable front‑loading too many rate cuts” without clearer inflation data and emphasized that key job market indicators remain “pretty stable,” reducing the urgency for additional easing.

He stressed that while future rate cuts could be appropriate if incoming inflation data shows sustained improvement, he preferred a more data‑dependent approach rather than acting too soon. Goolsbee also noted that disruptions in economic reporting caused by the recent government shutdown made it harder to assess inflation trends — a factor that influenced his vote against the rate cut.

This dissent illustrates ongoing debate within the Fed about timing and magnitude of monetary easing, an important narrative for mortgage pros tracking rate expectations and borrower sentiment.

Join the Daily LOBC Live Call

Loan officers! Don’t miss the free Daily Loan Officer Breakfast Club (LOBC) Zoom call each Monday–Friday at 8:30–9:00 AM ET, where industry pros share actionable tips, scripts, and up‑to‑the‑minute market insights. Designed for both new and seasoned originators, these live sessions help you sharpen your skills, stay ahead of market trends, and grow your referral business.

Expect strategy breakdowns, success stories, and the chance to ask real questions to experts and peers alike. Guests regularly include top producers and coaches who bring real‑world experience to each session.

Whether you’re focused on purchase business, refinance opportunities, or deepening realtor partnerships, the LOBC call is a practical daily boost — and it’s completely free.

Click the live stream image to join the call

How Linkybot.ai Landed Real Appointments — Podcast Takeaways

Read the Full Story → Mortgage Loan Officer Podcast

On the latest Mortgage Loan Officer Podcast, I interviewed Casey O’Toole, founder of Linkybot.ai, and we dove deep into how this tool has transformed outreach for mortgage professionals. Linkybot is not just another “automation” tool — it’s engineered to create personalized digital touchpoints that convert clicks into real conversations.

During the episode, I shared concrete stories about personally using Linkybot to fill my calendar with appointments keeping my pipeline active. I also shared first‑hand how impressed I am with its ability to streamline engagement across email, text, LinkedIn, and more without feeling spammy. For many listeners, this was the most practical, immediately actionable part of the show.

If you want to learn about Linkybot for yourself, visit: http://linkybot.ai

— and when you use the code LOBC, you’ll save 20% on your subscription. This kind of tech‑first lead generation strategy is something every producer should be exploring in a market where traditional outreach often gets ignored.

House Leaders Unveil Major, Industry‑Backed Housing Legislation

Read the Full Story → Scotsman Guide

House Financial Services Committee leadership introduced the Housing for the 21st Century Act, a sweeping, bipartisan housing reform package backed by major industry associations including the Mortgage Bankers Association (MBA). The bill attempts to address housing affordability and supply shortages by modernizing federal programs, adjusting FHA loan limits, and expanding financing for rural and manufactured housing.

Industry groups have applauded the effort, saying it could unlock barriers to construction, improve housing supply pipelines, and expand access to credit for underserved communities. The legislation now advances toward committee discussions and full House consideration, giving mortgage and real estate pros plenty of policy developments to watch.

Loan Officer Perspective

Mortgage professionals should pay close attention to both the macro and micro takeaways from this week’s news. Understanding rate cut sentiment and dissent helps you position borrower conversations realistically and confidently.

Meanwhile, the success stories shared on The Mortgage Loan Officer Podcast underscore the importance of adopting modern outreach strategies — like Linkybot — that convert digital engagement into real business results.

Combining fresh tactics with informed market outlooks gives you a competitive edge regardless of interest rate direction.

Real Estate Agent Perspective

Real estate agents benefit from grasping the nuance behind rate‑cut expectations and how they affect buyer affordability and financing chatter.

At the same time, innovative lead‑gen tools and referral strategies — like those discussed with Linkybot on the podcast — can inspire agents to rethink how they nurture professional networks and convert leads.

Keeping an eye on housing policy reform discussions also equips you to better advise clients on long–term market trends.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 12, 2025

Fed Rate Cut Signals Mixed Impacts on Mortgage & Housing Markets

Today’s mortgage and housing headlines were dominated by the Fed Rate Cut and what it means for markets, legislation and home sales activity. The Federal Reserve’s quarter‑point cut drove modest improvements in mortgage rates and MBS pricing, but Fed Chair Jerome Powell made it clear that lower rates alone won’t fix deeper housing market constraints. Meanwhile, key bipartisan housing reform stalled in Congress, and Powell emphasized the mortgage lock‑in effect as a persistent drag on mobility and market fluidity. For mortgage pros and real estate professionals, the focus keyword Fed Rate Cut will be central to understanding today’s market dynamics and where opportunities lie in 2026.

Mortgage Bonds & Rates Improve After Fed Rate Cut

Read the Full Story → Mortgage News Daily

Mortgage News Daily reported that following the latest Fed Rate Cut, secondary mortgage markets and mortgage bond prices rallied modestly, pushing 30‑year fixed rates slightly lower to around 6.30%. Rates softened in part due to the decline in the 10‑year Treasury yield that accompanied the Fed’s decision. Current mortgage rate data shows small weekly improvements that reflect market optimism tied to monetary policy easing. Still, broader economic forces and bond market behavior remain the primary drivers of mortgage rates.

MBS commentary noted that the Fed’s communication about future policy was cautious: while the cut is supportive, officials signaled they may pause further reductions if inflation pressures persist. That outlook has important implications for how long mortgage rates could stay elevated, even after the Fed takes action meant to lower borrowing costs.

Mortgage professionals are watching markets for how this Fed Rate Cut plays out in mortgage pricing and loan demand, especially as lenders adjust pricing relative to bond yields and current homebuyer interest.

Join the Daily LOBC Live Call

If you’re digesting all this Fed Rate Cut news and wondering what moves to make next — join the Daily LOBC live call! Every weekday morning, we break down market news before lenders and agents get to their desks. Coaches and guest experts share actionable strategies on navigating rate moves, pricing tips to stay competitive, and insights on how to capture more business when volatility hits.

Whether it’s mastering price locks, understanding rate sheets, or talking buyers off the mortgage rate cliff, LOBC covers it all in 30 minutes or less — free. You’ll walk away with perspective on current mortgage spreads, pipeline management tactics, and the confidence to talk to prospects and referral partners about why today’s Fed Rate Cut matters.

Click the live stream image to join the call.

ROAD to Housing Act Pulled from Defense Bill — Reform Delayed

Read the Full Story → Scotsman Guide

Scotsman Guide reports that a major bipartisan housing bill, the ROAD to Housing Act, was removed from a must‑pass defense bill, pushing meaningful housing reform efforts into 2026. The bill would have included measures to address barriers to homeownership and support housing supply — long sought after in an era shaped by elevated mortgage rates and market lock‑in dynamics.

Its absence underscores how Fed Rate Cut headlines aren’t the only policymakers’ tool in trying to support the housing market. Structural policy efforts still face political hurdles, meaning legislative help might lag behind the monetary policy shifts that markets react to daily.

Mortgage and real estate professionals have noted that without complementary housing supply reforms, rate cuts alone may have limited impact on long‑term affordability and inventory shortages.

Powell Flags Mortgage Lock‑In Effect as Market Drag

Read the Full Story → MPAMAG

In comments following the Fed’s rate decision, Federal Reserve Chair Jerome Powell acknowledged that even with the Fed Rate Cut, housing market challenges are deeper than just elevated interest rates. Powell said a 25‑basis‑point reduction in the federal funds rate “may not make much of a difference” for housing activity given structural headwinds.

Powell specifically pointed to low housing supply and the mortgage lock‑in effect, where homeowners with pandemic‑era low rates are reluctant to sell because they would have to take on higher mortgage rates today — a dynamic that has limited listings and slowed transactions.

While monetary policy influences broader costs, Powell emphasized that the housing shortage and market mobility issues are not things the Fed can fix on its own, suggesting that further Fed Rate Cut moves won’t solve inventory or construction bottlenecks.

Loan Officer Perspective

Loan officers can use the current Fed Rate Cut narrative to educate borrowers on why mortgage rates are moving differently than Fed funds. While the federal funds rate influences short‑term borrowing costs, mortgage rates are more closely tied to bond markets and supply/demand dynamics. This is a great opportunity to explain how MBS pricing impacts loan pricing, and why savvy borrowers might still find good options now rather than waiting. Emphasize the importance of effective rate locking tools and crystal‑clear communication on rate forecasts.

Real Estate Agent Perspective

For agents, the Fed Rate Cut gives a chance to reignite conversations with buyers who may have previously shelved their plans. Even modest downward shifts in mortgage rates can improve affordability, and pairing rate insights with localized inventory data can help agents make persuasive cases for clients to revisit the market. At the same time, be sure to address the lock‑in effect: many homeowners may be holding on due to their low existing rates, so creative strategies around pricing and making moves are key.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 11, 2025

FHA Refi Boom Signals Market Momentum and 3D Construction Shakes Up the Future

This week’s real estate and mortgage news highlights a surprising FHA refinance boom that led to a jump in mortgage demand, a modest rise in buyer-agent commissions, and an eyebrow-raising move by Walmart into 3D-printed commercial real estate. These stories paint a picture of a market finding new energy even amid challenges, and a future that’s being reshaped by innovation. Whether you’re helping clients refinance, negotiating commissions, or just marveling at 3D-printed buildings, the industry continues to offer both opportunities and surprises. The focus keyword this week: FHA Refi Boom.

FHA Refi Boom Leads Surprise Jump in Mortgage Demand

Read the Full Story → MPAMAG

A new report from the Mortgage Bankers Association shows a surprising 2.8% weekly jump in mortgage applications, driven largely by a spike in FHA-backed refinances. These loans increased 19% in a single week — a strong signal that borrowers are responding to small improvements in rates and economic sentiment.

FHA refinance activity now makes up nearly 14% of all loan applications, the highest level in over a year. Analysts say this reflects growing demand among borrowers with older or higher-rate loans, many of whom may not have benefited from previous refi booms.

While overall market volume remains modest by historic standards, this FHA trend could mark a turning point. It suggests a segment of the market is finding renewed opportunity — especially where rate relief or cash-out refinances can improve household budgets.

Join the Daily LOBC Live Call

Want daily insight on headlines like this? The free LOBC Live Call happens every Monday–Friday from 8:30 to 9:00 AM ET. It’s a fast-paced Zoom session for mortgage professionals, covering market movement, prospecting tips, strategic plays, and more.

You’ll hear fresh strategies for leveraging current refi trends, navigating borrower conversations, and staying sharp on the latest mortgage shifts. Bonus: surprise guest appearances from top performers and coaches who walk the walk.

This isn’t fluff — it’s a tactical, daily reset that helps you stay on your game and in the know. Click the live stream image to join the call.

Buyer-Agent Commissions Edge Back Up in Q3 2025

Read the Full Story → Redfin

Despite last year’s legal shifts and commission reform headlines, buyer-agent compensation has actually crept up. According to Redfin, the national average buyer’s agent commission rose to 2.42% in Q3 2025, up from 2.36% a year ago.

Commissions on homes priced under $500,000 averaged 2.52%, nearly matching levels not seen since early 2023. Even in the $500,000–$999,999 range, buyer-agent commissions edged up to 2.32%, signaling a stable and slightly improving income landscape for agents.

The key takeaway? While the industry braced for dramatic commission slashes post-NAR settlement, consumer behavior has largely supported traditional models — for now. Buyers still value agent expertise, and the data backs it up.

Walmart Enters the 3D-Printed Real Estate Game

Read the Full Story → CNBC

Walmart is stepping into the world of 3D-printed construction — but not for houses. Partnering with materials company Sika, the retail giant is exploring how 3D printing can speed up and economize warehouse and distribution center builds.

While this doesn’t directly impact residential real estate or mortgage pipelines (yet), it does show how seriously major players are taking construction tech. Faster, cheaper building methods could eventually influence everything from commercial zoning to modular housing.

This one’s more of a “watch and wonder” moment than an action step — but it reminds us that innovation is accelerating. Real estate won’t look the same in 10 years… maybe not even in five.

Loan Officer Perspective

The FHA refi boom opens a door. Start pulling FHA borrower lists from the last 2–4 years — especially those still carrying rates above market or in need of cash-out options. With guidelines and rates favoring FHA scenarios right now, it’s a prime segment for outreach.

Commission stability also helps lenders — when agents are earning predictably, they’re more likely to refer and collaborate. Use this data to reinforce the value of strong partnerships.

Finally, keep one eye on innovation. 3D printing may not affect today’s mortgage deals, but commercial trends have a way of migrating into residential before you know it.

Real Estate Agent Perspective

The increase in buyer-agent commissions — despite legal and media pressure — is a win. It suggests buyers still want representation and are willing to pay for it, especially on entry-level homes. Stay confident in your value and be prepared to communicate it clearly.

FHA refis might not be your core business, but they influence market energy. When people refi, they also list, buy, and refer. Sync with your lender partners and watch for signs of movement in your database.

As for Walmart’s 3D-printed warehouses? It’s a glimpse at where the industry is going. If they can build a big box store in a week, what’s next? Apartment buildings? Single-family homes?

Home Buyer & Seller Perspective

If you have an FHA mortgage — or know someone who does — now could be a good time to explore a refinance. Lowering your rate or accessing equity could free up cash or reduce monthly payments.

Buying a home? The average commission paid to a buyer’s agent is still close to 2.5%, especially on homes under $500,000. That means you can expect strong representation — and you should ask what’s included in your agent’s services.

Big picture: The real estate world is evolving. Whether it’s refi programs or 3D-printed buildings, it’s smart to have a professional guide. Contact the loan officer or real estate agent who shared this post with you if you have questions or want to talk about your next move.

Frank’s Thoughts

Man — the refinance boom, commission rebound, and 3D printed real estate all in one week? Nuts.

I love the FHA refi data. For folks still carrying older, high-rate mortgages, this is a real chance to improve cash flow or tap equity. As a lender, I’d be intentional about reaching out to those customers — even those who locked in a couple years ago.

The commission story reminds me: change doesn’t always shake out how you expect. After all the chatter when the new commission rules dropped, rates are basically back where they started. The industry may reform paperwork and disclosure, but people still value good agents — turn-of-the-key peace-of-mind still has value.

And about that 3D printing thing… heck — when I think about my grandkids and what the world will look like 60 years from now, I’m part excited, part “grab the popcorn.” We live in extraordinary times. Who knows — maybe by then real estate won’t just be “buy or sell,” it’ll be “print or build.”

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 4, 2025

2026 Housing Market Prediction

The 2026 market prediction from Redfin offers a cautious but hopeful glimpse into the future of U.S. housing. Instead of volatility, the next chapter looks stable and slow-moving — with moderate price growth, steady sales, and a potential return of affordability for many buyers. This shift, which Redfin calls the “Great Housing Reset,” could open the door for more sustainable housing activity after years of extreme price swings and rate shock. For mortgage and real estate professionals, it’s a critical time to prepare clients for a market defined by balance, not chaos — and to re-engage with those who’ve been sitting on the sidelines.

The Great Housing Reset: What 2026 Might Look Like

Redfin’s 2026 housing forecast suggests a slow but steady normalization of the market. After the extreme ups and downs of the pandemic boom and subsequent rate hikes, 2026 is shaping up to be a year of mild recovery — and perhaps even a touch of relief for both buyers and sellers.

Key predictions include mortgage rates easing slightly to an average of 6.3%, a modest dip from the higher levels seen in 2023–2025. This drop, while not dramatic, could help boost affordability for would-be homebuyers. Meanwhile, home prices are expected to rise by just 1% year-over-year — a huge contrast to the double-digit surges of the past few years. This moderation in price growth, combined with stronger wage growth, may finally tip the affordability scales in favor of buyers.

Existing home sales are expected to rise about 3% over 2025 levels, reaching approximately 4.2 million transactions. While this doesn’t mark a full return to pre-pandemic activity, it does suggest that more homeowners may be willing to list — especially as mortgage rate lock-in begins to ease. Redfin points out that the mortgage-rate spread (the difference between existing rates and new loan offers) will shrink, giving more sellers a financial reason to make a move.

Importantly, Redfin forecasts that wage growth will finally outpace home-price growth in 2026. That’s a big deal. For years, home prices have far outstripped income gains, pushing many buyers out of the market. If that dynamic flips, even slightly, it could signal a turning point for housing affordability and demand — especially among first-time and entry-level buyers.

However, Redfin cautions that this return to balance won’t be felt evenly. Some metro areas will continue to struggle with affordability, and inventory challenges may linger in high-demand regions. Rent growth is also expected to continue in many cities, keeping the pressure on renters and potentially driving more interest in homeownership. But overall, this is not a forecast of crash or correction — it’s a forecast of healing and recalibration.

This “reset” is not without challenges, but it provides an opening for real estate and mortgage professionals to shift their messaging from urgency to long-term strategy. It’s also a prime moment to reconnect with potential buyers and sellers who paused their plans over the past few years, helping them understand how a stable market can still be a strong market — if approached with the right mindset.

Loan Officer Perspective

For LOs, this is a golden window to re-engage with both purchase and refinance prospects. Even though rates remain elevated historically, they’re softening enough to make a difference — especially if paired with wage growth and slower home price appreciation. Use this as a time to educate clients about affordability trends, payment strategies, and creative loan options.

Real Estate Agent Perspective

Agents can position themselves as guides through this new era of balance. Clients may not feel urgency, but they will need clarity and strategy. Use this stable environment to highlight long-term equity gains, the cost of renting versus buying, and why today’s market offers a healthier foundation for sustainable homeownership.

Special Opportunity: SBA Loans Through One Click Commercial

Do you have clients, friends, family, or coworkers who could use a small business loan? There’s a great way to help them — and if you’re a mortgage or real estate pro, you can even get paid for your referrals.

Connect with Kelly Dutton at One Click Commercial. She’s a powerhouse when it comes to SBA lending. Whether it’s for a startup, business acquisition, working capital, or commercial real estate — Kelly and her team can guide your referrals through the process with ease.

Visit http://workwithoneclick.com to learn more and start referring today.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 3, 2025

Mortgage Rates in Flux Per Redfin

Mortgage rates are back in the spotlight this week as Redfin reports signs of renewed volatility ahead of the next Fed meeting. As investors bet on potential rate cuts, markets are sending mixed signals — keeping mortgage professionals and homebuyers guessing. Meanwhile, construction loan volume for single-family homes is ticking upward, signaling optimism among builders. This shift sets the stage for Park Place Financial’s standout no-income construction funding program, which offers speed and flexibility to get builds started fast. If you’re in real estate or lending, this week’s developments around mortgage rates demand attention.

Mortgage Rates Could Bounce Around Before the Next Fed Meeting

Read the Full Story → Redfin

Redfin’s latest economic update reveals that mortgage rates dipped last week as the market began pricing in a possible interest rate cut from the Federal Reserve. With bond yields dropping, the average 30-year fixed rate followed — offering a glimmer of relief to potential borrowers.

However, Redfin economists caution that this dip might not last. With limited economic data ahead of the Fed’s upcoming meeting, any surprise inflation reading or labor market update could send rates bouncing back upward.

That means both buyers and loan officers are once again walking the tightrope: rate lock timing is tricky, but those who stay on top of the market can capitalize quickly when the window opens.

Join the Daily LOBC Live Call

Every weekday from 8:30 to 9:00 AM ET, the LOBC Live Call gives mortgage professionals a free, powerful 30-minute coaching boost. It’s a fast-paced Zoom call loaded with tips, updates, and strategies for today’s market.

Whether you’re navigating volatile mortgage rates, exploring construction loans, or trying to sharpen your lead conversion skills — this call delivers real-world solutions from successful producers across the country.

Expect fresh ideas, quick takeaways, and valuable connections — including live Q&A and guest appearances. Click the live stream image to join the call.

Construction Lending Is Up — and Builders Are Getting Busy

Read the Full Story → Eye on Housing

New data from the NAHB shows single-family construction loan volume rose in Q3, indicating renewed confidence in new-home development. While overall mortgage lending remains tight, this increase suggests lenders are gradually loosening up for construction financing.

It’s an encouraging sign after a year of slowdowns in the building sector. Builders, developers, and investors may find it easier to access funds — especially for projects with solid experience and a clear path to sale or occupancy.

As builders gear up for more starts, agents and lenders should take note. This isn’t just about dirt turning — it’s about deal flow returning to the new construction pipeline.

Fast, Flexible Construction Loans Through Park Place Financial

With construction lending showing signs of life, now’s the time to connect with a lender that knows how to move fast. Park Place Financial offers a no-income single-family construction program with highly competitive pricing — tailored to the build and the experience of the builder.

That means fewer delays, less paperwork, and more shovels in the ground. For clients who are ready to build or investors looking to start new projects, Park Place can get things rolling without the usual hurdles.

If you want to learn more or run a deal by them, visit http://buildwithparkplace.com.

This is how smart builders stay ahead.

Loan Officer Perspective

For loan officers, Redfin’s report on rate fluctuations is a reminder to stay alert and proactive. Help your clients time their rate locks strategically, and be ready to explain the risks of waiting in this volatile market.

The uptick in construction lending — and Park Place’s unique product — creates opportunity to reconnect with builders and land developers who might have pulled back in 2023.

Now’s the time to position yourself as the go-to partner for fast-moving funding options, especially with so few lenders offering streamlined construction solutions.

Real Estate Agent Perspective

Agents, now is a smart time to re-engage clients who’ve considered building instead of buying existing homes. With construction lending on the rise and programs like Park Place’s available, custom builds are becoming more realistic again.

Use the Redfin report to create urgency — if rates dip, help buyers act fast. And if they’re nervous about the resale market, introduce the idea of building new with the right lender and contractor team.

New builds can often close more smoothly and with less competition. Agents who understand this angle can win more listings and attract savvy buyers.

Home Buyer & Seller Perspective

For buyers, this week’s mortgage rate drop could be an opportunity — but don’t wait too long. Rates may bounce again, so talking to a mortgage professional now is smart. If you’re considering building, know that new financing options are making it easier to get started.

For sellers, more buyers could come back into the market if rates settle down — but competition from new builds may also rise. Pricing and timing are everything right now.

Have questions? Reach out to the loan officer or agent who shared this post with you — they can help you decide if this is the right time to act.

Frank’s Thoughts

You can feel the market shifting, can’t you? Rates dip, calls increase, and suddenly you’ve got four pre-approvals to review before lunch. The key is to stay calm and ready — because volatility brings opportunity if you’re prepared.

I’m loving the construction trends. It’s been a tough run for builders, and this upward tick in lending volume — paired with Park Place’s killer program — is the boost many of them needed. Introduce your builder clients to this kind of solution and watch the deals multiply.

Keep showing up, keep educating your clients, and stay consistent. The people who win in markets like this are the ones who stay engaged and keep their heads in the game.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

December 2, 2025

Credit Report Fees, Rent Burdens, and a Journey of Reinvention

This week’s focus is on credit report fees, which are under fire as the Mortgage Bankers Association calls for reform in how credit data is handled in mortgage originations. At the same time, a troubling new report shows that over half of American renters remain cost-burdened in high-rent states like California and Florida. On a more personal note, a popular podcast episode featuring Megan Anderson offers a heartfelt glimpse into the life transitions many in the industry can relate to. These stories collectively speak to the pressures and possibilities shaping today’s housing and lending environment.

MBA Slams Credit Reporting Price Hikes, Renews Push to End Tri-Merge

Read the Full Story → MBA

The Mortgage Bankers Association (MBA) is sounding the alarm over steep increases in credit report fees by the three national bureaus. In a strongly worded press release, the group criticized the bureaus for acting like a government-sanctioned oligopoly and using their dominance to implement unjustified pricing models that directly impact consumers and lenders.

At the center of the issue is the long-standing requirement to use “tri-merge” credit reports—one from each bureau—for most mortgage originations. The MBA argues that modern data systems make this outdated and inefficient. Instead, they advocate for a “single-merge” model, which would provide cost savings and reduce complexity without sacrificing risk assessment.

MBA President and CEO Bob Broeksmit urged regulators to open a federal investigation into these practices, citing anti-competitive behavior. The MBA is pushing Fannie Mae and Freddie Mac to revise their requirements, and is calling for action from the Federal Housing Finance Agency (FHFA) to support fairer credit access across the industry.

Join the Daily LOBC Live Call

If you’re a mortgage professional looking to sharpen your skills and grow your business, don’t miss the Daily LOBC Live Call. Held every Monday through Friday from 8:30–9:00 AM ET, this free Zoom call offers quick-hit coaching from top experts in the industry.

Each session covers real-time tactics for lead generation, conversion, scripting, and navigating market shifts. You’ll also hear from experienced loan officers and industry guests who bring fresh insights and perspectives to help you level up.

Whether you’re just starting out or a seasoned pro, this daily dose of coaching can become the most valuable 30 minutes of your day. Click the live stream image to join the call.

Half of Renters Are Still Cost-Burdened — Especially in Key States

Read the Full Story → Eye On Housing

New U.S. Census data analyzed by the National Association of Home Builders shows that 50.3% of renters nationwide—over 23 million households—spend 30% or more of their income on rent and utilities. These “cost-burdened” renters are particularly concentrated in states like Florida (60%), California (55%), and Nevada (57%).

In contrast, only 24.3% of homeowners are cost-burdened, a sign that ownership continues to offer long-term financial stability, especially in lower interest environments. Among owner-occupied households, the cost burden is highest in California, where about 33% exceed the 30% income threshold.

These statistics underscore the growing affordability divide and suggest that many renters remain on financially shaky ground. While mortgage rates and home prices dominate headlines, this report brings attention back to the broader housing crisis—particularly for low- and middle-income Americans.

Podcast Spotlight: Megan Anderson’s Journey from Van Life to Europe and Beyond

Read the Full Story → Mortgage Loan Officer Podcast

In a moving conclusion to her three-part series, Megan Anderson—formerly with MBS Highway—shares the personal growth that emerged from her one-year journey living in a van. Now passing through Spain and traveling across Europe, she’s taking time to reflect before returning to the U.S. for the next chapter of her life.

The episode explores themes of identity, ambition, and clarity. She explains how letting go of status and routine led to a clearer sense of purpose—and how that internal shift is now reshaping the way she thinks about success in the mortgage industry.

This story resonates because it’s not just about quitting a job or traveling abroad—it’s about reinvention. For many mortgage and real estate professionals, it serves as a reminder that true growth sometimes means stepping into the unknown. Anderson’s vulnerability makes this more than a podcast—it’s a message of hope for anyone seeking more meaning in their career.

Frank’s Thoughts

The MBA’s stance on credit report fees shows that industry advocacy matters. It’s encouraging to see leadership speak out when systems no longer serve borrowers or professionals.

These cost-burdened renter stats? They’re not just numbers—they’re people stuck in cycles they want out of. And we’re the ones who can help them move toward ownership.

Megan’s story hit home. She didn’t just travel—she transformed. Her courage reminds us that it’s okay to pause, reflect, and pivot. There’s power in choosing your path, even when it looks unconventional.

Powered by: Mortgage Marketing Animals

Important Links

Share this:

November 21, 2025

No Rate Cut For YOU!

After much anticipation, the Federal Reserve looks increasingly unlikely to deliver a Rate Cut in December, thanks to stronger-than-expected jobs data released this week. Despite recent hopes of an easing cycle kicking off by year-end, economic resilience continues to delay that pivot. For mortgage and real estate professionals, this news resets expectations once again. As 2025 winds down, the market remains caught between optimism for lower rates and the Fed’s caution about inflationary risks tied to labor strength. Let’s unpack what this latest report means and how it’s shifting sentiment across the housing landscape.

Strong Jobs Data Pushes Rate Cut Expectations into 2026

The headline news? The September payroll report, delayed by earlier government funding gaps, came in hotter than expected. Employers added more jobs than analysts had forecast, reinforcing the view that the labor market remains tight. That’s a big deal for the Federal Reserve, which has consistently signaled that a cooling job market is a necessary condition before it can consider easing monetary policy. With that softness still missing in action, markets are recalibrating their rate cut bets—again.

Before this jobs report, some investors were clinging to a sliver of hope that the Fed might pull the trigger on a small rate cut at its December meeting. That hope is now virtually gone. In fact, futures markets are pushing their expectations for the first rate cut well into the second half of 2026. Fed officials have been increasingly vocal about the risk of cutting too soon—and a solid labor market gives them little reason to move fast.

One of the key metrics in the report was the steady unemployment rate and a surprise uptick in wage growth. While those are good signs for workers, they also add pressure to the Fed’s inflation-fighting campaign. Rising wages can lead to more spending, which in turn can reignite inflation—exactly what the Fed wants to avoid. The result? A more cautious central bank, and a market that’s had to swallow some tough medicine.

This has direct implications for the mortgage world. Bond yields rose on the news, pushing mortgage rates higher once again after a brief autumn dip. Anyone hoping for a year-end reprieve now faces the reality that current rates may stick around well into next year. That’s not to say the market is frozen—activity continues—but buyers and sellers will need to be more strategic and more informed than ever.

The bottom line: the labor market’s strength has, for now, shut the door on a December Rate Cut. That doesn’t mean rates won’t come down eventually, but the timeline has definitely stretched. As always, real estate and mortgage pros who stay informed and proactive will be the ones who thrive during this holding pattern.

Read the Full Story → CNBC

Frank’s Thoughts

It’s easy to get bummed when a hoped-for rate drop doesn’t come—but hey, this is the real world. The Fed’s job is to balance everything, and sometimes, strength in the job market pushes a rate cut further out.

That just means we’ve got to pivot, not panic. There are still plenty of tools in our toolbox to help people move forward. Smart strategies beat rate watching every single time.

So keep your head up, stay focused, and use this news as a conversation starter with your clients. Being calm and confident always wins in the long run.

Powered by: Mortgage Marketing Animals

Important Links