Today’s live call was packed with valuable insights and strategies. We had Owen Lee on the call, and he shared some fascinating information that’s crucial for us to consider right now.

Key Points from the Call:

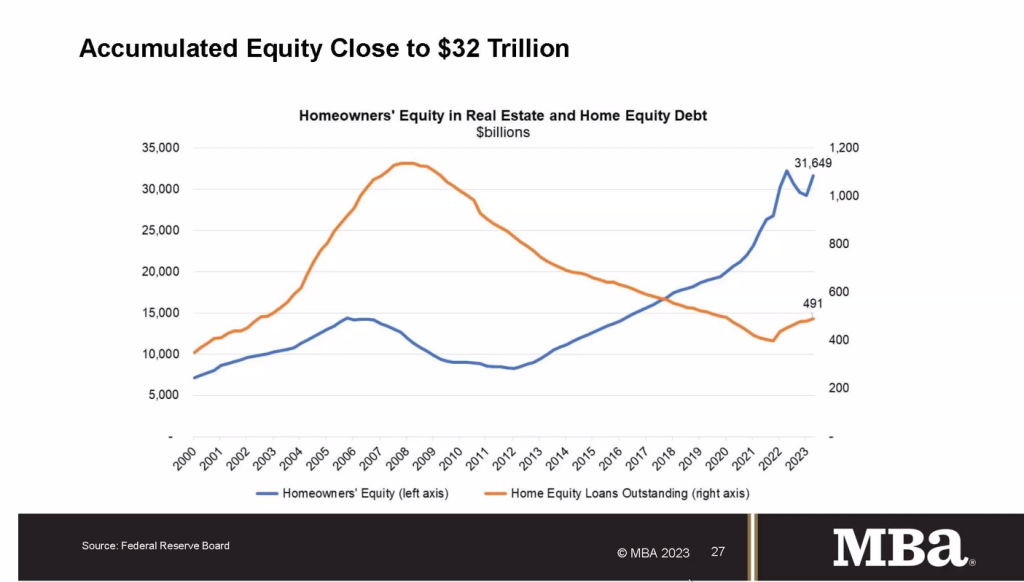

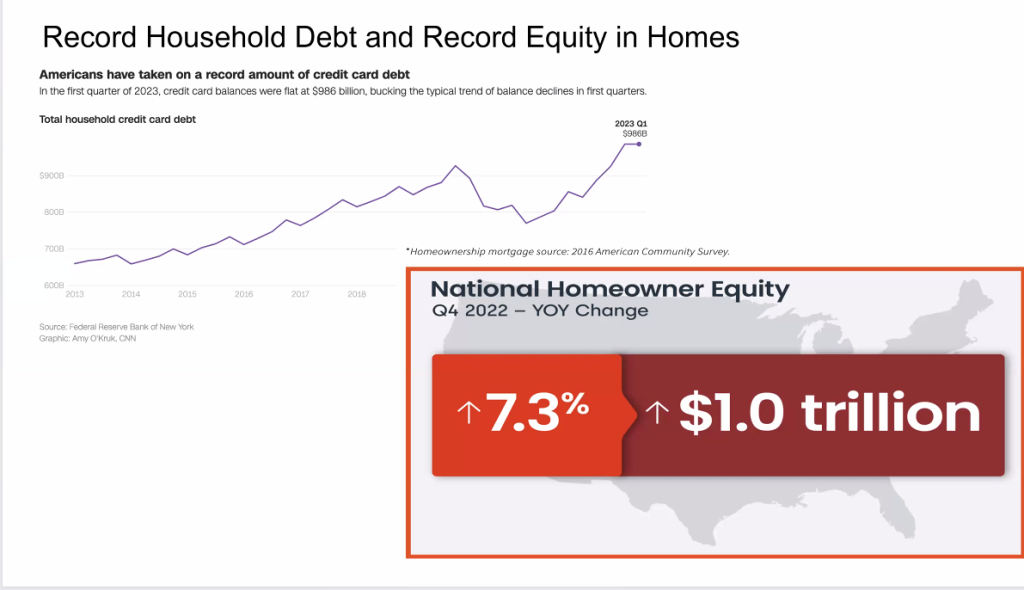

- Record-High Home Equity: Homeowners across the country currently hold a total of $32 trillion in equity, marking an all-time record. This unprecedented level of equity presents a significant opportunity for cash-out refinances.

- Consumer Debt at an All-Time High: Equally important, consumer debt in the United States has reached over $1 trillion, also an all-time high. With credit card interest rates often running in the teens and sometimes even in the 21-22% range, many homeowners are burdened with high-interest debt.

- Refinancing Opportunities: Despite mortgages taken out in 2020 having low interest rates in the 2-3% range, it’s important not to overlook the potential savings for homeowners through refinancing. One member shared a compelling example of how refinancing a customer from 3.5% to 6.5%, combined with paying off high-interest debt, saved that customer $1,400 a month.

Encouragement for Your Outreach: Don’t hesitate to reach out to your past client database and discuss their current debt situation, even if they have low mortgage rates. Given the high levels of home equity and consumer debt, refinancing could still provide substantial monthly savings for many homeowners. Now is the perfect time to assist your clients in leveraging their equity to improve their financial situation.

Action for Today: Make those calls to your past clients. Ask them if their debt situation needs to be reviewed. You might be able to save them a significant amount of money and build stronger relationships in the process.

PS: To learn more about how we can help you grow your business and develop a winning mindset, visit DailySuccessPlan.com. Don’t forget to join our free live Zoom coaching calls every Monday to Friday from 8:30 AM to 9:00 AM ET at LoanOfficerBreakfastClub.com. Also, register for our upcoming Loan Officer Boot Camp on July 18-19, 2024, by visiting MastermindRetreats.com.